Paysend is a global financial company established to change the way how money moves from one person to another. The company was established in April 2017. A team of banking and payment experts gets together to form the company after they are fed up with slow payment processing.

Contact Paysend

PaySend

Transfer options

Withdrawal options

Payment options

Being the first company to introduce card-to-card transfer, Paysend connects 12 billion cards including Visa, Mastercard, UnionPay, and other cards. Currently, the company has more than two million users all over the world. A few of the popular products of Paysend include Paysend Link, Paysend Business, Paysend Global Account, and Paysend Global Transfers.

How to make a transaction

Thanks to Paysend for making it easy to transfer payments from one card to another card. Let’s find out how to make a transaction using Paysend. If you don’t have a Paysend account, you need to create one before starting the following process.

- Open the application or visit the official website paysend.com. Click the “New Transfer” button.

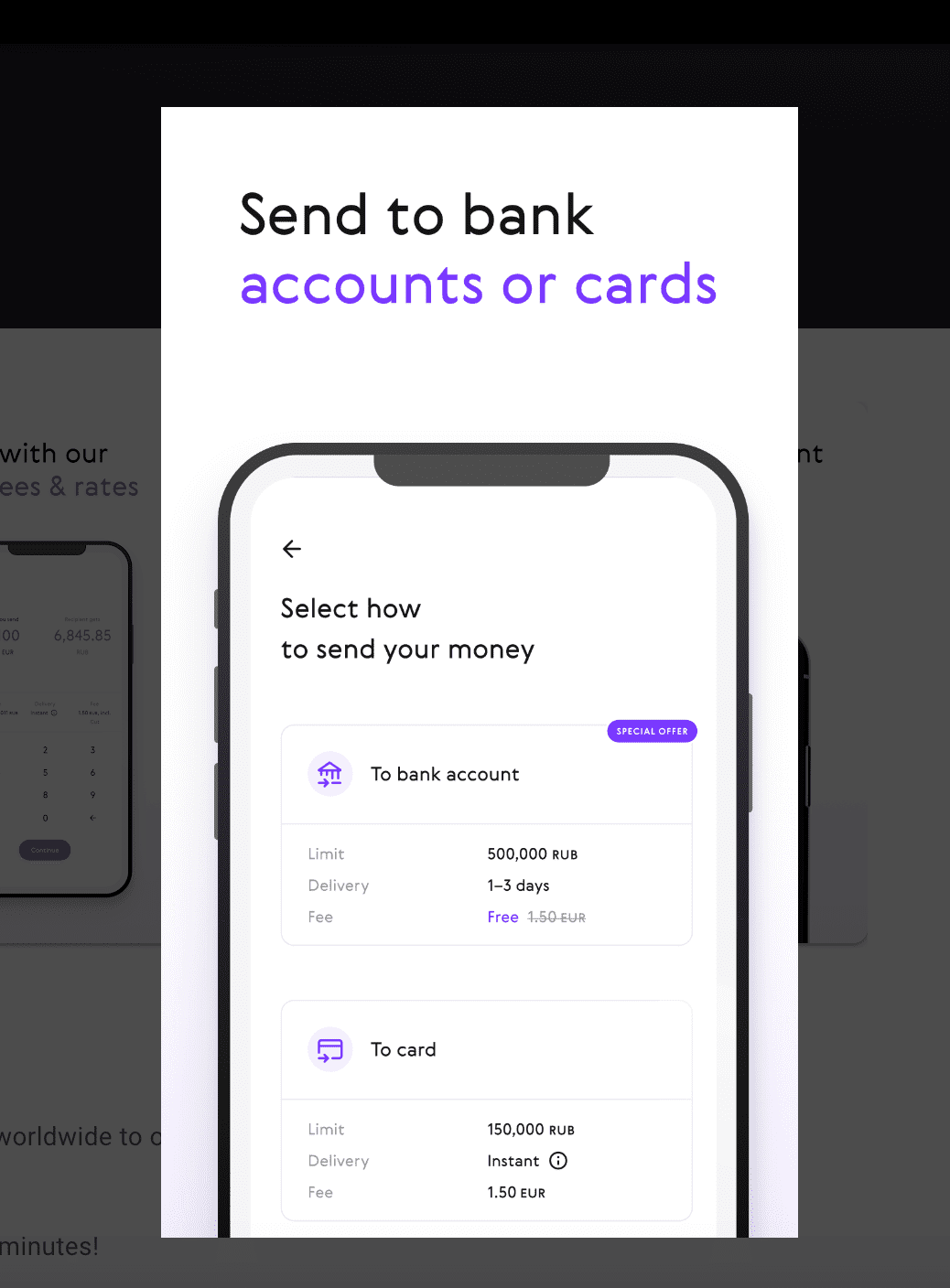

- Select the transfer method. Let’s assume you want to make a transfer from one card to another card. Click on “To Card” and enter the beneficiary’s card details. To qualify for zero commission offers, you have to send money to a Mastercard.

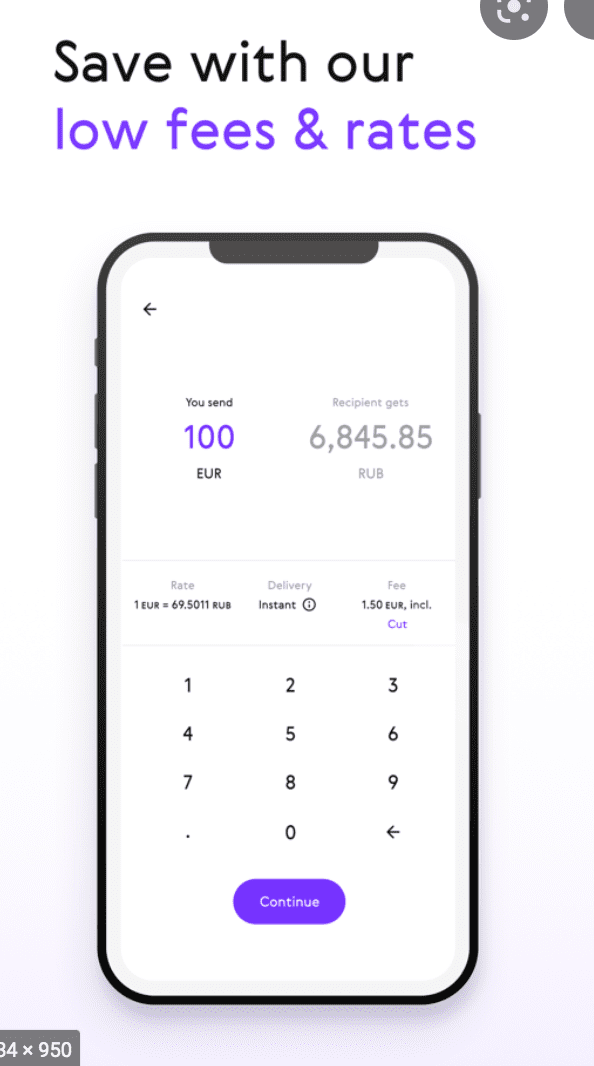

- Now, write the amount and you will see the exchange rate. If you are okay with the details, you can move to the next step.

- Here, you will enter your card details.

- Confirm your details and it is done.

Fees & Exchange Rates

Paysend charges a fixed fee regardless of the transfer amount. Depend on the sender’s location, you will be charged a fixed payment. If you are sending payment from Europe, you have to pay 1.5 Euros. If you are making a transaction from the United States, you need to pay two dollars. From Canada and the United Kingdom, you have to pay three Canadian dollars and one pound respectively. Before you make a transaction, you can see the exact amount of charges you need to pay for the transaction. The most positive thing about Paysend is that you don’t need to pay any other charges.

When it comes to exchanging rates, Paysend has zero perfect exchange rate margins. It makes the FinTech Company as one of the best solutions to send money all over the world.

Advantages

Why you should use Paysend to make the transfer when there are so many options? Let’s find out how Paysend is a better alternative to other companies.

- Paysend supports payment transfers to 90 countries and they are expanding to other countries as well.

- They charge a flat fee with no hidden charges. You have to pay a zero percent on the exchange rate as well.

- While transferring money, they ensure perfect security that is certified by Mastercard, Visa, UnionPay, etc.

- Unlike conventional companies, they offer a variety of payment transfer methods.

- They have 24/7 customer support, which is remarkable. You can contact the support as soon as you have any trouble.

Popular destinations of transfers

- Afghanistan

- Åland Islands

- Albania

- Algeria

- American Samoa

- Andorra

- Angola

- Anguilla

- Antigua and Barbuda

- Argentina

- Armenia

- Aruba

- Australia

- Austria

- Azerbaijan

- Bahamas

- Bahrain

- Bangladesh

- Barbados

- Belarus

- Belgium

- Belize

- Benin

- Bermuda

- Bhutan

- Bolivia

- Bosnia And Herzegovina

- Botswana

- Brazil

- British Virgin Islands

- Brunei Darussalam

- Bulgaria

- Burkina Faso

- Burundi

- Cambodia

- Cameroon

- Canada

- Cape Verde

- Caribbean Netherlands

- Cayman Islands

- Central African Republic

- Chad

- Chile

- China

- Colombia

- Comoros

- Congo RDC

- Congo

- Cook Islands

- Costa Rica

- Croatia

- Cuba

- Curacao

- Cyprus

- Czech Republic

- Denmark

- Djibouti

- Dominica

- Dominican Republic

- Ecuador

- Egypt

- El Salvador

- Equatorial Guinea

- Eritrea

- Estonia

- Ethiopia

- Faroe Islands

- Fiji

- Finland

- France

- French Guiana

- French Polynesia

- Gabon

- Gambia

- Georgia

- Germany

- Ghana

- Gibraltar

- Greece

- Greenland

- Grenada

- Guadeloupe

- Guam

- Guatemala

- Guinea

- Guinea-Bissau

- Guyana

- Haiti

- Honduras

- Hong Kong

- Hungary

- Iceland

- India

- Indonesia

- Iran

- Iraq

- Ireland

- Israel

- Italy

- Ivory Coast

- Jamaica

- Japan

- Jordan

- Kazakhstan

- Kenya

- Kiribati

- Kosovo

- Kuwait

- Kyrgyzstan

- Laos

- Latvia

- Lebanon

- Lesotho

- Liberia

- Libya

- Liechtenstein

- Lithuania

- Luxembourg

- Macao

- Macedonia

- Madagascar

- Malawi

- Malaysia

- Maldives

- Mali

- Malta

- Marshall Islands

- Martinique

- Mauritania

- Mauritius

- Mayotte

- Mexico

- Micronesia

- Moldova

- Monaco

- Mongolia

- Montenegro

- Morocco

- Mozambique

- Myanmar

- Namibia

- Nauru

- Nepal

- Netherlands

- Netherlands Antilles

- New Caledonia

- New Zealand

- Nicaragua

- Niger

- Nigeria

- Northern Mariana Islands

- Norway

- Oman

- Pakistan

- Palau

- Palestine

- Panama

- Papua New Guinea

- Paraguay

- Peru

- Philippines

- Poland

- Portugal

- Puerto Rico

- Qatar

- Réunion

- Romania

- Russia

- Rwanda

- Saint Barthélemy

- Saint Kitts And Nevis

- Saint Lucia

- Saint Martin

- St Vincent & the Grenadines

- Samoa

- San Marino

- Sao Tome And Principe

- Saudi Arabia

- Senegal

- Serbia

- Seychelles

- Sierra Leone

- Singapore

- Sint Maarten

- Slovakia

- Slovenia

- Solomon Islands

- Somalia

- South Africa

- South Korea

- South Sudan

- Spain

- Sri Lanka

- Sudan

- Suriname

- Swaziland

- Sweden

- Switzerland

- Syrian Arab Republic

- Taiwan

- Tajikistan

- Tanzania

- Thailand

- Timor-Leste

- Togo

- Tonga

- Trinidad And Tobago

- Tunisia

- Turkey

- Turkmenistan

- Turks and Caicos Islands

- Tuvalu

- Uganda

- Ukraine

- United Arab Emirates

- United Kingdom

- United States

- US Minor Outlying Islands

- US Virgin Islands

- Uruguay

- Uzbekistan

- Vanuatu

- Vatican

- Venezuela

- Vietnam

- Wallis And Futuna

- Yemen

- Zambia

- Zimbabwe