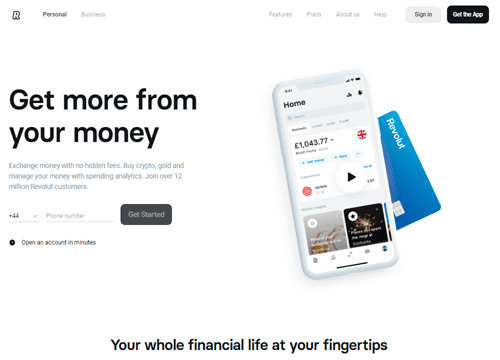

Revolut is a pioneering financial digital platform that provides innovative FX services, cash e transfers and neo-banking solutions. Fully authorized by the FCA, it is a highly efficient smartphone App that is managed from the UK. And from March this year, the use of this app has been extended to cover all the European countries and the USA.

Contact Revolut

Revolut

Transfer options

Withdrawal options

Payment options

The online business has been operating since 2015, and now it makes opening and operating digital accounts for all your international financial transitions easier than it has ever been in the past. Presently, it is a leading champion in offering accounts for multiple currencies. The service facilitates the exchange and transfer of money in more than 24 currencies to about 140 countries.

5 Steps on How to Make a Transaction Using Revolut

Are you fed up of having to deal with concealed fees that usually springs at you only after you have made an international money transfer? Here is the easiest way to send money abroad to an individual or a bank account and beat hidden charges in 5 easy steps using a Revolut App.

- Downloading the App. Go to Google play or any other app store and download the Revolut app.

- Account Registration. To register an account, you will be required to go through a process of verification by providing the following information (Your full name and address, All relevant contact details, Identification proof).

- Service Selection. After entering your details, the next step is to select the types of services you want, for instance, type of transfer, international credit card or current account.

- Transfer Funding. Choose the currencies for which you want exchanges, and then use the app to initiate a transfer to your beneficiary.

- Currency Conversion. This last step is automated, and it is carried out by Revolut. The money is delivered to the recipient in a converted form.

Fees & Exchange Rates

The fees and rate of currency conversion by Revolut are pegged on the interbank standards which is typically lower than the consumer rates. If there are any additional charges, then that is always levied by the intermediary or the receiving banks.

Advantages

- The state-of-the-art Revolut app comes with several advanced features that allows you to quickly transfer money.

- All notifications about the state of your transfer are instantaneous.

- The app enables bill splitting, savings and budgeting on the current account.

- Its money card comes with an automatic ability to convert currencies at the basic inter-bank rates.

- Always offers the highest conversion rates in the market at any given time.

- It enables global spending through the Revolute card which makes purchasing internationally easy, efficient, convenient, and fast.

- The service can host multiple currency accounts which expedites international cash transfers to any type of businesses or corporate commercial cards.

- It facilitates integration with several financial platforms and software for accounting.

- The financial settlements are instant and all reports for expenses are immediately available.

- Protection of personal information is guaranteed and client confidentiality is a must.

- Offers transactions and alerts for crypto currency.

Clearly, Revolut is one of the best global super app. for any kind of financial dealing.

Popular destinations of transfers

- Afghanistan

- Åland Islands

- Albania

- Algeria

- American Samoa

- Andorra

- Angola

- Anguilla

- Antigua and Barbuda

- Argentina

- Armenia

- Aruba

- Australia

- Austria

- Azerbaijan

- Bahamas

- Bahrain

- Bangladesh

- Barbados

- Belarus

- Belgium

- Belize

- Benin

- Bermuda

- Bhutan

- Bolivia

- Bosnia And Herzegovina

- Botswana

- Brazil

- British Virgin Islands

- Brunei Darussalam

- Bulgaria

- Burkina Faso

- Burundi

- Cambodia

- Cameroon

- Canada

- Cape Verde

- Caribbean Netherlands

- Cayman Islands

- Central African Republic

- Chad

- Chile

- China

- Colombia

- Comoros

- Congo RDC

- Congo

- Cook Islands

- Costa Rica

- Croatia

- Cuba

- Curacao

- Cyprus

- Czech Republic

- Denmark

- Djibouti

- Dominica

- Dominican Republic

- Ecuador

- Egypt

- El Salvador

- Equatorial Guinea

- Eritrea

- Estonia

- Ethiopia

- Faroe Islands

- Fiji

- Finland

- France

- French Guiana

- French Polynesia

- Gabon

- Gambia

- Georgia

- Germany

- Ghana

- Gibraltar

- Greece

- Greenland

- Grenada

- Guadeloupe

- Guam

- Guatemala

- Guinea

- Guinea-Bissau

- Guyana

- Haiti

- Honduras

- Hong Kong

- Hungary

- Iceland

- India

- Indonesia

- Iran

- Iraq

- Ireland

- Israel

- Italy

- Ivory Coast

- Jamaica

- Japan

- Jordan

- Kazakhstan

- Kenya

- Kiribati

- Kosovo

- Kuwait

- Kyrgyzstan

- Laos

- Latvia

- Lebanon

- Lesotho

- Liberia

- Libya

- Liechtenstein

- Lithuania

- Luxembourg

- Macao

- Macedonia

- Madagascar

- Malawi

- Malaysia

- Maldives

- Mali

- Malta

- Marshall Islands

- Martinique

- Mauritania

- Mauritius

- Mayotte

- Mexico

- Micronesia

- Moldova

- Monaco

- Mongolia

- Montenegro

- Morocco

- Mozambique

- Myanmar

- Namibia

- Nauru

- Nepal

- Netherlands

- Netherlands Antilles

- New Caledonia

- New Zealand

- Nicaragua

- Niger

- Nigeria

- Northern Mariana Islands

- Norway

- Oman

- Pakistan

- Palau

- Palestine

- Panama

- Papua New Guinea

- Paraguay

- Peru

- Philippines

- Poland

- Portugal

- Puerto Rico

- Qatar

- Réunion

- Romania

- Russia

- Rwanda

- Saint Barthélemy

- Saint Kitts And Nevis

- Saint Lucia

- Saint Martin

- St Vincent & the Grenadines

- Samoa

- San Marino

- Sao Tome And Principe

- Saudi Arabia

- Senegal

- Serbia

- Seychelles

- Sierra Leone

- Singapore

- Sint Maarten

- Slovakia

- Slovenia

- Solomon Islands

- Somalia

- South Africa

- South Korea

- South Sudan

- Spain

- Sri Lanka

- Sudan

- Suriname

- Swaziland

- Sweden

- Switzerland

- Syrian Arab Republic

- Taiwan

- Tajikistan

- Tanzania

- Thailand

- Timor-Leste

- Togo

- Tonga

- Trinidad And Tobago

- Tunisia

- Turkey

- Turkmenistan

- Turks and Caicos Islands

- Tuvalu

- Uganda

- Ukraine

- United Arab Emirates

- United Kingdom

- United States

- US Minor Outlying Islands

- US Virgin Islands

- Uruguay

- Uzbekistan

- Vanuatu

- Vatican

- Venezuela

- Vietnam

- Wallis And Futuna

- Yemen

- Zambia

- Zimbabwe