TorFX was born way back in 2004 as Tor Currency Exchange, LTD, and since then, it has not stopped growing. Thanks to their dedication and commitment towards its users, TorFX has become one of the top money transfer services Worldwide. Their services are available for both individuals and businesses alike.

Contact TorFX

TorFX

Transfer options

Withdrawal options

Payment options

Offering dedicated products in the international money transfer market. Additionally, TorFX has a customer service team available 24/7, some of the most competitive exchange rates, supports over 60 currencies, and its online platform is easy to use. Also, their transfers are completed within 24-hours.

How to make a transaction using TorFX

One of the many things that make TorFX attractive to users is how easy it is to use their online platform to send money abroad to friends, family, or make international payments. The following guide will teach you how to use TorFX step by step. Just make sure to follow our instructions to the letter.

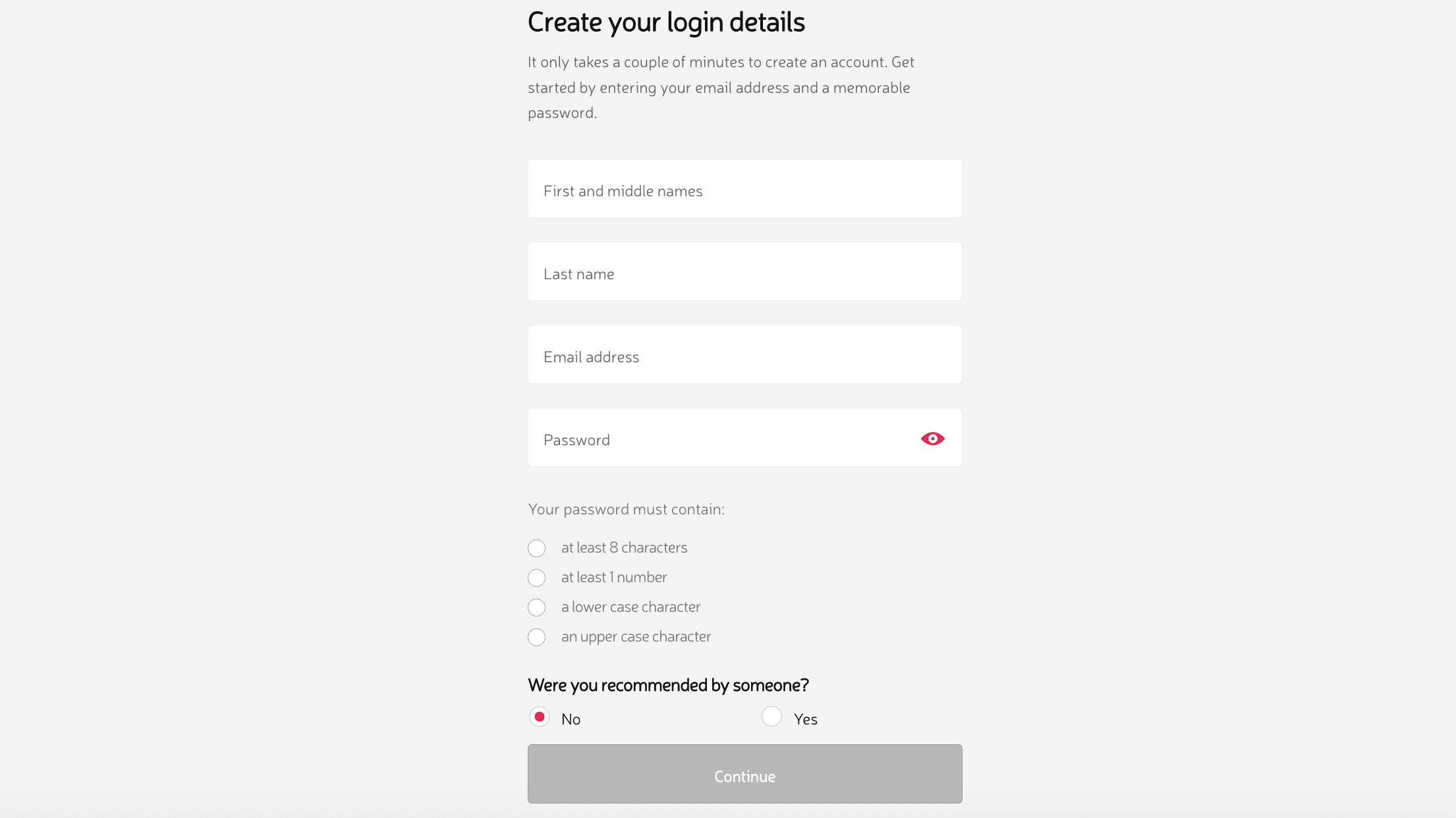

- Creating an Account. As usual, the first step is to create an account. TorFX offers two ways to do this through a free quote or signing up online. If you use the free quote, you'll be paired with a personal account manager that will guide you through the process. If you sign up online, just fill in the information they ask. Is a simple 4-step process that doesn't take much of your time, and in the end, you'll get your user's name and your password.

- Sending the Funds. Now that you have access to your account, you can proceed to make a transfer. In this section, you have to fill in the recipient's information, as well as the currency. Double-check all the details, and continue to the next step.

- Payment Method. The only payment method TorFX offers its users it's your own bank account.

Fees & Exchange Rates

When it comes to charging fees and exchange rates, TorFX definitely stands out from the competition, their system is quite unique. There are no hidden charges and compare to banks and other services, the rates are incredibly competitive.

TorFX does not charge fixed fees. They make their money by charging interbank exchange rates, and the rates they take from their customers. These rates range between 1.90% for large transfers to 2.70% for small transfers.

As mentioned before, TorFX doesn't have any hidden charges, customers only have to watch out for those interbank rates.

Advantages of using TorFX

TorFX's targeted audiences are small-medium businesses and individuals who want to send money to family members or friends. For sixteen years, they have developed products to cater to the needs of their clients. Here are other advantages of using TorFX:

- No transfer fees. Regardless of the amount you're transferring, TorFX does not charge any transfer fees.

- Costumed products. Every product offered by TorFX is tailored to serve the needs of both businesses and individuals alike.

- Supports over 60 currencies. Another great advantage is the number of different currency TorFX supports. Ensuring you won't be losing any money changing from one currency to another.

Popular destinations of transfers

- Afghanistan

- Åland Islands

- Albania

- Algeria

- American Samoa

- Andorra

- Angola

- Anguilla

- Antigua and Barbuda

- Argentina

- Armenia

- Aruba

- Australia

- Austria

- Azerbaijan

- Bahamas

- Bahrain

- Bangladesh

- Barbados

- Belarus

- Belgium

- Belize

- Benin

- Bermuda

- Bhutan

- Bolivia

- Bosnia And Herzegovina

- Botswana

- Brazil

- British Virgin Islands

- Brunei Darussalam

- Bulgaria

- Burkina Faso

- Burundi

- Cambodia

- Cameroon

- Canada

- Cape Verde

- Caribbean Netherlands

- Cayman Islands

- Central African Republic

- Chad

- Chile

- China

- Colombia

- Comoros

- Congo RDC

- Congo

- Cook Islands

- Costa Rica

- Croatia

- Cuba

- Curacao

- Cyprus

- Czech Republic

- Denmark

- Djibouti

- Dominica

- Dominican Republic

- Ecuador

- Egypt

- El Salvador

- Equatorial Guinea

- Eritrea

- Estonia

- Ethiopia

- Faroe Islands

- Fiji

- Finland

- France

- French Guiana

- French Polynesia

- Gabon

- Gambia

- Georgia

- Germany

- Ghana

- Gibraltar

- Greece

- Greenland

- Grenada

- Guadeloupe

- Guam

- Guatemala

- Guinea

- Guinea-Bissau

- Guyana

- Haiti

- Honduras

- Hong Kong

- Hungary

- Iceland

- India

- Indonesia

- Iran

- Iraq

- Ireland

- Israel

- Italy

- Ivory Coast

- Jamaica

- Japan

- Jordan

- Kazakhstan

- Kenya

- Kiribati

- Kosovo

- Kuwait

- Kyrgyzstan

- Laos

- Latvia

- Lebanon

- Lesotho

- Liberia

- Libya

- Liechtenstein

- Lithuania

- Luxembourg

- Macao

- Macedonia

- Madagascar

- Malawi

- Malaysia

- Maldives

- Mali

- Malta

- Marshall Islands

- Martinique

- Mauritania

- Mauritius

- Mayotte

- Mexico

- Micronesia

- Moldova

- Monaco

- Mongolia

- Montenegro

- Morocco

- Mozambique

- Myanmar

- Namibia

- Nauru

- Nepal

- Netherlands

- Netherlands Antilles

- New Caledonia

- New Zealand

- Nicaragua

- Niger

- Nigeria

- Northern Mariana Islands

- Norway

- Oman

- Pakistan

- Palau

- Palestine

- Panama

- Papua New Guinea

- Paraguay

- Peru

- Philippines

- Poland

- Portugal

- Puerto Rico

- Qatar

- Réunion

- Romania

- Russia

- Rwanda

- Saint Barthélemy

- Saint Kitts And Nevis

- Saint Lucia

- Saint Martin

- St Vincent & the Grenadines

- Samoa

- San Marino

- Sao Tome And Principe

- Saudi Arabia

- Senegal

- Serbia

- Seychelles

- Sierra Leone

- Singapore

- Sint Maarten

- Slovakia

- Slovenia

- Solomon Islands

- Somalia

- South Africa

- South Korea

- South Sudan

- Spain

- Sri Lanka

- Sudan

- Suriname

- Swaziland

- Sweden

- Switzerland

- Syrian Arab Republic

- Taiwan

- Tajikistan

- Tanzania

- Thailand

- Timor-Leste

- Togo

- Tonga

- Trinidad And Tobago

- Tunisia

- Turkey

- Turkmenistan

- Turks and Caicos Islands

- Tuvalu

- Uganda

- Ukraine

- United Arab Emirates

- United Kingdom

- United States

- US Minor Outlying Islands

- US Virgin Islands

- Uruguay

- Uzbekistan

- Vanuatu

- Vatican

- Venezuela

- Vietnam

- Wallis And Futuna

- Yemen

- Zambia

- Zimbabwe