Skrill is an online money transfer service that lets you make international transfer to any bank account, mobile wallet, or email address in just seconds.

Contact Skrill

Skrill

Transfer options

Withdrawal options

Payment options

Founded in 2001, it is today owned by Paysafe Group. With Skrill, you can transfer funds via credit card, debit card, and SOFORT, or bank transfer. The service is fully secured and keeps your personal credentials completely safe.

How to make a transaction — step by step guide

Making the money transfer with Skrill is not difficult at all. Just create account on the site or its application and you’re all set to go. Here is the step-by-step guide that will help you to make a seamless transaction.

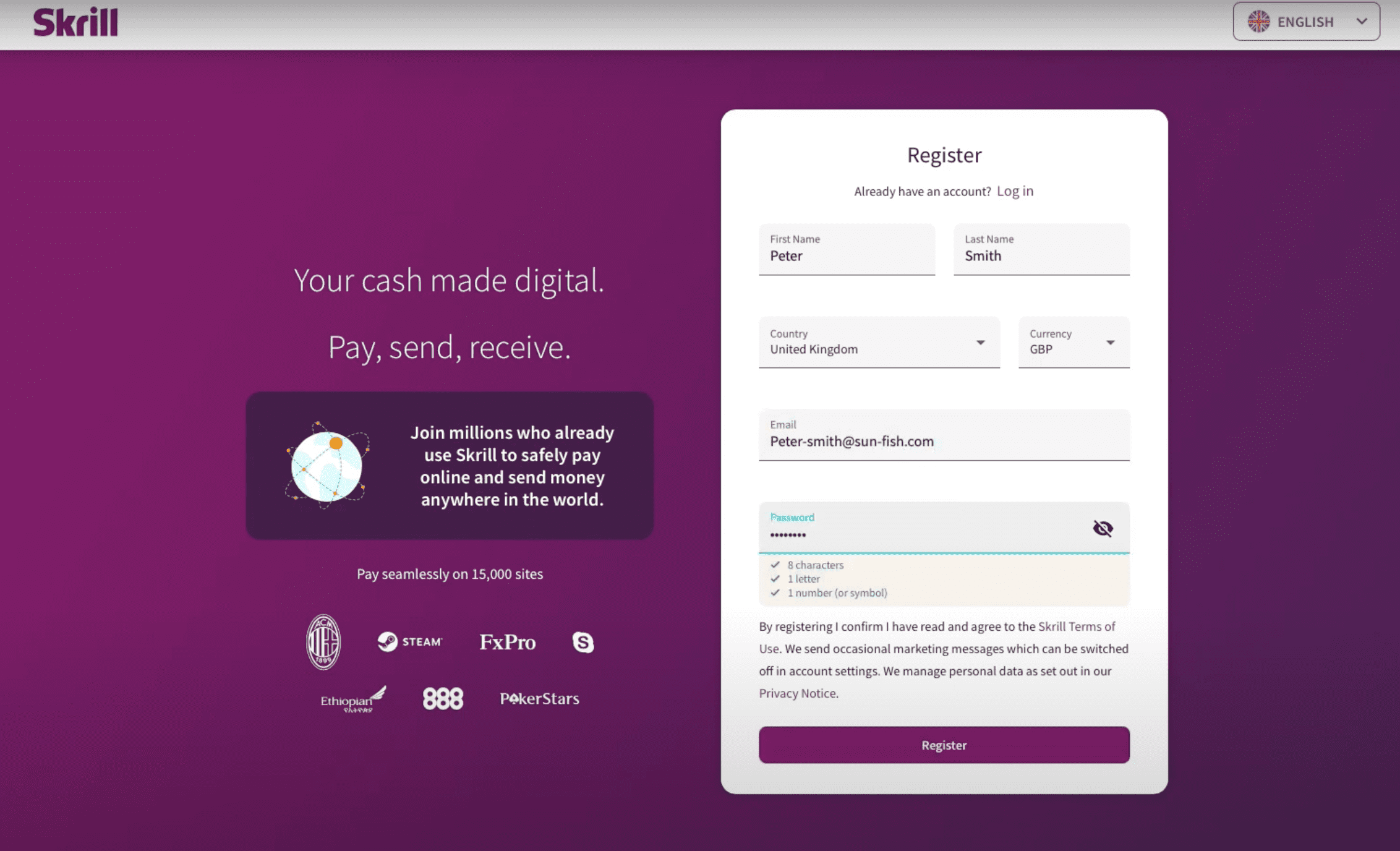

- Create the account. First of all, head to Skrill and sign up for the account. Here, you need to put just the basic details like name, email, address, and password.

- Verification process. The second step needs your attention. In this step, you have to verify your account by providing personal details like full name, address, and a government-issued ID card like driver’s license, passport, or any such ID card. The verifying process might take a bit time.

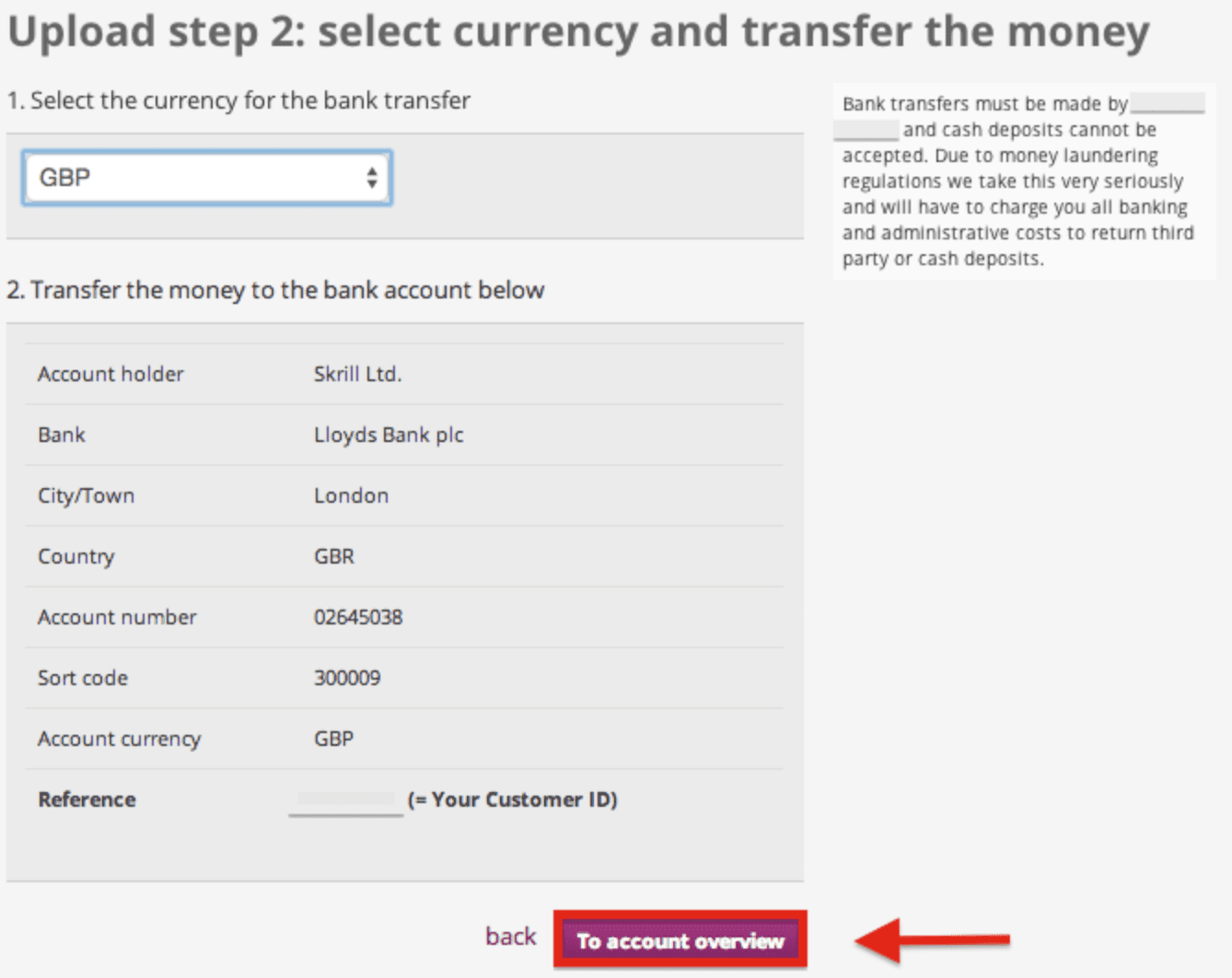

- Set up your transfer. After verifying your details, your account is all set and you’re ready to go. Fill the beneficiary’s details and move on with your transaction. Once you have filled all the required information, cross-check everything because this is the final step. After this, you won’t get any chance to make corrections.

- Press the button and transfer the money. All set? Okay, press the send button and wait for the confirmation message. As soon as you’ll receive the confirmation message, the money will be processed into the account of the person on the other end.

Fee & exchange rate

We understand, now you must be wondering what are the fees and exchange rates of this money transfer service? No? Well, Skrill is absolutely free to transfer money to an international bank account or mobile account. If you’re opting for the credit card or debit card transfer, you might be charged a little transaction fee depending on your location.

As for the exchange rates, Skrill offers a full conversion rate for its money transfer service. There are no hidden costs. The great thing about this money transfer service is that the money usually arrives on the same day. At the maximum, it can take 3-5 business days.

Advantages of using Skrill

There is a bunch of benefits of using Skrill for online money transfer. Some of them are as follows.

- You can instantly send money to different countries. Service is available in almost all countries.

- Not just the countries, Skrill offers its service in many different languages too.

- It offers you the flexibility to transfer money into the account of the receiver.

- It is fully transparent and user-friendliness. There are no hidden charges.

- It is completely secure, reliable, and hassle-free.

- It has great customer support.

Popular destinations of transfers

- Afghanistan

- Åland Islands

- Albania

- Algeria

- American Samoa

- Andorra

- Angola

- Anguilla

- Antigua and Barbuda

- Argentina

- Armenia

- Aruba

- Australia

- Austria

- Azerbaijan

- Bahamas

- Bahrain

- Bangladesh

- Barbados

- Belarus

- Belgium

- Belize

- Benin

- Bermuda

- Bhutan

- Bolivia

- Bosnia And Herzegovina

- Botswana

- Brazil

- British Virgin Islands

- Brunei Darussalam

- Bulgaria

- Burkina Faso

- Burundi

- Cambodia

- Cameroon

- Canada

- Cape Verde

- Caribbean Netherlands

- Cayman Islands

- Central African Republic

- Chad

- Chile

- China

- Colombia

- Comoros

- Congo RDC

- Congo

- Cook Islands

- Costa Rica

- Croatia

- Cuba

- Curacao

- Cyprus

- Czech Republic

- Denmark

- Djibouti

- Dominica

- Dominican Republic

- Ecuador

- Egypt

- El Salvador

- Equatorial Guinea

- Eritrea

- Estonia

- Ethiopia

- Faroe Islands

- Fiji

- Finland

- France

- French Guiana

- French Polynesia

- Gabon

- Gambia

- Georgia

- Germany

- Ghana

- Gibraltar

- Greece

- Greenland

- Grenada

- Guadeloupe

- Guam

- Guatemala

- Guinea

- Guinea-Bissau

- Guyana

- Haiti

- Honduras

- Hong Kong

- Hungary

- Iceland

- India

- Indonesia

- Iran

- Iraq

- Ireland

- Israel

- Italy

- Ivory Coast

- Jamaica

- Japan

- Jordan

- Kazakhstan

- Kenya

- Kiribati

- Kosovo

- Kuwait

- Kyrgyzstan

- Laos

- Latvia

- Lebanon

- Lesotho

- Liberia

- Libya

- Liechtenstein

- Lithuania

- Luxembourg

- Macao

- Macedonia

- Madagascar

- Malawi

- Malaysia

- Maldives

- Mali

- Malta

- Marshall Islands

- Martinique

- Mauritania

- Mauritius

- Mayotte

- Mexico

- Micronesia

- Moldova

- Monaco

- Mongolia

- Montenegro

- Morocco

- Mozambique

- Myanmar

- Namibia

- Nauru

- Nepal

- Netherlands

- Netherlands Antilles

- New Caledonia

- New Zealand

- Nicaragua

- Niger

- Nigeria

- Northern Mariana Islands

- Norway

- Oman

- Pakistan

- Palau

- Palestine

- Panama

- Papua New Guinea

- Paraguay

- Peru

- Philippines

- Poland

- Portugal

- Puerto Rico

- Qatar

- Réunion

- Romania

- Russia

- Rwanda

- Saint Barthélemy

- Saint Kitts And Nevis

- Saint Lucia

- Saint Martin

- St Vincent & the Grenadines

- Samoa

- San Marino

- Sao Tome And Principe

- Saudi Arabia

- Senegal

- Serbia

- Seychelles

- Sierra Leone

- Singapore

- Sint Maarten

- Slovakia

- Slovenia

- Solomon Islands

- Somalia

- South Africa

- South Korea

- South Sudan

- Spain

- Sri Lanka

- Sudan

- Suriname

- Swaziland

- Sweden

- Switzerland

- Syrian Arab Republic

- Taiwan

- Tajikistan

- Tanzania

- Thailand

- Timor-Leste

- Togo

- Tonga

- Trinidad And Tobago

- Tunisia

- Turkey

- Turkmenistan

- Turks and Caicos Islands

- Tuvalu

- Uganda

- Ukraine

- United Arab Emirates

- United Kingdom

- United States

- US Minor Outlying Islands

- US Virgin Islands

- Uruguay

- Uzbekistan

- Vanuatu

- Vatican

- Venezuela

- Vietnam

- Wallis And Futuna

- Yemen

- Zambia

- Zimbabwe