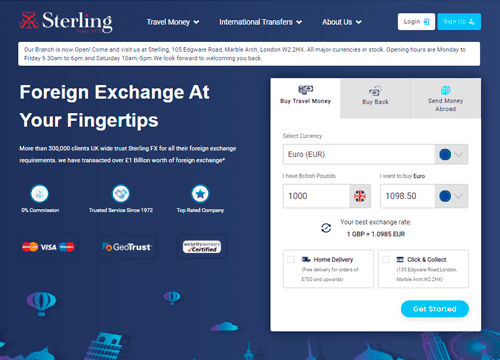

Sterling FX has emerged as one of the best providers of foreign currency exchange services. The company already claims to have more than 300,000 customers. Sterling FX supports at least 24 currencies. If you are wondering if Sterling FX is a reliable service, you will find your answer in this post. Keep reading!

Contact Sterling FX

Sterling FX Ltd

Transfer options

Withdrawal options

Payment options

How to make a transaction

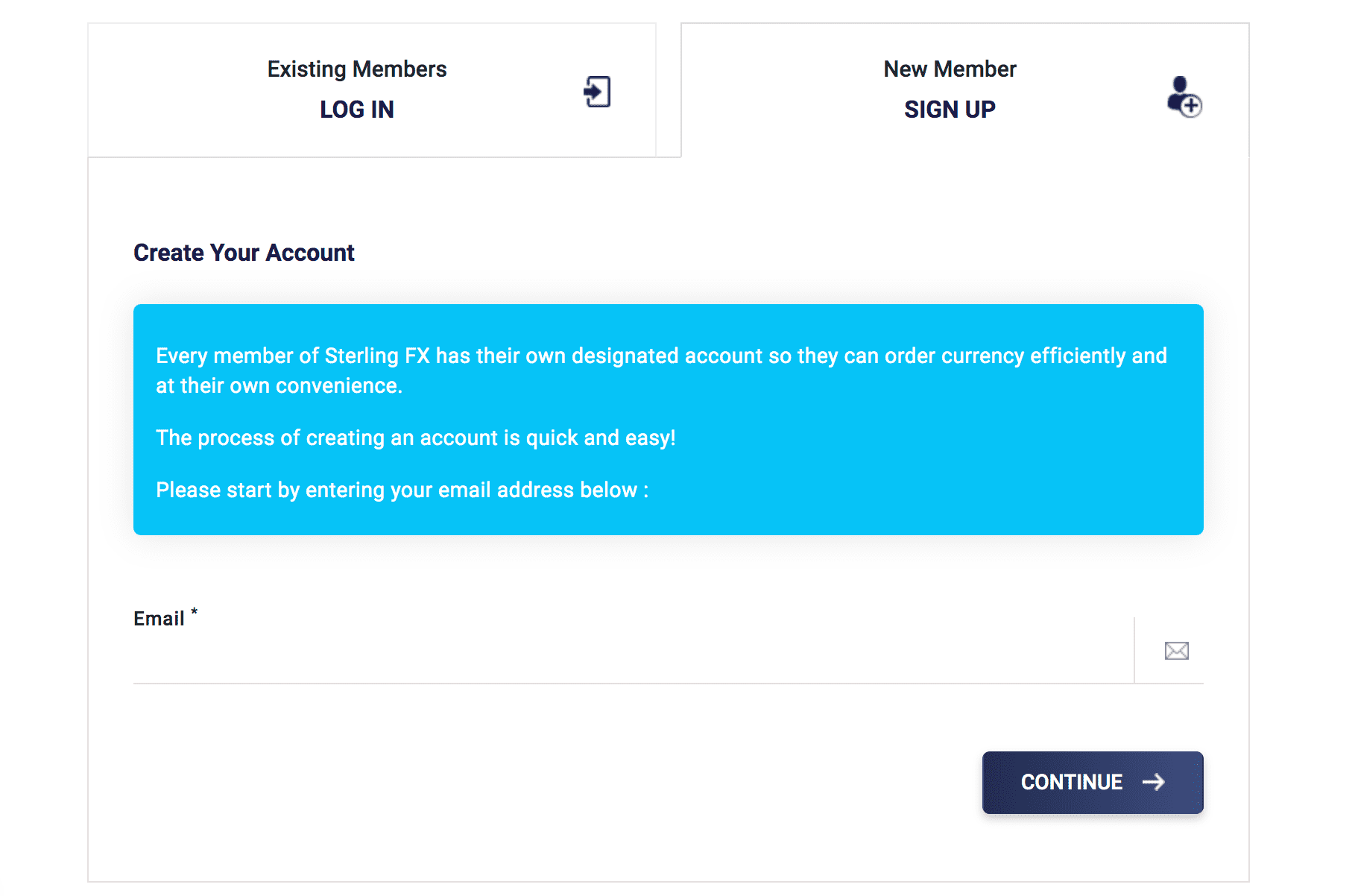

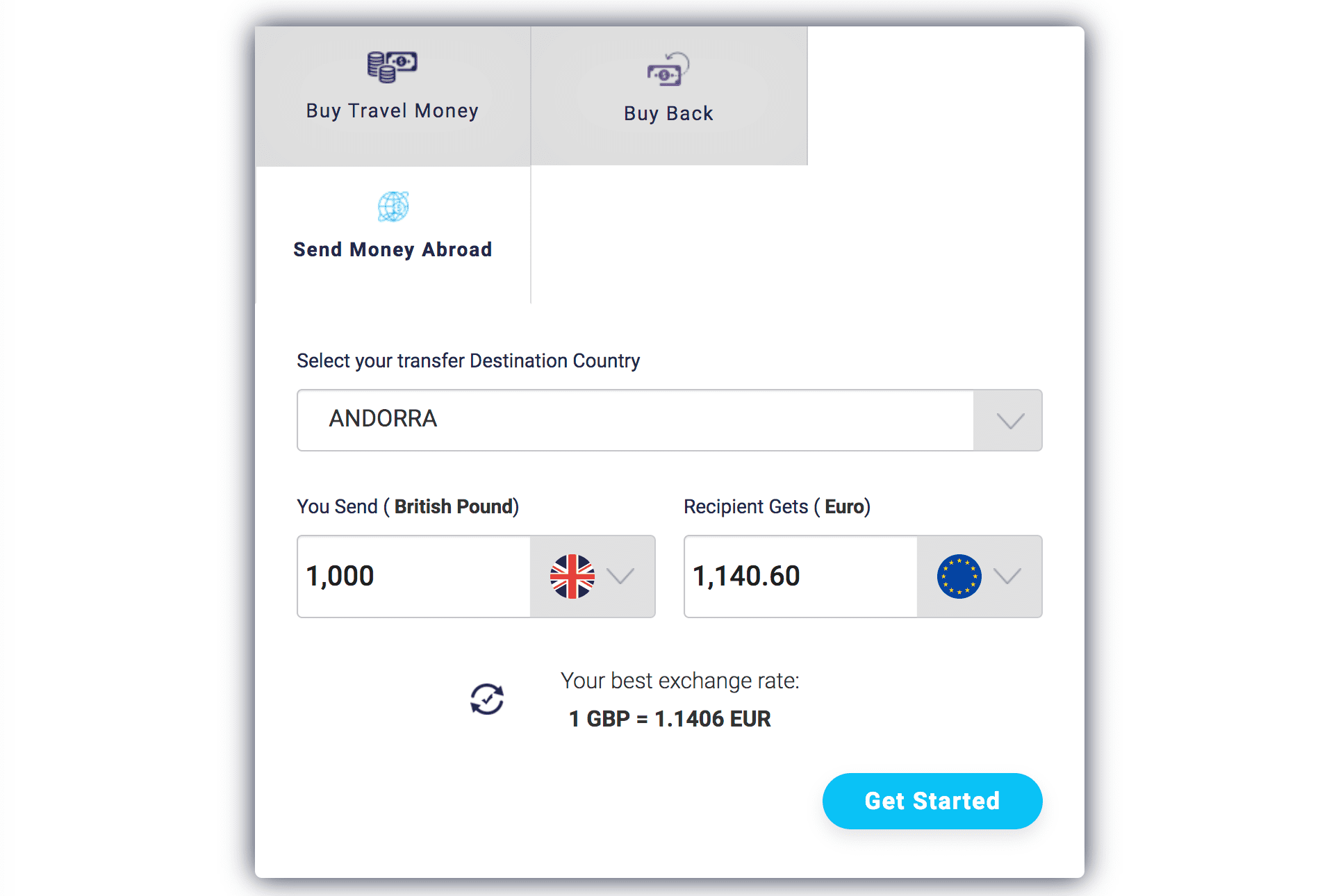

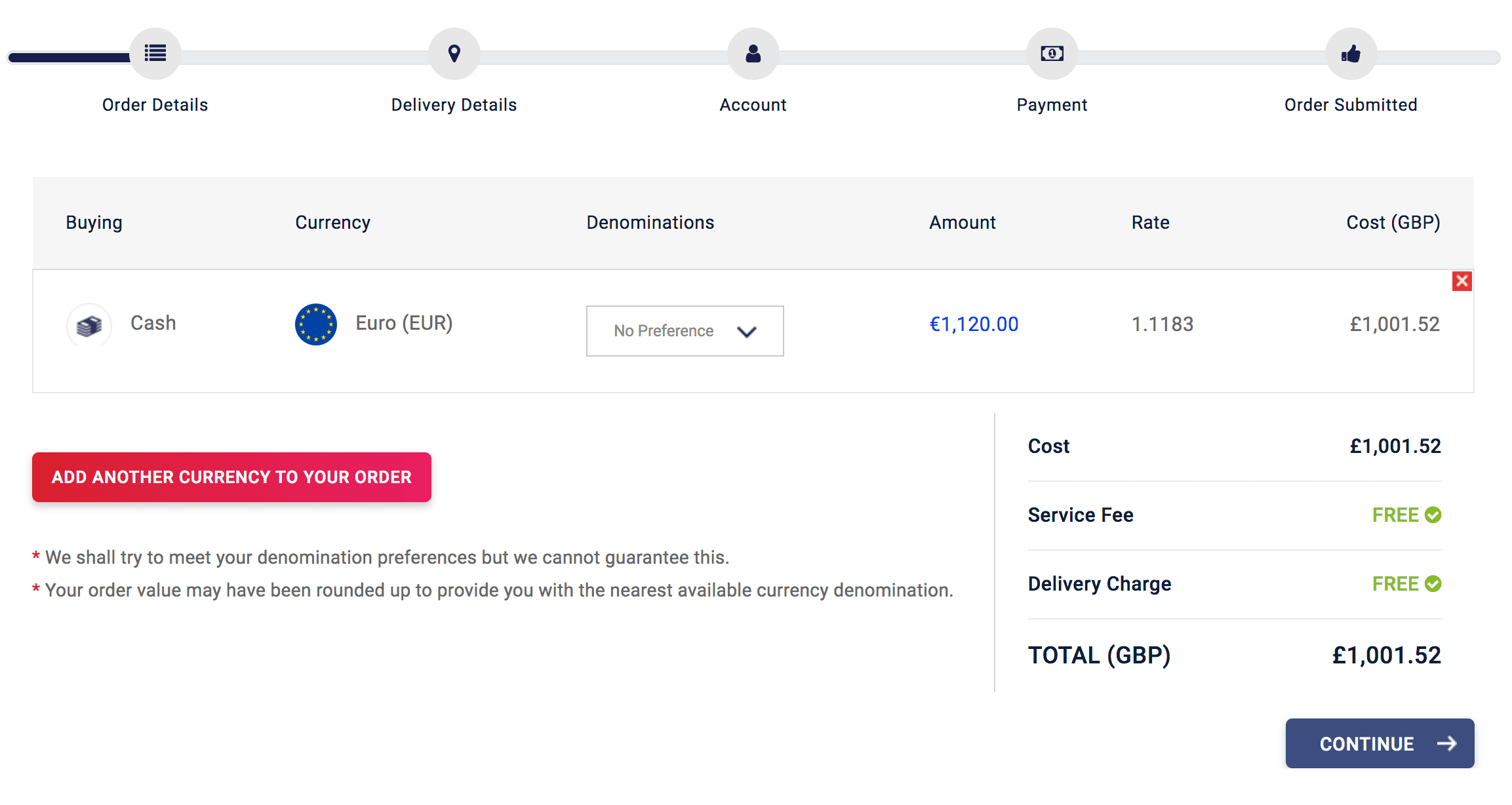

Making a transaction via Sterling FX is super easy. Now we are going to show you the step-by-step process.

- First, you have to sign up. There are several transferring methods and you have to select one. Choose the one that is convenient for you.

- The next step is to select your recipient’s currency. How much money would you like to send? Specify it.

- After that you need to confirm the exchange rate. The rates are never static; they are always changing. Once you have accepted the rate, it will be fixed.

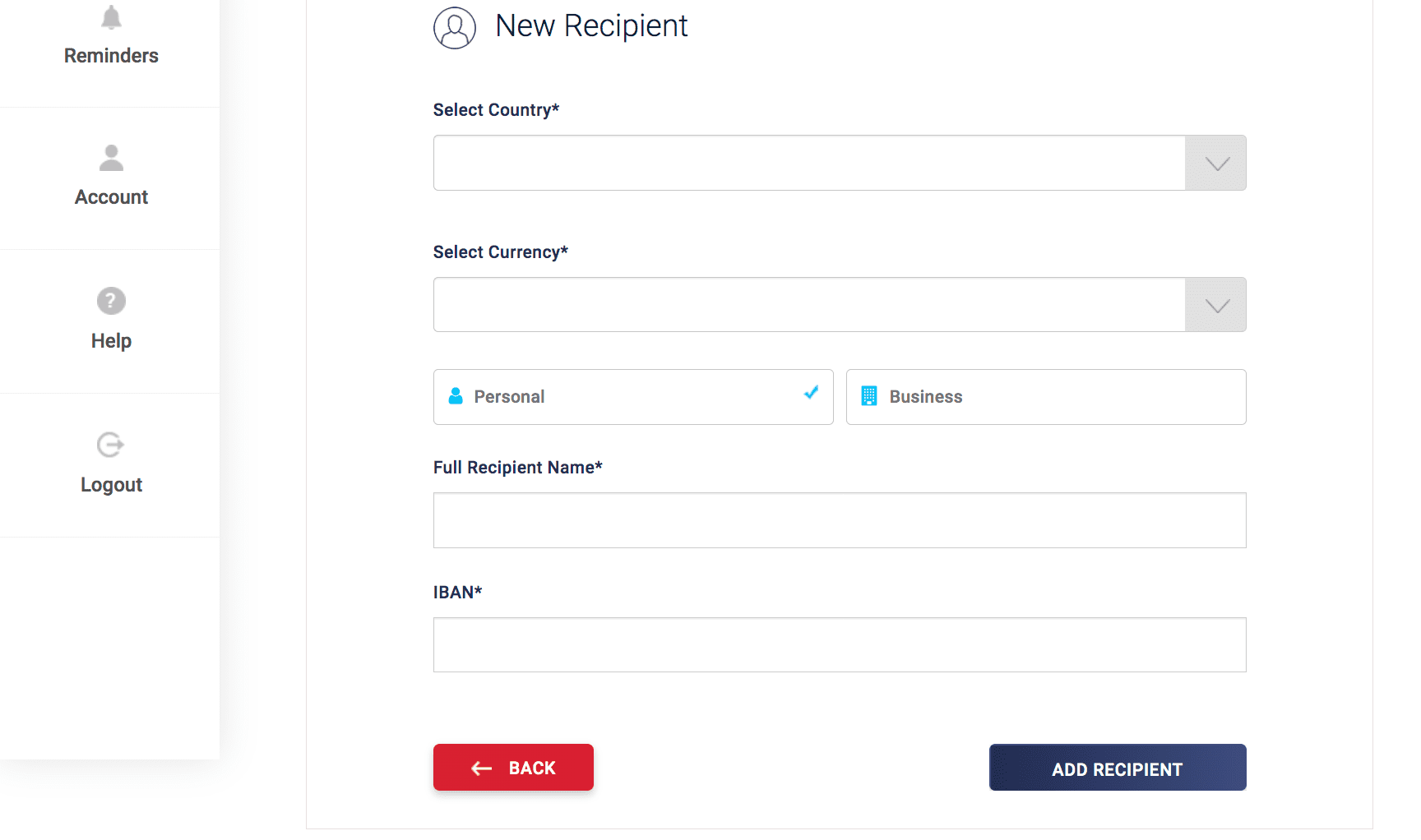

- Confirm your recipient. If you are a regular user of the service, you will have to select the particular recipient. And if you have never sent money to the recipient, you have to add the recipient.

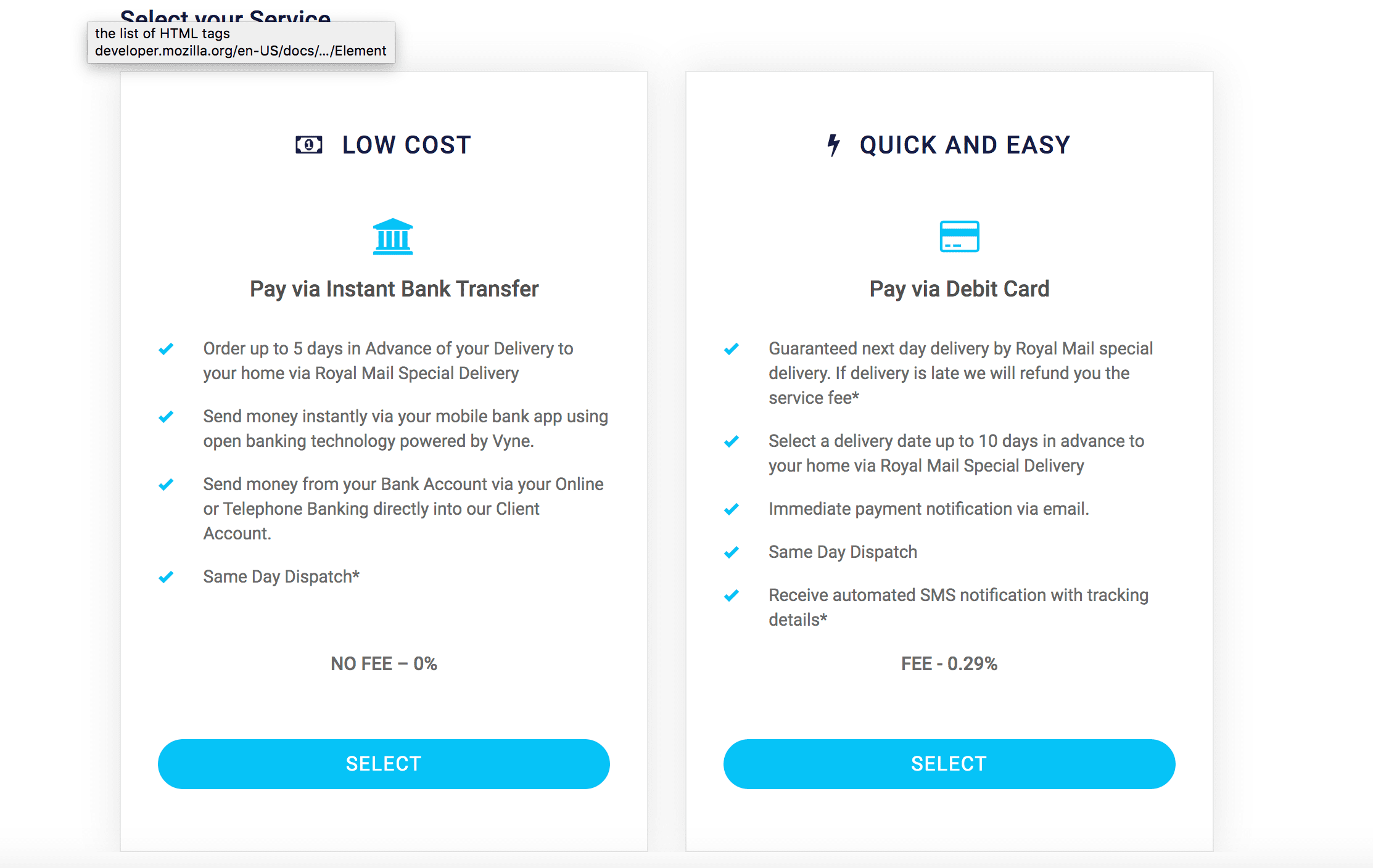

- Once you have completed all the steps mentioned above, you have to make your payment via bank transfer or debit card. You will receive a message letting you know the progress.

Fees & Exchange Rates

Like other money transfer companies, Sterling FX has its running costs, and the company charges a margin which is slightly above the rate of mid-market exchange. For some transfers, you may have to pay a fee. Now we are going to discuss the fees and exchange rates a little bit in detail. For exchange rates, the margins are usually from 0.5% to 1%. In this industry, the margin is really competitive. High street banks charge as high as 5% margins.

Sterling FX has an option called “Low Cost Payment”. If you use that option, you will not have to pay fees for your transfer. But in such a case, the transaction will not be very fast. But if you use the “Quick and Easy Payment” you will have to pay a fee of 0.39% of the amount you are transferring.

There are also additional costs. For wire transfers, you may have to pay a fee. In some cases, your recipient may have to pay a fee as well. To know if there is any external fee involved, you can contact your bank.

Advantages

Sterling FX has gained huge popularity in a relatively short period of time, thanks to its competitive service. Users like this service mainly because it helps them send money cheaply and quickly.

Probably the best thing about this service is that it charges no fee except you are using “Quick and Easy Payment”. The exchange rates are quite competitive. No matter what currency you are trading in, the margin will always be less than 1%. In most cases, it is slightly higher than 0.5%.

The pricing policy of this company is transparent. That means, you do not have to pay any hidden fee. The conversion rate can be easily estimated, because the website has a calculator. So, you can know beforehand exactly what amount the recipient is going to receive.

If you need to cancel your transfer, you can do it immediately after your order booking. You just have to call the number given on the website. However, it is important to mention here that you will have to pay a fee for trade reversal. Taking all relevant factors into consideration, we can say that Sterling FX is a reliable money transfer company.

Popular destinations of transfers

- Afghanistan

- Åland Islands

- Albania

- Algeria

- American Samoa

- Andorra

- Angola

- Anguilla

- Antigua and Barbuda

- Argentina

- Armenia

- Aruba

- Australia

- Austria

- Azerbaijan

- Bahamas

- Bahrain

- Bangladesh

- Barbados

- Belarus

- Belgium

- Belize

- Benin

- Bermuda

- Bhutan

- Bolivia

- Bosnia And Herzegovina

- Botswana

- Brazil

- British Virgin Islands

- Brunei Darussalam

- Bulgaria

- Burkina Faso

- Burundi

- Cambodia

- Cameroon

- Canada

- Cape Verde

- Caribbean Netherlands

- Cayman Islands

- Central African Republic

- Chad

- Chile

- China

- Colombia

- Comoros

- Congo RDC

- Congo

- Cook Islands

- Costa Rica

- Croatia

- Cuba

- Curacao

- Cyprus

- Czech Republic

- Denmark

- Djibouti

- Dominica

- Dominican Republic

- Ecuador

- Egypt

- El Salvador

- Equatorial Guinea

- Eritrea

- Estonia

- Ethiopia

- Faroe Islands

- Fiji

- Finland

- France

- French Guiana

- French Polynesia

- Gabon

- Gambia

- Georgia

- Germany

- Ghana

- Gibraltar

- Greece

- Greenland

- Grenada

- Guadeloupe

- Guam

- Guatemala

- Guinea

- Guinea-Bissau

- Guyana

- Haiti

- Honduras

- Hong Kong

- Hungary

- Iceland

- India

- Indonesia

- Iran

- Iraq

- Ireland

- Israel

- Italy

- Ivory Coast

- Jamaica

- Japan

- Jordan

- Kazakhstan

- Kenya

- Kiribati

- Kosovo

- Kuwait

- Kyrgyzstan

- Laos

- Latvia

- Lebanon

- Lesotho

- Liberia

- Libya

- Liechtenstein

- Lithuania

- Luxembourg

- Macao

- Macedonia

- Madagascar

- Malawi

- Malaysia

- Maldives

- Mali

- Malta

- Marshall Islands

- Martinique

- Mauritania

- Mauritius

- Mayotte

- Mexico

- Micronesia

- Moldova

- Monaco

- Mongolia

- Montenegro

- Morocco

- Mozambique

- Myanmar

- Namibia

- Nauru

- Nepal

- Netherlands

- Netherlands Antilles

- New Caledonia

- New Zealand

- Nicaragua

- Niger

- Nigeria

- Northern Mariana Islands

- Norway

- Oman

- Pakistan

- Palau

- Palestine

- Panama

- Papua New Guinea

- Paraguay

- Peru

- Philippines

- Poland

- Portugal

- Puerto Rico

- Qatar

- Réunion

- Romania

- Russia

- Rwanda

- Saint Barthélemy

- Saint Kitts And Nevis

- Saint Lucia

- Saint Martin

- St Vincent & the Grenadines

- Samoa

- San Marino

- Sao Tome And Principe

- Saudi Arabia

- Senegal

- Serbia

- Seychelles

- Sierra Leone

- Singapore

- Sint Maarten

- Slovakia

- Slovenia

- Solomon Islands

- Somalia

- South Africa

- South Korea

- South Sudan

- Spain

- Sri Lanka

- Sudan

- Suriname

- Swaziland

- Sweden

- Switzerland

- Syrian Arab Republic

- Taiwan

- Tajikistan

- Tanzania

- Thailand

- Timor-Leste

- Togo

- Tonga

- Trinidad And Tobago

- Tunisia

- Turkey

- Turkmenistan

- Turks and Caicos Islands

- Tuvalu

- Uganda

- Ukraine

- United Arab Emirates

- United Kingdom

- United States

- US Minor Outlying Islands

- US Virgin Islands

- Uruguay

- Uzbekistan

- Vanuatu

- Vatican

- Venezuela

- Vietnam

- Wallis And Futuna

- Yemen

- Zambia

- Zimbabwe