The post office was first introduced in 1986, in the United Kingdom to help people communicate through sending and receiving letters from different locations. It has also facilitated the delivery of small and large parcels within the U.K. Besides the delivery of parcels and letters, the company also offers a wide range of bill payment options, top-up services for mobile phones, and prepaid energy meters. However, with changing times in technology, the company decided to revolutionize its services to facilitate a quick and efficient transfer of money in 2015.

Contact Post Office

Post Office Money

Transfer options

Withdrawal options

Payment options

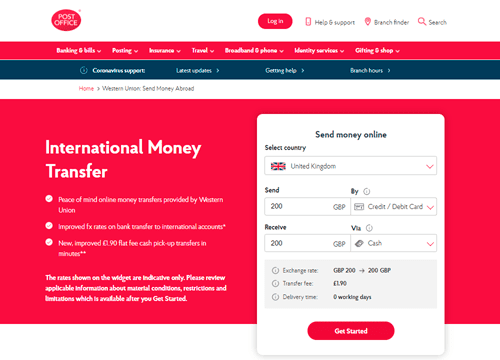

It launched the post office money brand that offers a wide variety of financial services to customers, including insurance, travel money services, loans, banking, savings, and mortgages. The company later decided to expand its money transfer services by working with Western Union in 2019 to ensure that it could provide customers cheap services. Working together with companies like MoneyGram and Western Union has expanded its borders since it now covers more than 200 countries globally.

How the Post office works

The process may vary depending on the type of service a customer needs. For those requesting online currency, the initial steps involve signing up their website and providing additional identification information before proceeding to make your request. For local currency, you should visit the post office for assistance. To send money overseas, or to a foreign bank, you should:

- Create an account at the post-office-Western union partnership, where you provide personal information crucial in facilitating the process.

- Then, choose the currency you want to exchange the money to book the transfer rates on the website.

- Give details of the receiver, including their address, and pay for the transaction to be complete.

- The receiver will be notified to pick up the money at the nearest agent location once the transaction is complete.

Fees and Exchange Rates

The U.K. Post office charges are very affordable and customer friendly. For post office travel money, interbank charges are usually incurred. A small amount of money is deducted from the customer's travel card to incur the transfer services and exchange of money between the different currencies. The company also charges some fees for the prepaid money card for services it provides to the customer using the card. These charges include withdrawal fees, which vary depending on the amount of money. Also, the inactivity fee may be incurred for customers who don't use their cards often. Lastly, you may incur some fee when transacting money outside the currencies provided in the card, and if you load the card with United Kingdom pounds.

Advantages of Post Office

- It's a very secure and credible company that many customers trust globally since its regulated to avoid fraud.

- It's widely available in all parts of the United Kingdom.

- The company offers various money transfer services to its customers, including local transfer, travel cards, and wire money transfer services.

- It also provides improved exchange rates and fees across international banks.

- It covers more than 200 countries, thus allowing customers to send money to different countries overseas.

Popular destinations of transfers

- Afghanistan

- Åland Islands

- Albania

- Algeria

- American Samoa

- Andorra

- Angola

- Anguilla

- Antigua and Barbuda

- Argentina

- Armenia

- Aruba

- Australia

- Austria

- Azerbaijan

- Bahamas

- Bahrain

- Bangladesh

- Barbados

- Belarus

- Belgium

- Belize

- Benin

- Bermuda

- Bhutan

- Bolivia

- Bosnia And Herzegovina

- Botswana

- Brazil

- British Virgin Islands

- Brunei Darussalam

- Bulgaria

- Burkina Faso

- Burundi

- Cambodia

- Cameroon

- Canada

- Cape Verde

- Caribbean Netherlands

- Cayman Islands

- Central African Republic

- Chad

- Chile

- China

- Colombia

- Comoros

- Congo RDC

- Congo

- Cook Islands

- Costa Rica

- Croatia

- Cuba

- Curacao

- Cyprus

- Czech Republic

- Denmark

- Djibouti

- Dominica

- Dominican Republic

- Ecuador

- Egypt

- El Salvador

- Equatorial Guinea

- Eritrea

- Estonia

- Ethiopia

- Faroe Islands

- Fiji

- Finland

- France

- French Guiana

- French Polynesia

- Gabon

- Gambia

- Georgia

- Germany

- Ghana

- Gibraltar

- Greece

- Greenland

- Grenada

- Guadeloupe

- Guam

- Guatemala

- Guinea

- Guinea-Bissau

- Guyana

- Haiti

- Honduras

- Hong Kong

- Hungary

- Iceland

- India

- Indonesia

- Iran

- Iraq

- Ireland

- Israel

- Italy

- Ivory Coast

- Jamaica

- Japan

- Jordan

- Kazakhstan

- Kenya

- Kiribati

- Kosovo

- Kuwait

- Kyrgyzstan

- Laos

- Latvia

- Lebanon

- Lesotho

- Liberia

- Libya

- Liechtenstein

- Lithuania

- Luxembourg

- Macao

- Macedonia

- Madagascar

- Malawi

- Malaysia

- Maldives

- Mali

- Malta

- Marshall Islands

- Martinique

- Mauritania

- Mauritius

- Mayotte

- Mexico

- Micronesia

- Moldova

- Monaco

- Mongolia

- Montenegro

- Morocco

- Mozambique

- Myanmar

- Namibia

- Nauru

- Nepal

- Netherlands

- Netherlands Antilles

- New Caledonia

- New Zealand

- Nicaragua

- Niger

- Nigeria

- Northern Mariana Islands

- Norway

- Oman

- Pakistan

- Palau

- Palestine

- Panama

- Papua New Guinea

- Paraguay

- Peru

- Philippines

- Poland

- Portugal

- Puerto Rico

- Qatar

- Réunion

- Romania

- Russia

- Rwanda

- Saint Barthélemy

- Saint Kitts And Nevis

- Saint Lucia

- Saint Martin

- St Vincent & the Grenadines

- Samoa

- San Marino

- Sao Tome And Principe

- Saudi Arabia

- Senegal

- Serbia

- Seychelles

- Sierra Leone

- Singapore

- Sint Maarten

- Slovakia

- Slovenia

- Solomon Islands

- Somalia

- South Africa

- South Korea

- South Sudan

- Spain

- Sri Lanka

- Sudan

- Suriname

- Swaziland

- Sweden

- Switzerland

- Syrian Arab Republic

- Taiwan

- Tajikistan

- Tanzania

- Thailand

- Timor-Leste

- Togo

- Tonga

- Trinidad And Tobago

- Tunisia

- Turkey

- Turkmenistan

- Turks and Caicos Islands

- Tuvalu

- Uganda

- Ukraine

- United Arab Emirates

- United Kingdom

- United States

- US Minor Outlying Islands

- US Virgin Islands

- Uruguay

- Uzbekistan

- Vanuatu

- Vatican

- Venezuela

- Vietnam

- Wallis And Futuna

- Yemen

- Zambia

- Zimbabwe