InstaReM or Instant Remittance is a private Fintech company that allows for cross-border digital money transfers to businesses and individuals. Headquartered in Singapore, it was founded back in 2014 by Michael Bermingham and Prajit Nanu; the latter turning CEO. The promise of this venture was to provide accurate exchange rates during international transfers.

Contact InstaReM

InstaReM PTY Ltd

Transfer options

Withdrawal options

Payment options

At the moment, the main area of focus for this company is in Asia and it allows a selective amount of sending countries across continents. These include Australia, United States, India, Singapore, and others. Plus, the receiving countries are more in number, some being China, India, Indonesia, Austria, Denmark, and many more.

How to make a transaction

The steps for one to transfer money overseas is not too difficult using this platform. They are as mentioned hereafter.

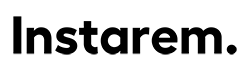

- The first thing that you need to do is open the main website of InstaReM. You need to open up an account; this part is free-of-cost

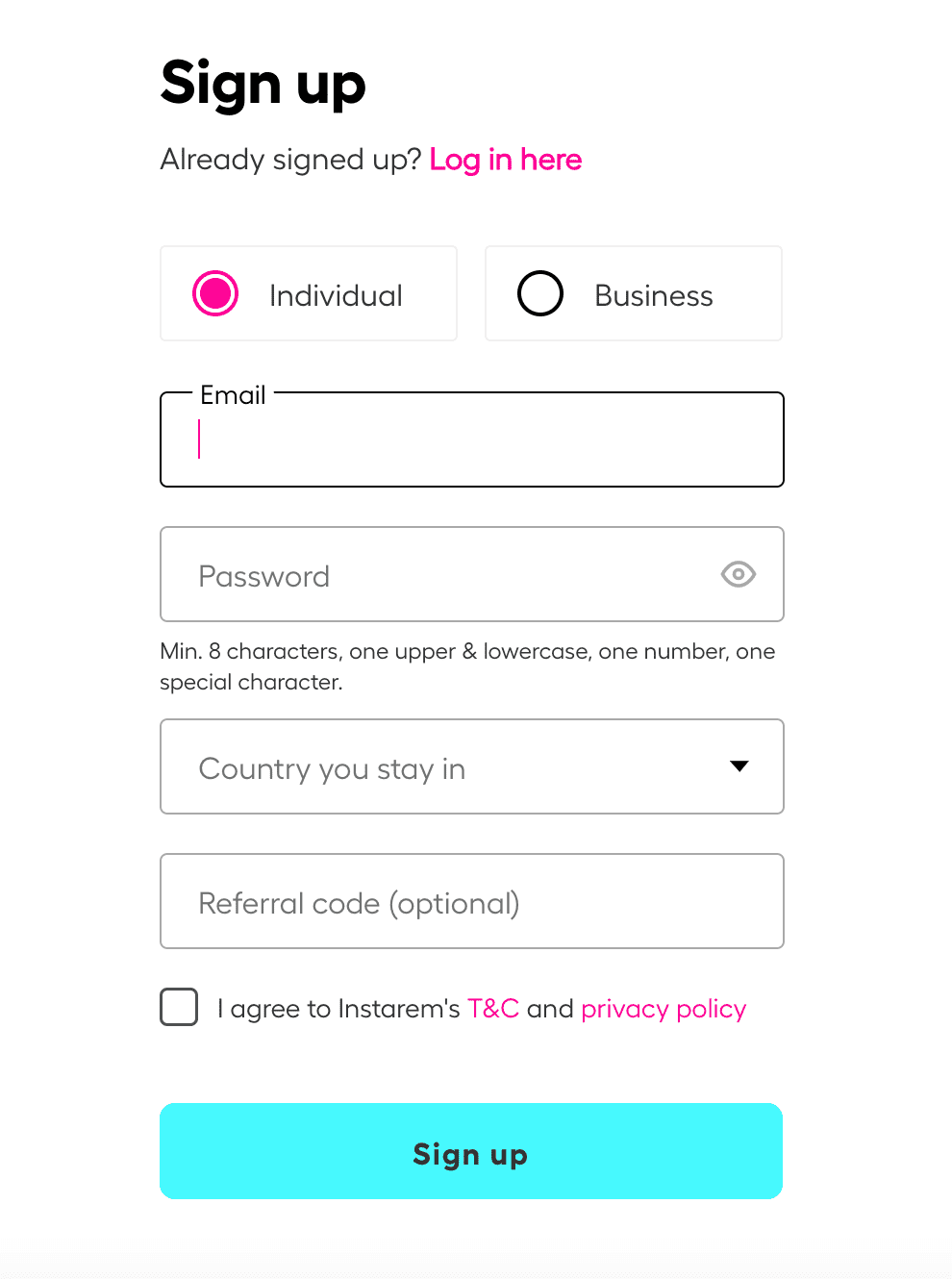

- The next that you need to do is mention the recipient of the transfer and the area

- Mention the amount that you need to transfer

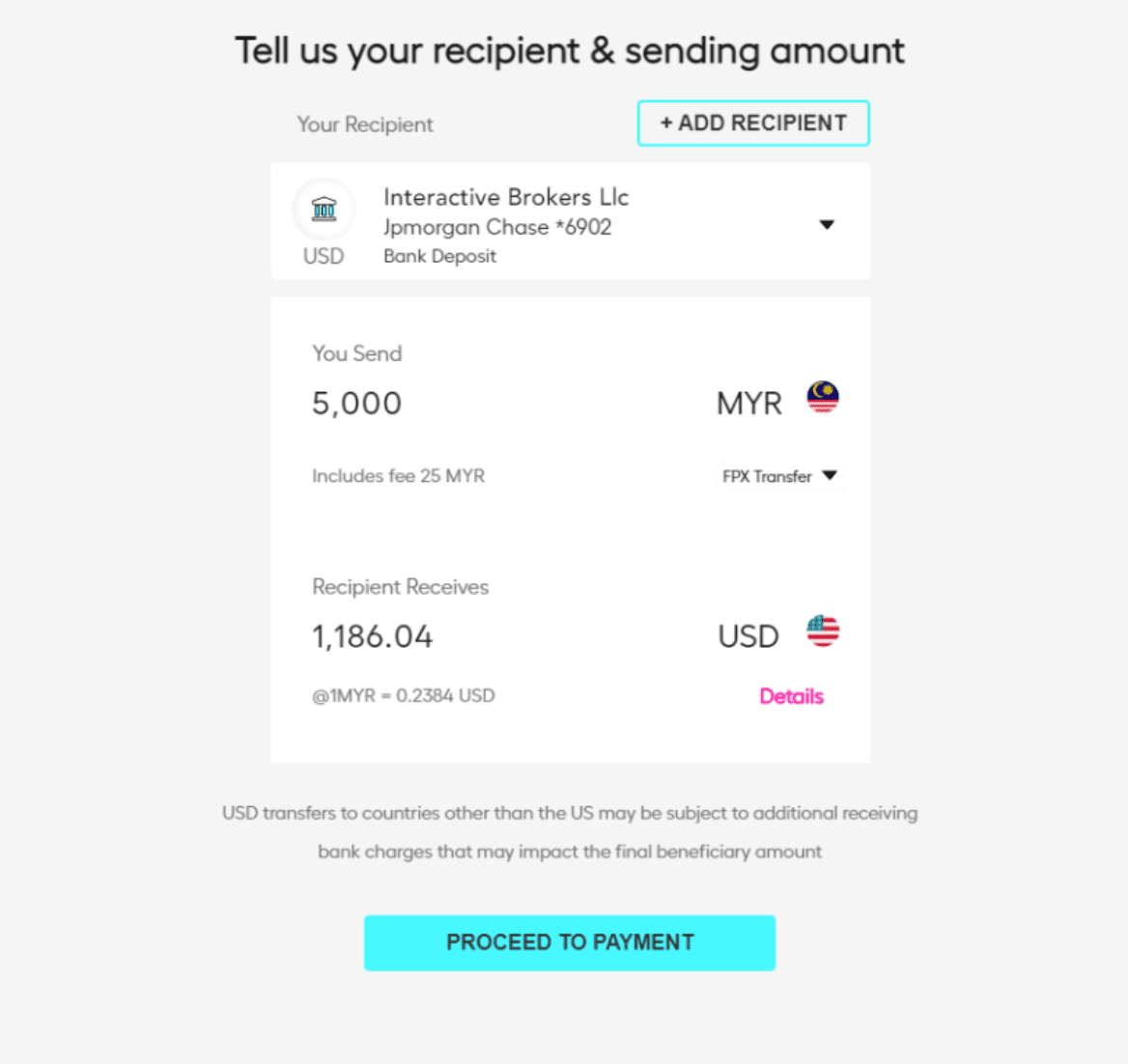

- Select the mode of payment that you wish to take up for the transfer

- Continue with your payment with your local bank or put in your credit or debit card information. Automatically, InstaReM would assess the currency of the recipient and convert your amount to match. Through the selected mode of payment, the service would go forward with a reliable money transfer

Fees & Exchange Rates

In the matter of transferring money oversea, one thing to focus on is the Fees and Exchange Rates. In InstaReM, the values and rates are highly influential and effective, beating out the fellow competition. However, it is not the cheapest model available in comparison to the other services.

InstaReM does focus on the standard mid-market rate of currency exchange between banks. For example, if you are transferring from Singapore, you would receive an exchange rate of 0.25%. As for transferring from places like Australia and Hong Kong, the standard rate is 0.5%.

As for the fees, that is not stagnant for all countries either. When you put in the requisite information as per the country you are sending to, you would notice the Fees structure. It is available on the currency converter of InstaReM, and one can notice it at any given time. Usually, the difference varies between 1% to 0% among all the fee transfer corridors.

Advantages

Without a doubt, there are many benefits of using InstaReM as the tool to transfer money internationally. They are as follows.

- Easy-to-Operate- The service to easy to use, and the company is transparent about all transfer-related information with its users.

- Fast Transfer- The transfers occur fast, and the money takes usually 1 to 2 business days to reach the recipient’s account.

- Low Cost- Taking up the service is not too costly either, as InstaReM only changes a small nominal fee.

- Loyalty Feature- This company also provides loyalty points to its users. When you utilize it, you would get such points during your account registration, and each time you transfer. Later, you can redeem the points over any future transactions.

Popular destinations of transfers

- Afghanistan

- Åland Islands

- Albania

- Algeria

- American Samoa

- Andorra

- Angola

- Anguilla

- Antigua and Barbuda

- Argentina

- Armenia

- Aruba

- Australia

- Austria

- Azerbaijan

- Bahamas

- Bahrain

- Bangladesh

- Barbados

- Belarus

- Belgium

- Belize

- Benin

- Bermuda

- Bhutan

- Bolivia

- Bosnia And Herzegovina

- Botswana

- Brazil

- British Virgin Islands

- Brunei Darussalam

- Bulgaria

- Burkina Faso

- Burundi

- Cambodia

- Cameroon

- Canada

- Cape Verde

- Caribbean Netherlands

- Cayman Islands

- Central African Republic

- Chad

- Chile

- China

- Colombia

- Comoros

- Congo RDC

- Congo

- Cook Islands

- Costa Rica

- Croatia

- Cuba

- Curacao

- Cyprus

- Czech Republic

- Denmark

- Djibouti

- Dominica

- Dominican Republic

- Ecuador

- Egypt

- El Salvador

- Equatorial Guinea

- Eritrea

- Estonia

- Ethiopia

- Faroe Islands

- Fiji

- Finland

- France

- French Guiana

- French Polynesia

- Gabon

- Gambia

- Georgia

- Germany

- Ghana

- Gibraltar

- Greece

- Greenland

- Grenada

- Guadeloupe

- Guam

- Guatemala

- Guinea

- Guinea-Bissau

- Guyana

- Haiti

- Honduras

- Hong Kong

- Hungary

- Iceland

- India

- Indonesia

- Iran

- Iraq

- Ireland

- Israel

- Italy

- Ivory Coast

- Jamaica

- Japan

- Jordan

- Kazakhstan

- Kenya

- Kiribati

- Kosovo

- Kuwait

- Kyrgyzstan

- Laos

- Latvia

- Lebanon

- Lesotho

- Liberia

- Libya

- Liechtenstein

- Lithuania

- Luxembourg

- Macao

- Macedonia

- Madagascar

- Malawi

- Malaysia

- Maldives

- Mali

- Malta

- Marshall Islands

- Martinique

- Mauritania

- Mauritius

- Mayotte

- Mexico

- Micronesia

- Moldova

- Monaco

- Mongolia

- Montenegro

- Morocco

- Mozambique

- Myanmar

- Namibia

- Nauru

- Nepal

- Netherlands

- Netherlands Antilles

- New Caledonia

- New Zealand

- Nicaragua

- Niger

- Nigeria

- Northern Mariana Islands

- Norway

- Oman

- Pakistan

- Palau

- Palestine

- Panama

- Papua New Guinea

- Paraguay

- Peru

- Philippines

- Poland

- Portugal

- Puerto Rico

- Qatar

- Réunion

- Romania

- Russia

- Rwanda

- Saint Barthélemy

- Saint Kitts And Nevis

- Saint Lucia

- Saint Martin

- St Vincent & the Grenadines

- Samoa

- San Marino

- Sao Tome And Principe

- Saudi Arabia

- Senegal

- Serbia

- Seychelles

- Sierra Leone

- Singapore

- Sint Maarten

- Slovakia

- Slovenia

- Solomon Islands

- Somalia

- South Africa

- South Korea

- South Sudan

- Spain

- Sri Lanka

- Sudan

- Suriname

- Swaziland

- Sweden

- Switzerland

- Syrian Arab Republic

- Taiwan

- Tajikistan

- Tanzania

- Thailand

- Timor-Leste

- Togo

- Tonga

- Trinidad And Tobago

- Tunisia

- Turkey

- Turkmenistan

- Turks and Caicos Islands

- Tuvalu

- Uganda

- Ukraine

- United Arab Emirates

- United Kingdom

- United States

- US Minor Outlying Islands

- US Virgin Islands

- Uruguay

- Uzbekistan

- Vanuatu

- Vatican

- Venezuela

- Vietnam

- Wallis And Futuna

- Yemen

- Zambia

- Zimbabwe