EasyFX — an online international transfer and currency exchange platform based in the UK. This funds transfer service provider, founded in 2005, started as payment and Foreign exchange platform and currently adopts advanced technologies to deliver excellent services to its customers.

Contact EasyFX

EasyFX

Transfer options

Withdrawal options

Payment options

How to make a transaction

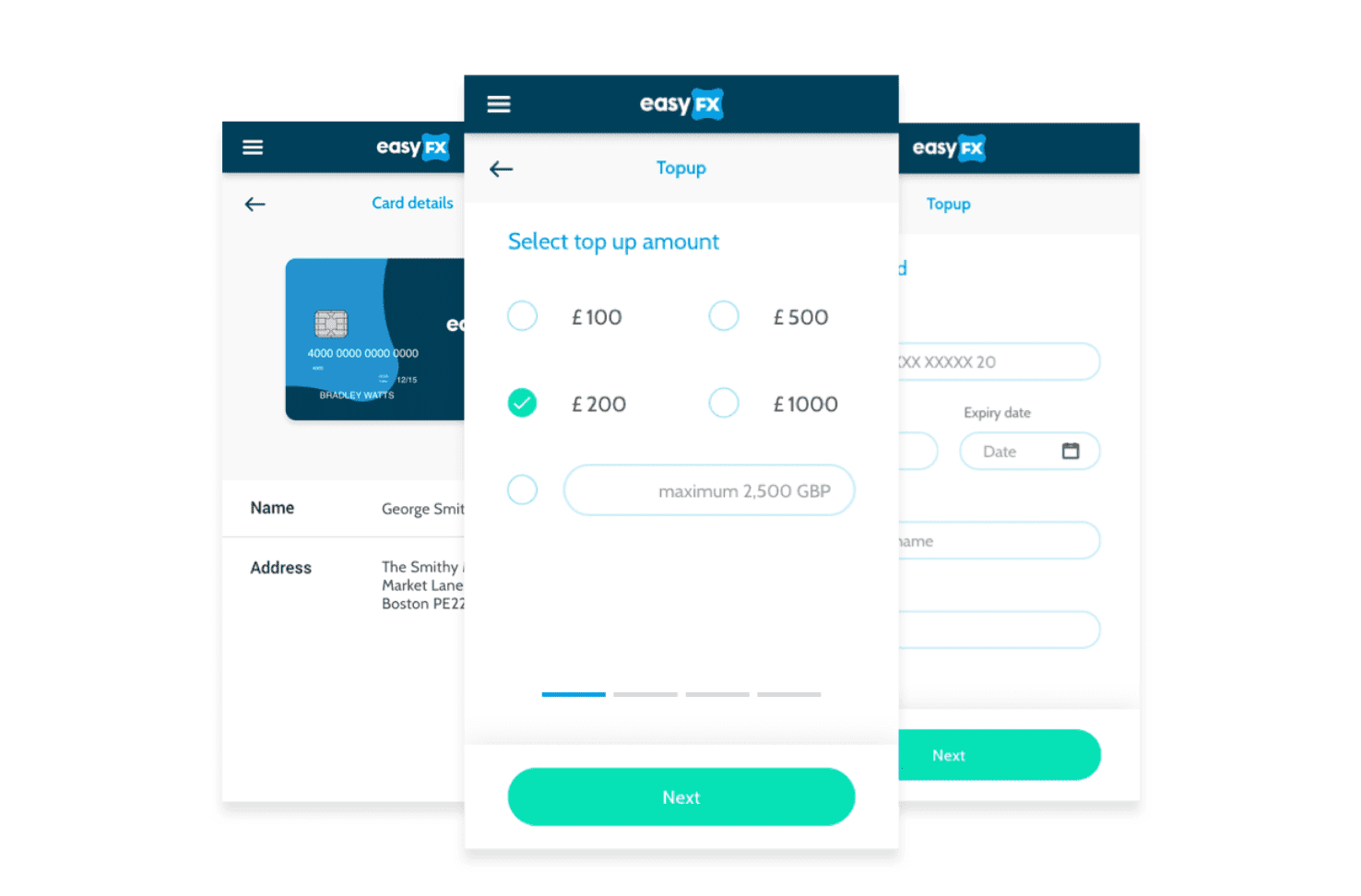

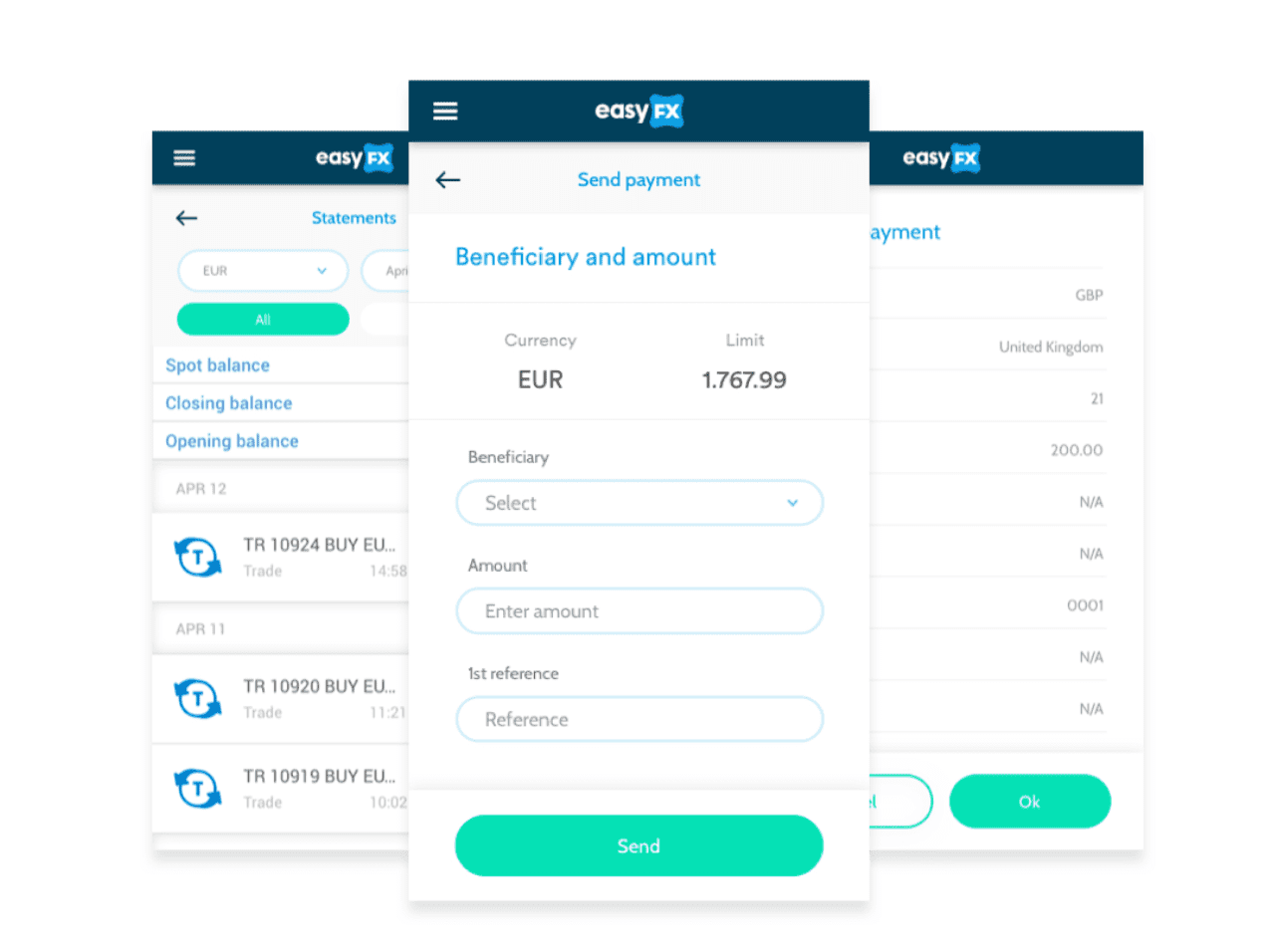

Performing transactions on this platform are simple to execute. Users can simply follow these steps:

- Create an account by signing up on the platform through the mobile app or web; you will need a valid email address and password. Clients need to authenticate their registration by proof of ID and address, this usually takes about 1 – 3 days to verify before users can make trades or start any transactions.

- Sign in using details and scroll to perform transactions. Top up your card. Proceed to add a recipient, then provide the details, and click on the “send payment” button. Then enter the desired funds you intend to send.

- Verify the details of the beneficiary and ensure that they are valid. Then you can hit the “confirm” button to authorize the payment. You will get a notification when the transaction is complete and successful.

Fees and Exchange Rates

EasyFX offers a highly economical rate for currency exchanges for its services. The rate is dependent on the current market rate and their charges are within a percentage of the marketplace price of currencies. The exchange rate is about 1 – 1.5% of the market index.

For fees, there are no charges when customers perform international transfers and this encourages international businesses and companies to adopt this transfer service. However, there are minor charges for trades performed using the prepaid card within the UK. ATM withdrawals draw a fee of about £1.50 while the charge for POS transactions is £0.40. Customers who request for prepaid card renewal or an extra card will pay about £6.

Advantages

- No Fee Transfers: This money transfer service allows users to perform international transfers at no cost. You can purchase items and make withdrawals using the debit or credit card of EasyFX at zero fees. Only for transactions within the UK carry nominal fees.

- Cheap Rates: For business owners and companies who perform multiple transactions that warrant exchanges between currencies, this platform offers the best rates. When related to the rate of other exchange platforms and commercial banks, it is highly competitive.

- Business Solutions: EasyFX services are key to the operations of both local and international business. They deliver varied services that promote business processes, especially access to different foreign currencies and contracts.

- Mobile App: This platform provides unrestricted access to its services and users can perform trades and exchanges with ease and convenience using the app. The design of the mobile app has a user-friendly interface and easy-to-understand features. Users can download the app, which is compatible with both Android and iOS devices.

- Prepaid Card: For international travellers, tourists, and clients who frequently take cash at ATMs, EasyFX prepaid card will be highly recommended. The card can hold multiple currencies, about 15, and this is suitable for international business agents and customers who travel a lot.

Popular destinations of transfers

- Afghanistan

- Åland Islands

- Albania

- Algeria

- American Samoa

- Andorra

- Angola

- Anguilla

- Antigua and Barbuda

- Argentina

- Armenia

- Aruba

- Australia

- Austria

- Azerbaijan

- Bahamas

- Bahrain

- Bangladesh

- Barbados

- Belarus

- Belgium

- Belize

- Benin

- Bermuda

- Bhutan

- Bolivia

- Bosnia And Herzegovina

- Botswana

- Brazil

- British Virgin Islands

- Brunei Darussalam

- Bulgaria

- Burkina Faso

- Burundi

- Cambodia

- Cameroon

- Canada

- Cape Verde

- Caribbean Netherlands

- Cayman Islands

- Central African Republic

- Chad

- Chile

- China

- Colombia

- Comoros

- Congo RDC

- Congo

- Cook Islands

- Costa Rica

- Croatia

- Cuba

- Curacao

- Cyprus

- Czech Republic

- Denmark

- Djibouti

- Dominica

- Dominican Republic

- Ecuador

- Egypt

- El Salvador

- Equatorial Guinea

- Eritrea

- Estonia

- Ethiopia

- Faroe Islands

- Fiji

- Finland

- France

- French Guiana

- French Polynesia

- Gabon

- Gambia

- Georgia

- Germany

- Ghana

- Gibraltar

- Greece

- Greenland

- Grenada

- Guadeloupe

- Guam

- Guatemala

- Guinea

- Guinea-Bissau

- Guyana

- Haiti

- Honduras

- Hong Kong

- Hungary

- Iceland

- India

- Indonesia

- Iran

- Iraq

- Ireland

- Israel

- Italy

- Ivory Coast

- Jamaica

- Japan

- Jordan

- Kazakhstan

- Kenya

- Kiribati

- Kosovo

- Kuwait

- Kyrgyzstan

- Laos

- Latvia

- Lebanon

- Lesotho

- Liberia

- Libya

- Liechtenstein

- Lithuania

- Luxembourg

- Macao

- Macedonia

- Madagascar

- Malawi

- Malaysia

- Maldives

- Mali

- Malta

- Marshall Islands

- Martinique

- Mauritania

- Mauritius

- Mayotte

- Mexico

- Micronesia

- Moldova

- Monaco

- Mongolia

- Montenegro

- Morocco

- Mozambique

- Myanmar

- Namibia

- Nauru

- Nepal

- Netherlands

- Netherlands Antilles

- New Caledonia

- New Zealand

- Nicaragua

- Niger

- Nigeria

- Northern Mariana Islands

- Norway

- Oman

- Pakistan

- Palau

- Palestine

- Panama

- Papua New Guinea

- Paraguay

- Peru

- Philippines

- Poland

- Portugal

- Puerto Rico

- Qatar

- Réunion

- Romania

- Russia

- Rwanda

- Saint Barthélemy

- Saint Kitts And Nevis

- Saint Lucia

- Saint Martin

- St Vincent & the Grenadines

- Samoa

- San Marino

- Sao Tome And Principe

- Saudi Arabia

- Senegal

- Serbia

- Seychelles

- Sierra Leone

- Singapore

- Sint Maarten

- Slovakia

- Slovenia

- Solomon Islands

- Somalia

- South Africa

- South Korea

- South Sudan

- Spain

- Sri Lanka

- Sudan

- Suriname

- Swaziland

- Sweden

- Switzerland

- Syrian Arab Republic

- Taiwan

- Tajikistan

- Tanzania

- Thailand

- Timor-Leste

- Togo

- Tonga

- Trinidad And Tobago

- Tunisia

- Turkey

- Turkmenistan

- Turks and Caicos Islands

- Tuvalu

- Uganda

- Ukraine

- United Arab Emirates

- United Kingdom

- United States

- US Minor Outlying Islands

- US Virgin Islands

- Uruguay

- Uzbekistan

- Vanuatu

- Vatican

- Venezuela

- Vietnam

- Wallis And Futuna

- Yemen

- Zambia

- Zimbabwe