Payoneer is an American financial services company founded in 2005 by an Israeli engineer, Yuval Tal. This company deals with online fund transfer and digital payment services restricted only for business and market places all around the globe. Hence, their mode of services differ slightly from other currency exchange service providers.

Contact Payoneer

Payoneer

Transfer options

Withdrawal options

Payment options

The targeted audience is business owners, freelancers, professionals, and service/product market places. Their primary job is to provide easy money exchange, payment solutions to freelancers, employees, and others. Payoneer does not provide money transfer services to individuals for personal use. They are working with several top clients across the world, such as Upwork, Fiverr, Amazon, Airbnb, and more.

How to make a transaction

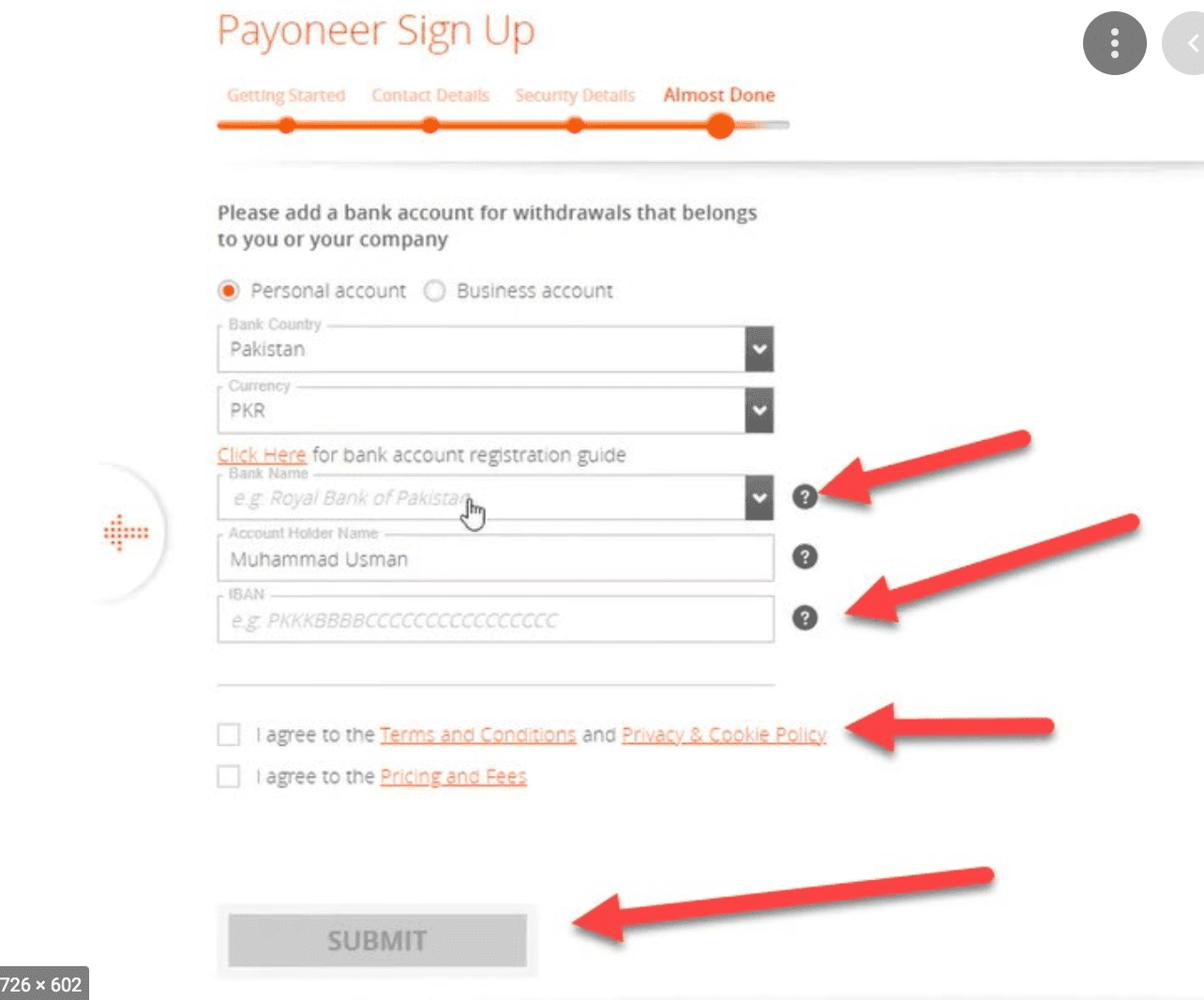

For making a transaction

You and your beneficiary need to open a Payoneer account. You also need to add the bank details of the person to whom you are sending the money. Then you can enter the details of the payment amount along with the recipient's details. The last step you need to do is to review all the details of the payment before proceeding to pay. Once you are done with the review, you need to click Pay, and then you will receive an instant payment confirmation along with the transaction ID. The entire process of sending money involves a fee levied by Payoneer.

For Receiving a Payment

If you do not have any Payoneer account but the recipient has an account, then the beneficiary can use the Payoneer’s billing service for requesting money from you. You can make the payment through debit card, credit card, or net banking. Payoneer may levy a fee depending upon the type of payment done.

After receiving the money in the beneficiary Payoneer account, the receiver can withdraw the funds from their local bank account.

Fees and Exchange rates

When you are using Payoneer, often the payment is made in one currency, but you may receive the fund in another currency. You need to pay a conversion fee of 2% which is above the mid-market rate. In some other countries, the fee may rise to 2.75%.

There is a ‘Make a Payment’ option for making and receiving fund transfer at no cost. If you have enrolled yourself in the Global Payments Service, Payoneer will help you receive money for US dollars, Euros, Pounds, Yen. If you are receiving money in Euros, Pounds, and Yen, then it is free to receive money. For US dollars, Payoneer levies a 1% transaction fee.

You can also use the billing service for receiving payments but you need to pay different fees if you are using an e-check or credit card. To withdraw the funds in the market places like Amazon, Fiverr, and Airbnb, you need to find the exact rates on the platform you are working with as these market places have their own set of exchange fees.

Advantages

Payoneer helps users to send and receive money in a convenient and safe way so that money from the sender to the beneficiary reaches quickly. Businesses as well as individuals are likely to make greater savings due to lower service charge offered by Payoneer. It also enables users to request for payment and clients to release the payment of their own preferred choice. With the help of smooth integration and multilingual support to the user, it is a great cross-border payment solution to send and receive money.

Popular destinations of transfers

- Afghanistan

- Åland Islands

- Albania

- Algeria

- American Samoa

- Andorra

- Angola

- Anguilla

- Antigua and Barbuda

- Argentina

- Armenia

- Aruba

- Australia

- Austria

- Azerbaijan

- Bahamas

- Bahrain

- Bangladesh

- Barbados

- Belarus

- Belgium

- Belize

- Benin

- Bermuda

- Bhutan

- Bolivia

- Bosnia And Herzegovina

- Botswana

- Brazil

- British Virgin Islands

- Brunei Darussalam

- Bulgaria

- Burkina Faso

- Burundi

- Cambodia

- Cameroon

- Canada

- Cape Verde

- Caribbean Netherlands

- Cayman Islands

- Central African Republic

- Chad

- Chile

- China

- Colombia

- Comoros

- Congo RDC

- Congo

- Cook Islands

- Costa Rica

- Croatia

- Cuba

- Curacao

- Cyprus

- Czech Republic

- Denmark

- Djibouti

- Dominica

- Dominican Republic

- Ecuador

- Egypt

- El Salvador

- Equatorial Guinea

- Eritrea

- Estonia

- Ethiopia

- Faroe Islands

- Fiji

- Finland

- France

- French Guiana

- French Polynesia

- Gabon

- Gambia

- Georgia

- Germany

- Ghana

- Gibraltar

- Greece

- Greenland

- Grenada

- Guadeloupe

- Guam

- Guatemala

- Guinea

- Guinea-Bissau

- Guyana

- Haiti

- Honduras

- Hong Kong

- Hungary

- Iceland

- India

- Indonesia

- Iran

- Iraq

- Ireland

- Israel

- Italy

- Ivory Coast

- Jamaica

- Japan

- Jordan

- Kazakhstan

- Kenya

- Kiribati

- Kosovo

- Kuwait

- Kyrgyzstan

- Laos

- Latvia

- Lebanon

- Lesotho

- Liberia

- Libya

- Liechtenstein

- Lithuania

- Luxembourg

- Macao

- Macedonia

- Madagascar

- Malawi

- Malaysia

- Maldives

- Mali

- Malta

- Marshall Islands

- Martinique

- Mauritania

- Mauritius

- Mayotte

- Mexico

- Micronesia

- Moldova

- Monaco

- Mongolia

- Montenegro

- Morocco

- Mozambique

- Myanmar

- Namibia

- Nauru

- Nepal

- Netherlands

- Netherlands Antilles

- New Caledonia

- New Zealand

- Nicaragua

- Niger

- Nigeria

- Northern Mariana Islands

- Norway

- Oman

- Pakistan

- Palau

- Palestine

- Panama

- Papua New Guinea

- Paraguay

- Peru

- Philippines

- Poland

- Portugal

- Puerto Rico

- Qatar

- Réunion

- Romania

- Russia

- Rwanda

- Saint Barthélemy

- Saint Kitts And Nevis

- Saint Lucia

- Saint Martin

- St Vincent & the Grenadines

- Samoa

- San Marino

- Sao Tome And Principe

- Saudi Arabia

- Senegal

- Serbia

- Seychelles

- Sierra Leone

- Singapore

- Sint Maarten

- Slovakia

- Slovenia

- Solomon Islands

- Somalia

- South Africa

- South Korea

- South Sudan

- Spain

- Sri Lanka

- Sudan

- Suriname

- Swaziland

- Sweden

- Switzerland

- Syrian Arab Republic

- Taiwan

- Tajikistan

- Tanzania

- Thailand

- Timor-Leste

- Togo

- Tonga

- Trinidad And Tobago

- Tunisia

- Turkey

- Turkmenistan

- Turks and Caicos Islands

- Tuvalu

- Uganda

- Ukraine

- United Arab Emirates

- United Kingdom

- United States

- US Minor Outlying Islands

- US Virgin Islands

- Uruguay

- Uzbekistan

- Vanuatu

- Vatican

- Venezuela

- Vietnam

- Wallis And Futuna

- Yemen

- Zambia

- Zimbabwe