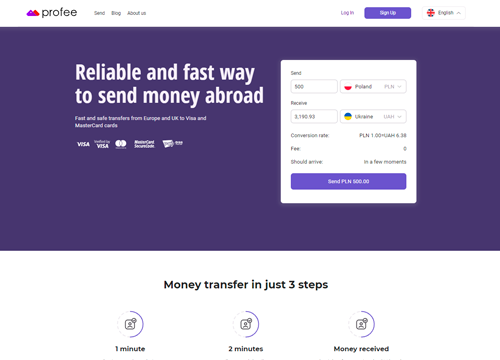

Profee was launched in 2017 and is now an international money transfer service that allows its users to perform easy, fast and secure money transfers without any hidden commissions. Service is available for the residents of the European Union and allows to send funds in more than 40 directions. These include all European Union member states, as well as Ukraine, Armenia, Azerbaijan, Georgia, Russia, Israel and a number of other countries.

Considering that Profee operates based on its Electronic Money Institution license as issued by the Central Bank of Cyprus, all users’ data is securely stored and funds are safeguarded.

Profee

Transfer options

Withdrawal options

Payment options

For the security of our clients all Profee accounts have limits for the amounts to be sent. Monthly limit for Basic account transactions is 150 euro and this is the account level user gets at registration.

Plus account allows users to make transactions worth 15.000 euro every year and the limit can be used up in one day. You will be required to upload a photo of your proof of identity and proof of address document for this account level.

Provision of information and documentation with regards to your source and value of wealth will allow upgrading to Premium level with annual transactional limit of 100.000 euro.

How to make the transaction

- Enter transfer amount and select currencies – you will see the exchange rate applied and the indicative amount to be credited to the recipient;

- Register on the website - you will need to provide your phone number, email address, your name and surname, residential address details, date of birth and citizenship;

- Verify your identity - should the transfer amount exceed your account limit you may be asked to verify your identity by uploading photos of your identity and proof of residence documents, as well as a selfie with your identity document in hand. Verification process is automated; however, it might take up to 25 minutes to verify the provided documents.

In this case in order to proceed with the transfer, you will have to re-initiate the transfer; - Enter card/bank account details – enter sender’s and recipient’s card/bank account details, hit Send button and confirm the transfer with an SMS-code.

The cost of transfer and exchange rates

Profee applies commission per transaction of up to 4.5% based on the following conditions: (a) currency pair, (b) the amount of the transaction, (c) geographies/corridor that you send money from/to, (d) means that Profee will use to deliver the payment.

Profee may also apply some currency exchange markup.

Information regarding the exact commission applied will be available on the transfer confirmation page. The same way as the exchange rate applied will be displayed on the transfer confirmation page before you complete the transfer.

The amount displayed on the screen for each transfer as the funds that will be delivered to the recipient is indicative as they cannot guarantee any fluctuations on the exchange rates. At the same time, Profee does not know any fees that may be charged by the institution who issued the card.

Advantages of using Profee

- No hidden fees. Commission applied, as well as the exchange rates applied are displayed on the payment confirmation page.

- Handy transfer calculator immediately shows the amount to be credited to the recipient’s card.

- Favourable exchange rates.

- Instant and free of charge increase of the limit applied to the account once your identity has been verified.

- Transfer in real time and directly from card to card.

- Cards issued by any European bank can be used to send the funds.

- Card data is stored safely in encrypted form in full compliance with the international PCI DSS standards.

- Sender opens Profee e-wallet account that also allows to issue virtual and / or plastic cards that can be linked to G Pay or Apple Pay and used for daily expenses both online and in retail stores.

Popular destinations of transfers

- Afghanistan

- Åland Islands

- Albania

- Algeria

- American Samoa

- Andorra

- Angola

- Anguilla

- Antigua and Barbuda

- Argentina

- Armenia

- Aruba

- Australia

- Austria

- Azerbaijan

- Bahamas

- Bahrain

- Bangladesh

- Barbados

- Belarus

- Belgium

- Belize

- Benin

- Bermuda

- Bhutan

- Bolivia

- Bosnia And Herzegovina

- Botswana

- Brazil

- British Virgin Islands

- Brunei Darussalam

- Bulgaria

- Burkina Faso

- Burundi

- Cambodia

- Cameroon

- Canada

- Cape Verde

- Caribbean Netherlands

- Cayman Islands

- Central African Republic

- Chad

- Chile

- China

- Colombia

- Comoros

- Congo RDC

- Congo

- Cook Islands

- Costa Rica

- Croatia

- Cuba

- Curacao

- Cyprus

- Czech Republic

- Denmark

- Djibouti

- Dominica

- Dominican Republic

- Ecuador

- Egypt

- El Salvador

- Equatorial Guinea

- Eritrea

- Estonia

- Ethiopia

- Faroe Islands

- Fiji

- Finland

- France

- French Guiana

- French Polynesia

- Gabon

- Gambia

- Georgia

- Germany

- Ghana

- Gibraltar

- Greece

- Greenland

- Grenada

- Guadeloupe

- Guam

- Guatemala

- Guinea

- Guinea-Bissau

- Guyana

- Haiti

- Honduras

- Hong Kong

- Hungary

- Iceland

- India

- Indonesia

- Iran

- Iraq

- Ireland

- Israel

- Italy

- Ivory Coast

- Jamaica

- Japan

- Jordan

- Kazakhstan

- Kenya

- Kiribati

- Kosovo

- Kuwait

- Kyrgyzstan

- Laos

- Latvia

- Lebanon

- Lesotho

- Liberia

- Libya

- Liechtenstein

- Lithuania

- Luxembourg

- Macao

- Macedonia

- Madagascar

- Malawi

- Malaysia

- Maldives

- Mali

- Malta

- Marshall Islands

- Martinique

- Mauritania

- Mauritius

- Mayotte

- Mexico

- Micronesia

- Moldova

- Monaco

- Mongolia

- Montenegro

- Morocco

- Mozambique

- Myanmar

- Namibia

- Nauru

- Nepal

- Netherlands

- Netherlands Antilles

- New Caledonia

- New Zealand

- Nicaragua

- Niger

- Nigeria

- Northern Mariana Islands

- Norway

- Oman

- Pakistan

- Palau

- Palestine

- Panama

- Papua New Guinea

- Paraguay

- Peru

- Philippines

- Poland

- Portugal

- Puerto Rico

- Qatar

- Réunion

- Romania

- Russia

- Rwanda

- Saint Barthélemy

- Saint Kitts And Nevis

- Saint Lucia

- Saint Martin

- St Vincent & the Grenadines

- Samoa

- San Marino

- Sao Tome And Principe

- Saudi Arabia

- Senegal

- Serbia

- Seychelles

- Sierra Leone

- Singapore

- Sint Maarten

- Slovakia

- Slovenia

- Solomon Islands

- Somalia

- South Africa

- South Korea

- South Sudan

- Spain

- Sri Lanka

- Sudan

- Suriname

- Swaziland

- Sweden

- Switzerland

- Syrian Arab Republic

- Taiwan

- Tajikistan

- Tanzania

- Thailand

- Timor-Leste

- Togo

- Tonga

- Trinidad And Tobago

- Tunisia

- Turkey

- Turkmenistan

- Turks and Caicos Islands

- Tuvalu

- Uganda

- Ukraine

- United Arab Emirates

- United Kingdom

- United States

- US Minor Outlying Islands

- US Virgin Islands

- Uruguay

- Uzbekistan

- Vanuatu

- Vatican

- Venezuela

- Vietnam

- Wallis And Futuna

- Yemen

- Zambia

- Zimbabwe