Established in 2014, Pockit aims to offer banking current accounts to people who can’t open an account with high-street banks in the UK. The company boasts of more than 500K customers and provides banking service via mobile devices.

Contact Pockit

Pockit

Transfer options

Withdrawal options

Payment options

How to Make a Transaction

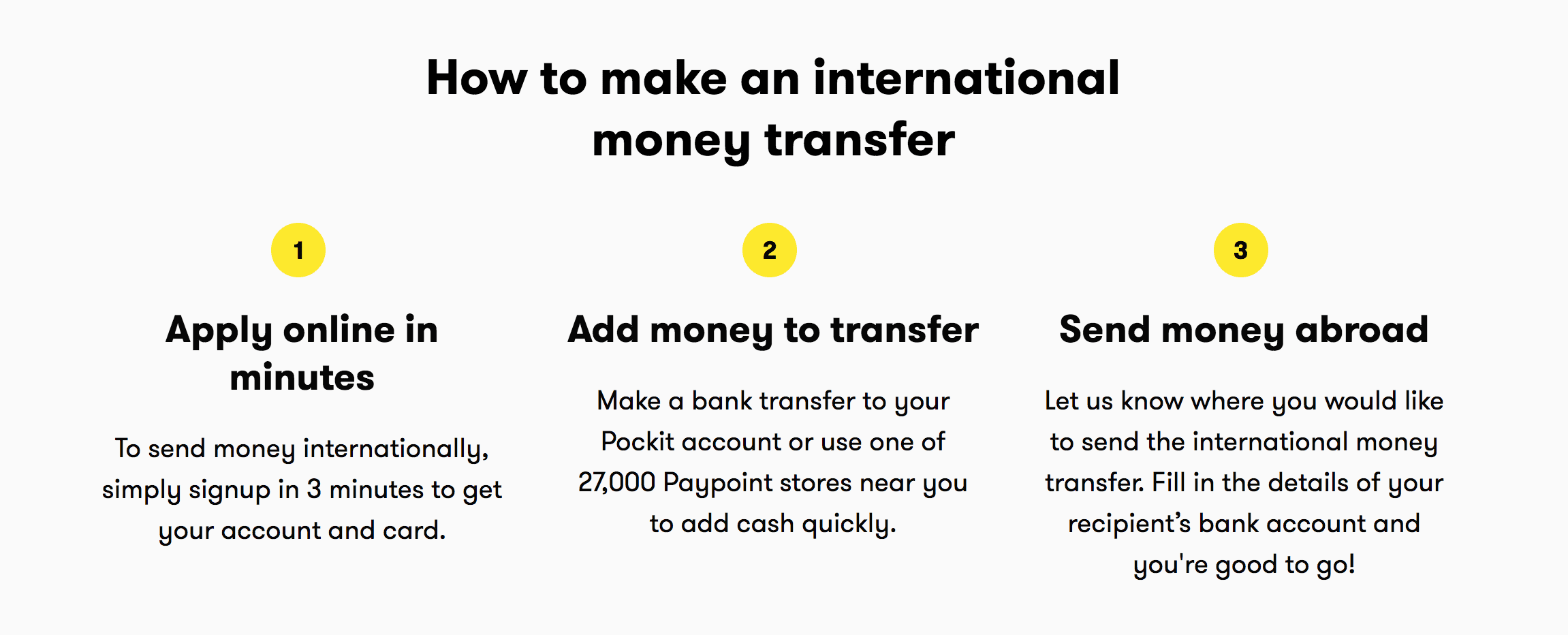

The first thing you need to do is open a Pockit account. Once you do that, you’ll get a Pockit Mastercard (prepaid) in a couple of working days. Next, you need to deposit money into your Pockit account, which is easy and can be done in either of the following ways.

Method 1 – Bank Transfer (No Fee Attached)

Pockit offers two plans — Simple Limit Account and Full Limit Accounts. You can have your income deposited in your account through bank transfer. The maximum deposit limit per day is £200 for a Simple Limit Account and £1,500 for a Full Limit Account.

To deposit money through bank transfer, you need to do the following:

- Note down the sort code and unique account number

- Forward this information to the depositor

Method 2 – Cash Deposit (£0.99 fee per deposit)

Pockit has 28,000 PayPoint retailers across the UK. You can make a deposit at any of these locations. Here’s what you need to do:

- Give the cashier your Pockit Mastercard

- Tell him how much you want to deposit

- Hand the cash to him

Full Limit Account holders can make a cash deposit of up to £249 per day. This limit for Simple Limit Account holders is £200.

Fees and Exchange Rates

Here are the various fees charged by Pockit:

- You need to pay a £99 fee for a Pockit Mastercard. If you want the Mastercard the next day, you will be charged £9.99.

- Like some banks, Pockit charges a small monthly fee just to hold an account. This fee is £99/month.

- £99 fee if you want to deposit money into your own Pockit account via a PayPoint retailer, every time you transfer money into another U.K. account, whenever you make a bill payment through Direct Debit, every time you take out cash from an ATM within the U.K, every time you take out cash from an ATM overseas

- 4% foreign exchange fee when you spend money abroad

- £99 fee in case you transfer money to an overseas bank account

- an exchange rate fee of up to 3.5% when you transfer money to an overseas bank account

Advantages

Some of the main advantages of Pockit are as follows:

- Opening an account is easy and fast

- No credit check is done on people who want to set up an account

- Paying money into a Pockit account is easy

- Range of additional services, such as LOQBOX that could boost your credit worthiness and help you save money

Popular destinations of transfers

- Afghanistan

- Åland Islands

- Albania

- Algeria

- American Samoa

- Andorra

- Angola

- Anguilla

- Antigua and Barbuda

- Argentina

- Armenia

- Aruba

- Australia

- Austria

- Azerbaijan

- Bahamas

- Bahrain

- Bangladesh

- Barbados

- Belarus

- Belgium

- Belize

- Benin

- Bermuda

- Bhutan

- Bolivia

- Bosnia And Herzegovina

- Botswana

- Brazil

- British Virgin Islands

- Brunei Darussalam

- Bulgaria

- Burkina Faso

- Burundi

- Cambodia

- Cameroon

- Canada

- Cape Verde

- Caribbean Netherlands

- Cayman Islands

- Central African Republic

- Chad

- Chile

- China

- Colombia

- Comoros

- Congo RDC

- Congo

- Cook Islands

- Costa Rica

- Croatia

- Cuba

- Curacao

- Cyprus

- Czech Republic

- Denmark

- Djibouti

- Dominica

- Dominican Republic

- Ecuador

- Egypt

- El Salvador

- Equatorial Guinea

- Eritrea

- Estonia

- Ethiopia

- Faroe Islands

- Fiji

- Finland

- France

- French Guiana

- French Polynesia

- Gabon

- Gambia

- Georgia

- Germany

- Ghana

- Gibraltar

- Greece

- Greenland

- Grenada

- Guadeloupe

- Guam

- Guatemala

- Guinea

- Guinea-Bissau

- Guyana

- Haiti

- Honduras

- Hong Kong

- Hungary

- Iceland

- India

- Indonesia

- Iran

- Iraq

- Ireland

- Israel

- Italy

- Ivory Coast

- Jamaica

- Japan

- Jordan

- Kazakhstan

- Kenya

- Kiribati

- Kosovo

- Kuwait

- Kyrgyzstan

- Laos

- Latvia

- Lebanon

- Lesotho

- Liberia

- Libya

- Liechtenstein

- Lithuania

- Luxembourg

- Macao

- Macedonia

- Madagascar

- Malawi

- Malaysia

- Maldives

- Mali

- Malta

- Marshall Islands

- Martinique

- Mauritania

- Mauritius

- Mayotte

- Mexico

- Micronesia

- Moldova

- Monaco

- Mongolia

- Montenegro

- Morocco

- Mozambique

- Myanmar

- Namibia

- Nauru

- Nepal

- Netherlands

- Netherlands Antilles

- New Caledonia

- New Zealand

- Nicaragua

- Niger

- Nigeria

- Northern Mariana Islands

- Norway

- Oman

- Pakistan

- Palau

- Palestine

- Panama

- Papua New Guinea

- Paraguay

- Peru

- Philippines

- Poland

- Portugal

- Puerto Rico

- Qatar

- Réunion

- Romania

- Russia

- Rwanda

- Saint Barthélemy

- Saint Kitts And Nevis

- Saint Lucia

- Saint Martin

- St Vincent & the Grenadines

- Samoa

- San Marino

- Sao Tome And Principe

- Saudi Arabia

- Senegal

- Serbia

- Seychelles

- Sierra Leone

- Singapore

- Sint Maarten

- Slovakia

- Slovenia

- Solomon Islands

- Somalia

- South Africa

- South Korea

- South Sudan

- Spain

- Sri Lanka

- Sudan

- Suriname

- Swaziland

- Sweden

- Switzerland

- Syrian Arab Republic

- Taiwan

- Tajikistan

- Tanzania

- Thailand

- Timor-Leste

- Togo

- Tonga

- Trinidad And Tobago

- Tunisia

- Turkey

- Turkmenistan

- Turks and Caicos Islands

- Tuvalu

- Uganda

- Ukraine

- United Arab Emirates

- United Kingdom

- United States

- US Minor Outlying Islands

- US Virgin Islands

- Uruguay

- Uzbekistan

- Vanuatu

- Vatican

- Venezuela

- Vietnam

- Wallis And Futuna

- Yemen

- Zambia

- Zimbabwe