Since 2011, Remitly is meticulously serving global audiences in the field of global money transfer. With this platform, you can easily send cash to people of more than 50 different countries across the world. As the best digital substitute of the convention cash transaction services, Remitly allows you to transfer your money quickly, safely, and at comparably affordable pricing.

Contact Remitly

Remitly U.K., Ltd

Transfer options

Withdrawal options

Payment options

Remitly supports different regional languages including English, French, Romanian, Turkish, German, Italian, Vietnamese, and Polish. Moreover, the application offers you two different types of money transaction procedures - Express and Economy. So, you can choose the one that suits your needs.

How to make a transaction - step by step procedure

Remitly comes with a very simple and straightforward interface. Hence, you will hardly face any difficulty while sharing money to abroad destinations. Just by undertaking the below-mentioned steps, you can execute the task of money transaction efficiently.

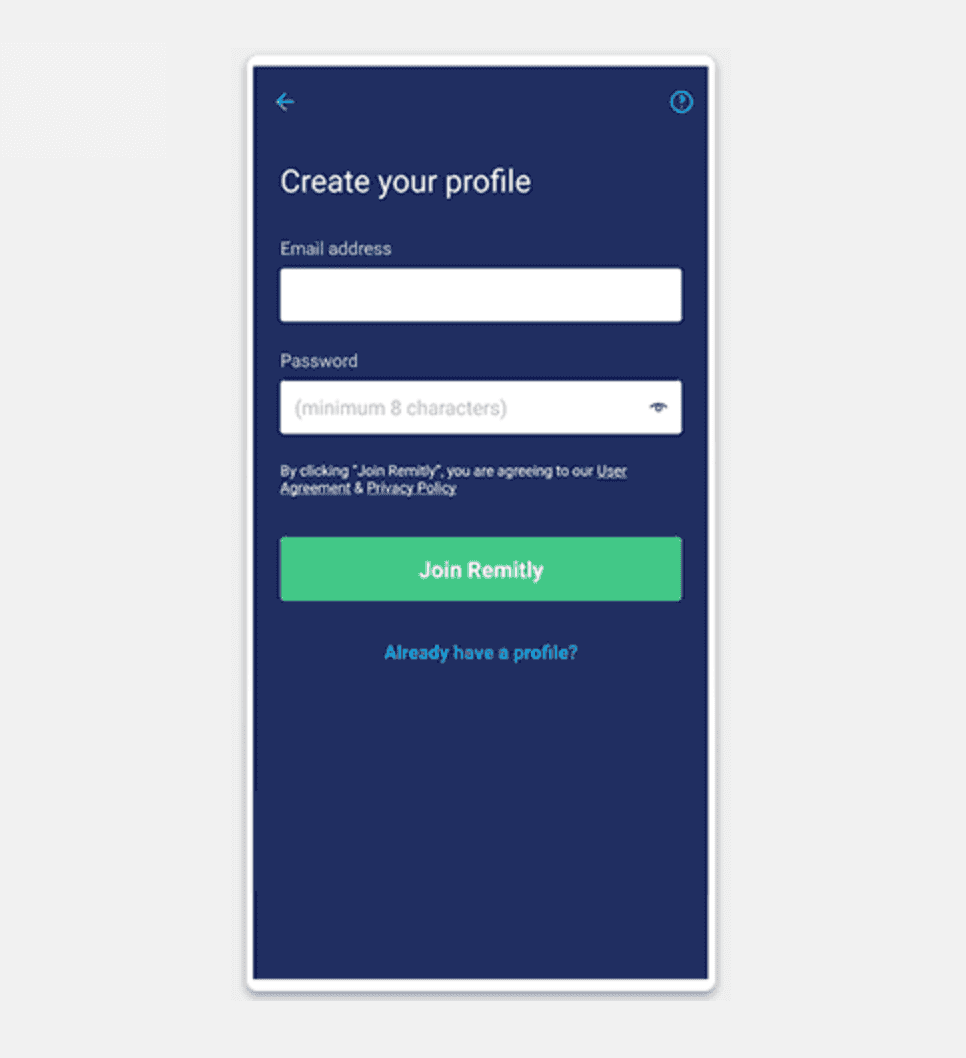

- Upon opening the platform, you would have to enrol your name by generating an account. After that, you need to fill the columns with suitable information such as name, address, ID proof, contact details, etc.

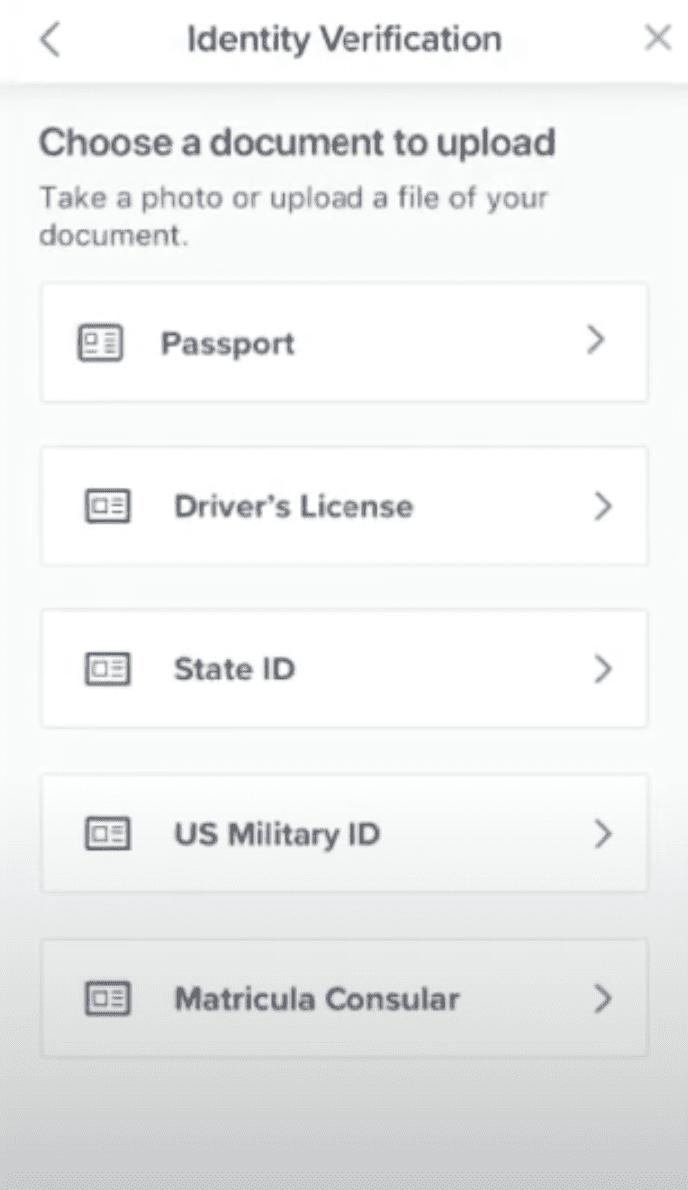

- Then, you would have to verify your ID

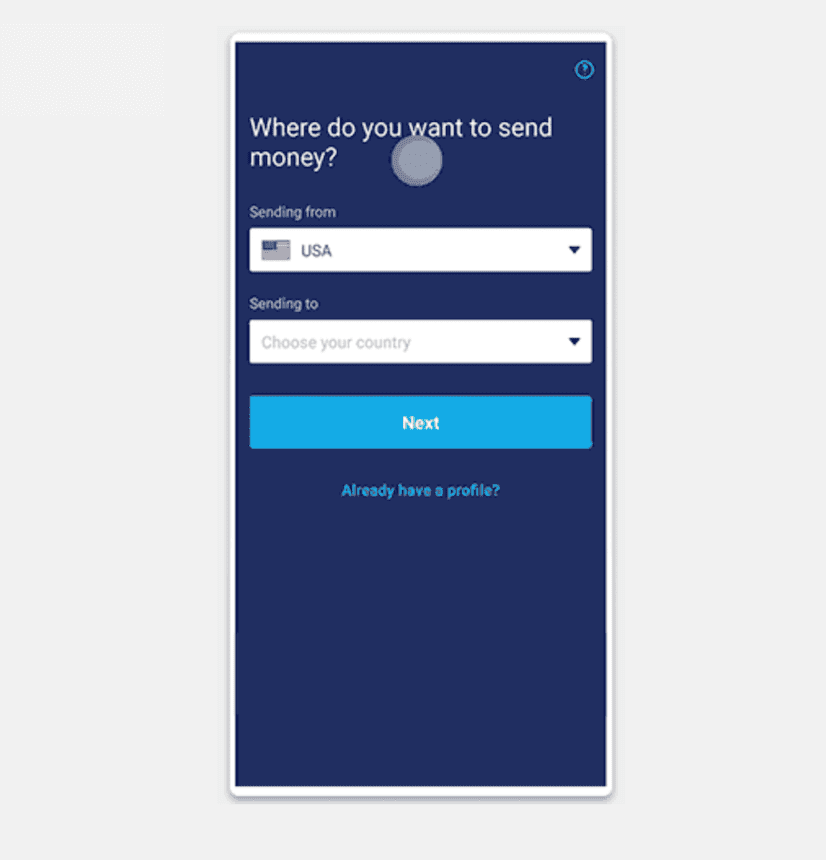

- In the third step, you have to write down the destination.

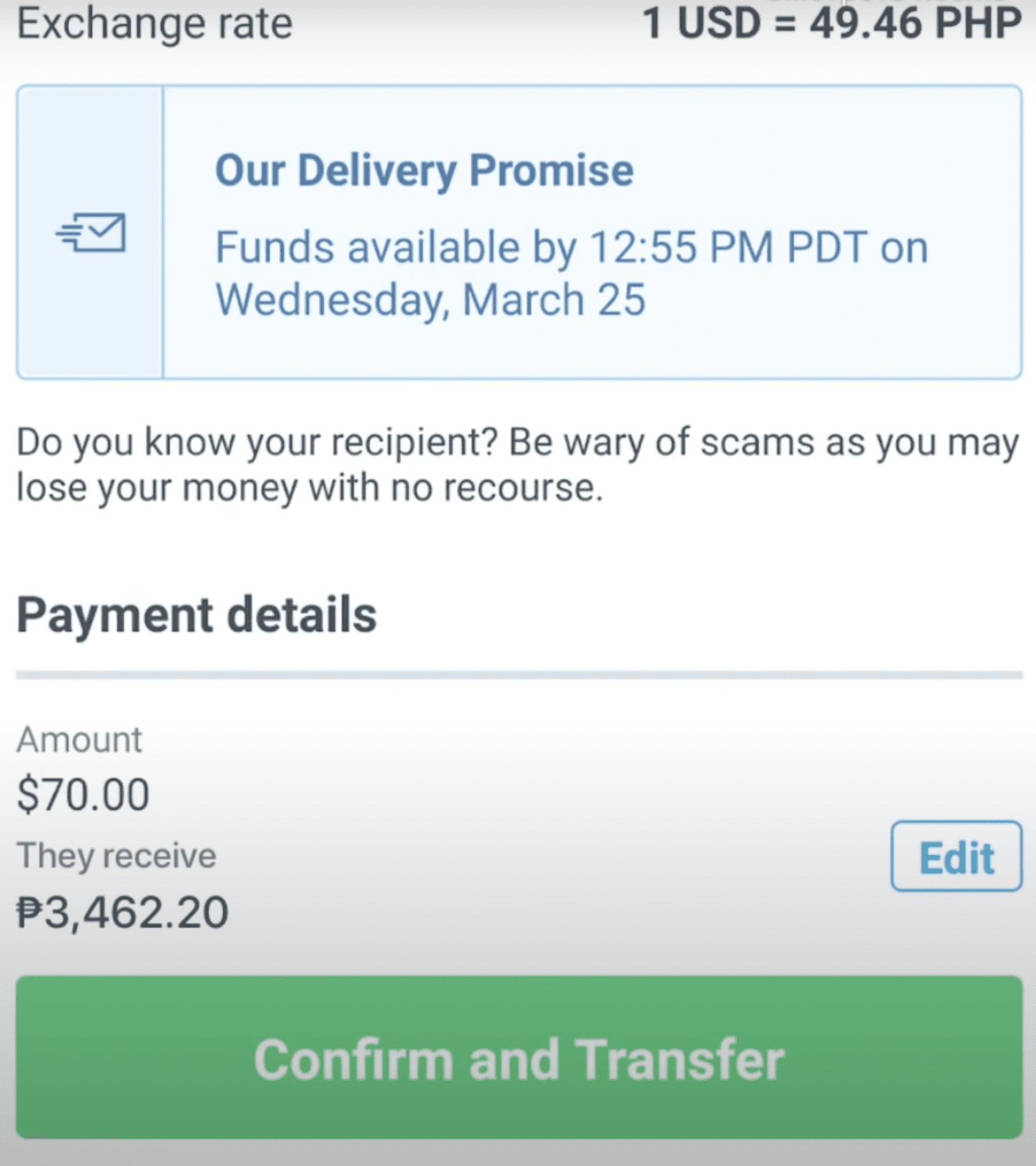

- In the fourth and final step, you just need to keep your notice on the status of the transaction for ensuring the accomplishment.

Fees & Exchange Rates

Estimating the fees and exchange rates of Remitly is pretty hard as it relies on a couple of factors. The exchange rates typically depend on the following attributes:

- Amount of money that you are willing to transfer

- The transaction procedure you decide to proceed with

- Name of the location where you desire to send the money

To know the exact exchange rates, you first need to create an account and login.

Advantages

As one of the best money transferring application, Remitly comes with a wide range of advantages. Some of them include:

- Due to its superior optimization, Remitly can be used on smartphones. So, the procedure of money transaction becomes much handier.

- With Remitly, you will be able to fund your monetary transaction with great ease. This excellent platform allows you to clear the payment through your credit and debit card , or bank transfer.

- Moreover, it undoubtedly offers a reasonable fee compared to the other alternatives. In addition, the exchange rates that it holds for the money transaction, as well as currency exchange, are considerable.

- Remitly keeps customer satisfaction on the top of its priority. Thus, to help out the clients, they stretch their helping hands 24/7. You can easily consult the officials through email, live chats and phone calls.

- Lastly, yet most importantly, with this service, you can rest all your concerns regarding the safety of your money. Even if your money fails to arrive on the mentioned time because of any technical fault, the platform will surely refund the charges.

Hence, if you, too, want to take on the task in the easiest way possible while maintaining safety, make sure to opt for Remitly.

Popular destinations of transfers

- Afghanistan

- Åland Islands

- Albania

- Algeria

- American Samoa

- Andorra

- Angola

- Anguilla

- Antigua and Barbuda

- Argentina

- Armenia

- Aruba

- Australia

- Austria

- Azerbaijan

- Bahamas

- Bahrain

- Bangladesh

- Barbados

- Belarus

- Belgium

- Belize

- Benin

- Bermuda

- Bhutan

- Bolivia

- Bosnia And Herzegovina

- Botswana

- Brazil

- British Virgin Islands

- Brunei Darussalam

- Bulgaria

- Burkina Faso

- Burundi

- Cambodia

- Cameroon

- Canada

- Cape Verde

- Caribbean Netherlands

- Cayman Islands

- Central African Republic

- Chad

- Chile

- China

- Colombia

- Comoros

- Congo RDC

- Congo

- Cook Islands

- Costa Rica

- Croatia

- Cuba

- Curacao

- Cyprus

- Czech Republic

- Denmark

- Djibouti

- Dominica

- Dominican Republic

- Ecuador

- Egypt

- El Salvador

- Equatorial Guinea

- Eritrea

- Estonia

- Ethiopia

- Faroe Islands

- Fiji

- Finland

- France

- French Guiana

- French Polynesia

- Gabon

- Gambia

- Georgia

- Germany

- Ghana

- Gibraltar

- Greece

- Greenland

- Grenada

- Guadeloupe

- Guam

- Guatemala

- Guinea

- Guinea-Bissau

- Guyana

- Haiti

- Honduras

- Hong Kong

- Hungary

- Iceland

- India

- Indonesia

- Iran

- Iraq

- Ireland

- Israel

- Italy

- Ivory Coast

- Jamaica

- Japan

- Jordan

- Kazakhstan

- Kenya

- Kiribati

- Kosovo

- Kuwait

- Kyrgyzstan

- Laos

- Latvia

- Lebanon

- Lesotho

- Liberia

- Libya

- Liechtenstein

- Lithuania

- Luxembourg

- Macao

- Macedonia

- Madagascar

- Malawi

- Malaysia

- Maldives

- Mali

- Malta

- Marshall Islands

- Martinique

- Mauritania

- Mauritius

- Mayotte

- Mexico

- Micronesia

- Moldova

- Monaco

- Mongolia

- Montenegro

- Morocco

- Mozambique

- Myanmar

- Namibia

- Nauru

- Nepal

- Netherlands

- Netherlands Antilles

- New Caledonia

- New Zealand

- Nicaragua

- Niger

- Nigeria

- Northern Mariana Islands

- Norway

- Oman

- Pakistan

- Palau

- Palestine

- Panama

- Papua New Guinea

- Paraguay

- Peru

- Philippines

- Poland

- Portugal

- Puerto Rico

- Qatar

- Réunion

- Romania

- Russia

- Rwanda

- Saint Barthélemy

- Saint Kitts And Nevis

- Saint Lucia

- Saint Martin

- St Vincent & the Grenadines

- Samoa

- San Marino

- Sao Tome And Principe

- Saudi Arabia

- Senegal

- Serbia

- Seychelles

- Sierra Leone

- Singapore

- Sint Maarten

- Slovakia

- Slovenia

- Solomon Islands

- Somalia

- South Africa

- South Korea

- South Sudan

- Spain

- Sri Lanka

- Sudan

- Suriname

- Swaziland

- Sweden

- Switzerland

- Syrian Arab Republic

- Taiwan

- Tajikistan

- Tanzania

- Thailand

- Timor-Leste

- Togo

- Tonga

- Trinidad And Tobago

- Tunisia

- Turkey

- Turkmenistan

- Turks and Caicos Islands

- Tuvalu

- Uganda

- Ukraine

- United Arab Emirates

- United Kingdom

- United States

- US Minor Outlying Islands

- US Virgin Islands

- Uruguay

- Uzbekistan

- Vanuatu

- Vatican

- Venezuela

- Vietnam

- Wallis And Futuna

- Yemen

- Zambia

- Zimbabwe