Azimo — is a reputable international financial platform that provides secure technology that ensures the security of payments. It provides users with confidentiality of all their transaction information by verification. Azimo is not a commercial bank; rather it is an electronic money and payment institution whose operations are well regulated.

Contact Azimo

Azimo Ltd

Transfer options

Withdrawal options

Payment options

Azimo offers its clients a substitute for conventional cash-based money transfer services; this is the digital transfer of cash. Customers can access the services on their website or through mobile apps for Android and iOS devices. This enables clients to send money through the Azimo platform at any time and wherever they may be.

How to make a Transaction with Azimo

The process of using Azimo to transfer cash is easy and very convenient. The steps include:

- The first step you have to take when you wish to send money through Azimo is opening an account. Users can sign up through the Azimo website or on the Android or iOS app using their mobile devices and create an account. It is recommended that customers use valid information and real names when signing up. Avoid the use of any nickname from your accounts.

- The next step will be to choose your preferred delivery method. Those available on Azimo include cash pick-up, direct to the bank, mobile top-up, mobile wallet, swift transfer. You can choose the delivery method relative to the country of the recipient. Users should also consider the processing time of each of these methods, as Azimo delivers within an hour to 24 hours.

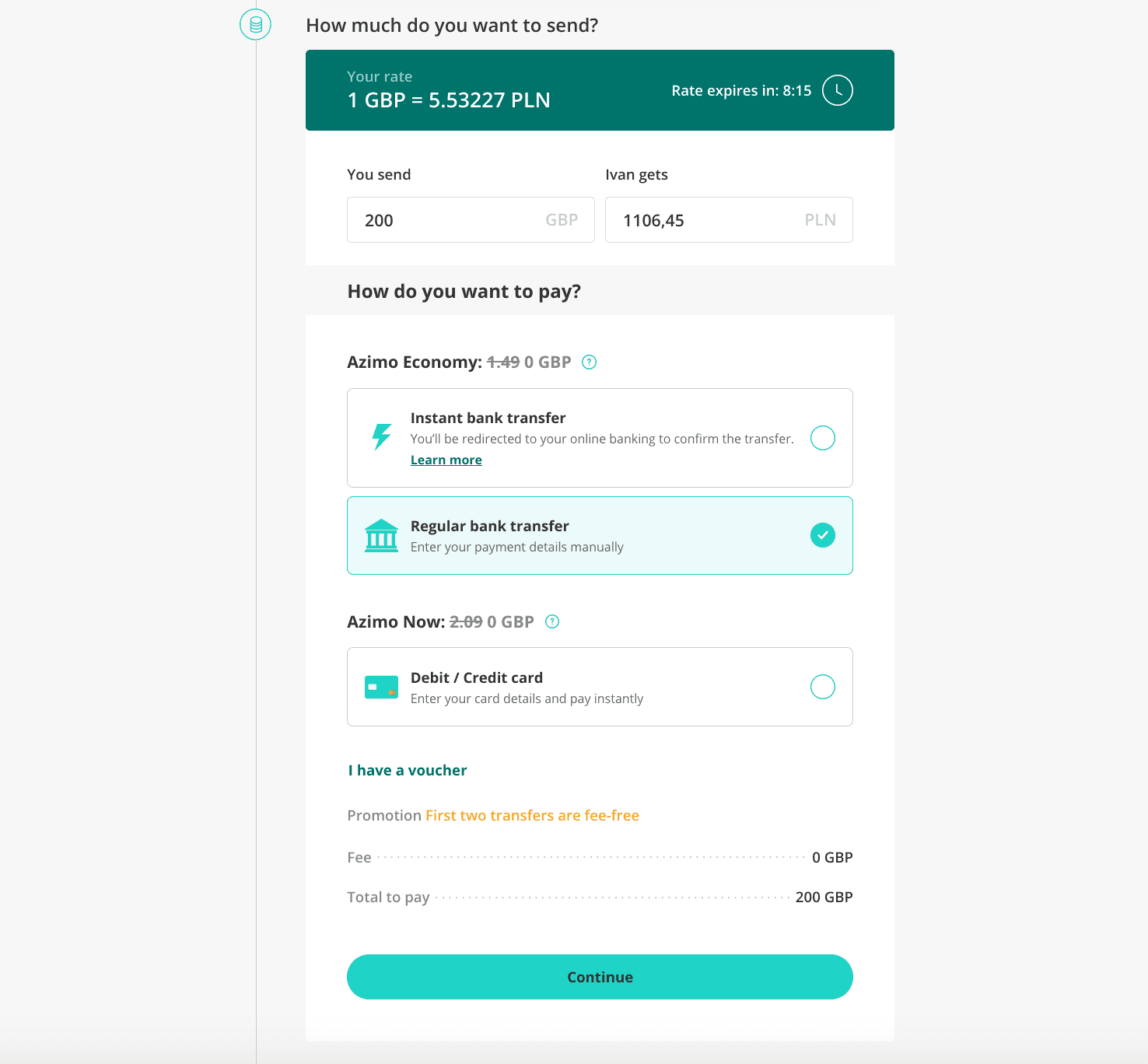

- Then you enter the details of the recipient. This information includes the name, address, account number, and other details depending on the delivery method. Also, you will input the amount you wish to send and choose how you want to pay for the transfer. You can select either a credit or debit card or a bank transfer.

- The final step is to pay for your transfer from the account or debit card you are using.

The aforementioned information is how you can send cash using Azimo. Users should note that the time interval from processing the payment to delivery to the recipient depends on certain factors. This includes the payment method for the transfer, the delivery method selected, and the destination country the money is being sent.

Customers should be aware that they could make any transfer using the website or mobile app. The procedure is the same regardless of the platform.

Fees and Exchange Rates

The exchange rate for currency conversion on Azimo is in the range of 0.1% - 2.25% depending on the currency pairing. For the transfer fee, Azimo gives a waiver of two free transfers to new customers. However, the range of fee charged for transfer is 0.1% and 0.25%.

Advantages of using Azimo

- One outstanding benefit is that you can send money to over 195 countries and there are a good number of delivery methods available on platform;

- They deliver payments in about 80 different currencies;

- There are several pay-out methods;

- Over 270,000 approved locations for cash pick-up. Azimo also works with over 20,000 banks globally to credit bank accounts of recipients;

- The website and mobile app are available in 10 different languages;

- Azimo has first-rate reviews on Trustpilot from over hundreds of thousands of its users;

- The fees and exchange rates charged are relatively cheap compared to banks and other money transfer services.

Popular destinations of transfers

- Afghanistan

- Åland Islands

- Albania

- Algeria

- American Samoa

- Andorra

- Angola

- Anguilla

- Antigua and Barbuda

- Argentina

- Armenia

- Aruba

- Australia

- Austria

- Azerbaijan

- Bahamas

- Bahrain

- Bangladesh

- Barbados

- Belarus

- Belgium

- Belize

- Benin

- Bermuda

- Bhutan

- Bolivia

- Bosnia And Herzegovina

- Botswana

- Brazil

- British Virgin Islands

- Brunei Darussalam

- Bulgaria

- Burkina Faso

- Burundi

- Cambodia

- Cameroon

- Canada

- Cape Verde

- Caribbean Netherlands

- Cayman Islands

- Central African Republic

- Chad

- Chile

- China

- Colombia

- Comoros

- Congo RDC

- Congo

- Cook Islands

- Costa Rica

- Croatia

- Cuba

- Curacao

- Cyprus

- Czech Republic

- Denmark

- Djibouti

- Dominica

- Dominican Republic

- Ecuador

- Egypt

- El Salvador

- Equatorial Guinea

- Eritrea

- Estonia

- Ethiopia

- Faroe Islands

- Fiji

- Finland

- France

- French Guiana

- French Polynesia

- Gabon

- Gambia

- Georgia

- Germany

- Ghana

- Gibraltar

- Greece

- Greenland

- Grenada

- Guadeloupe

- Guam

- Guatemala

- Guinea

- Guinea-Bissau

- Guyana

- Haiti

- Honduras

- Hong Kong

- Hungary

- Iceland

- India

- Indonesia

- Iran

- Iraq

- Ireland

- Israel

- Italy

- Ivory Coast

- Jamaica

- Japan

- Jordan

- Kazakhstan

- Kenya

- Kiribati

- Kosovo

- Kuwait

- Kyrgyzstan

- Laos

- Latvia

- Lebanon

- Lesotho

- Liberia

- Libya

- Liechtenstein

- Lithuania

- Luxembourg

- Macao

- Macedonia

- Madagascar

- Malawi

- Malaysia

- Maldives

- Mali

- Malta

- Marshall Islands

- Martinique

- Mauritania

- Mauritius

- Mayotte

- Mexico

- Micronesia

- Moldova

- Monaco

- Mongolia

- Montenegro

- Morocco

- Mozambique

- Myanmar

- Namibia

- Nauru

- Nepal

- Netherlands

- Netherlands Antilles

- New Caledonia

- New Zealand

- Nicaragua

- Niger

- Nigeria

- Northern Mariana Islands

- Norway

- Oman

- Pakistan

- Palau

- Palestine

- Panama

- Papua New Guinea

- Paraguay

- Peru

- Philippines

- Poland

- Portugal

- Puerto Rico

- Qatar

- Réunion

- Romania

- Russia

- Rwanda

- Saint Barthélemy

- Saint Kitts And Nevis

- Saint Lucia

- Saint Martin

- St Vincent & the Grenadines

- Samoa

- San Marino

- Sao Tome And Principe

- Saudi Arabia

- Senegal

- Serbia

- Seychelles

- Sierra Leone

- Singapore

- Sint Maarten

- Slovakia

- Slovenia

- Solomon Islands

- Somalia

- South Africa

- South Korea

- South Sudan

- Spain

- Sri Lanka

- Sudan

- Suriname

- Swaziland

- Sweden

- Switzerland

- Syrian Arab Republic

- Taiwan

- Tajikistan

- Tanzania

- Thailand

- Timor-Leste

- Togo

- Tonga

- Trinidad And Tobago

- Tunisia

- Turkey

- Turkmenistan

- Turks and Caicos Islands

- Tuvalu

- Uganda

- Ukraine

- United Arab Emirates

- United Kingdom

- United States

- US Minor Outlying Islands

- US Virgin Islands

- Uruguay

- Uzbekistan

- Vanuatu

- Vatican

- Venezuela

- Vietnam

- Wallis And Futuna

- Yemen

- Zambia

- Zimbabwe