TransferMate is a money transfer company that allows you B2B money transfer. The company is not much old. It was founded in 2010 by Terry Clune and Sinead Fitzmaurice under ‘The Taxback Group company umbrella. The company is presently headquartered in Kilkenny, Ireland. Besides that, it also has major offices in San Francisco, Sydney, and New York.

Contact TransferMate

TransferMate

Transfer options

Withdrawal options

Payment options

How to make a transfer - Step by step guide

TransferMate has an easy user interface and it allows you a quick and hassle-free transfer. Unlike many other money transfer services, you don’t have to go through a time-consuming process to make the transfer. In just a few steps and minutes, you can do this. Here is the step-by-step guide to make money transfer through TransferMate.

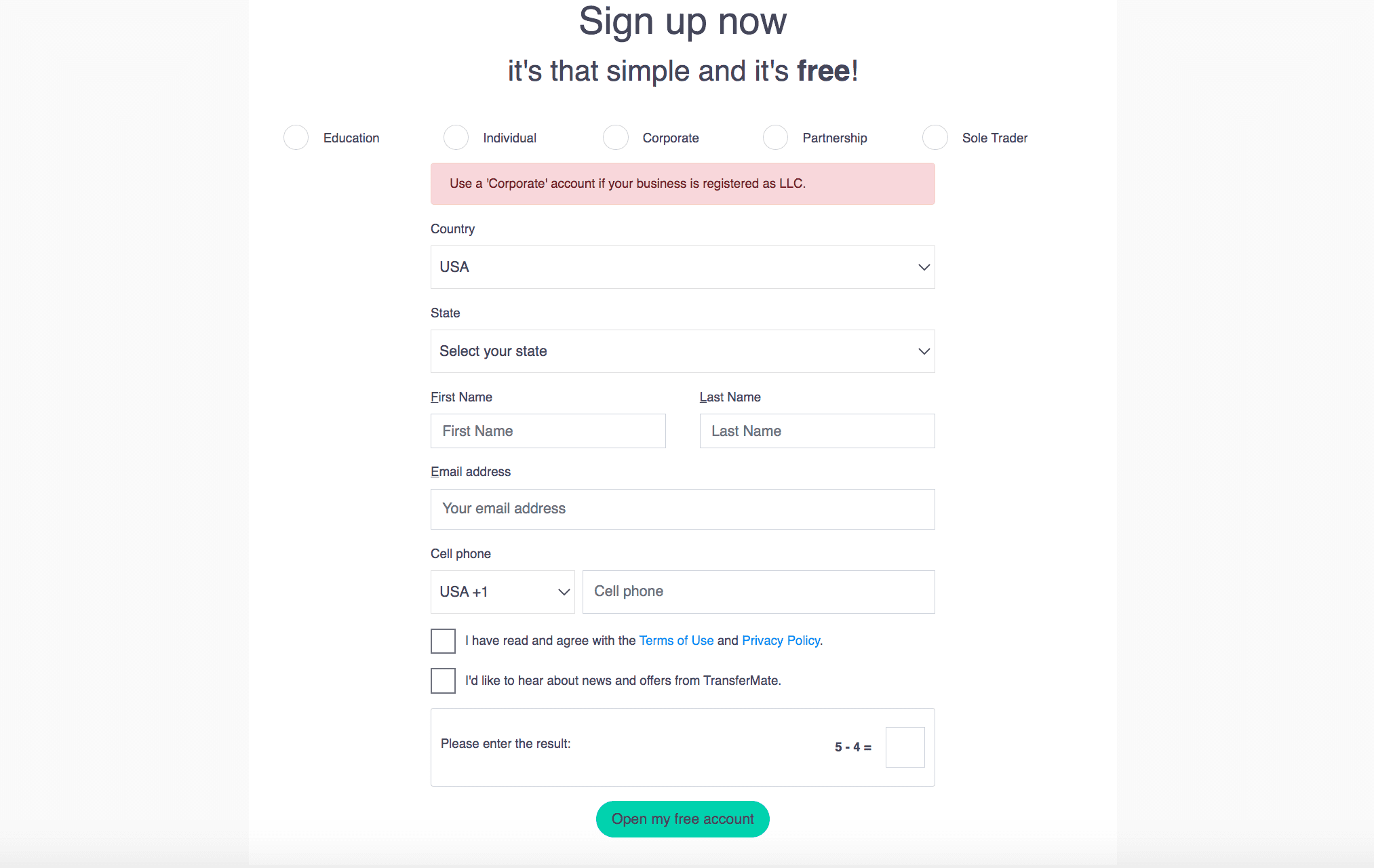

- Create an account. The first step is to create an account on TransferMate website. Signing up on TransferMate is completely free. Here, you have to provide just basic details such as nationality, name, email address, state, and mobile number. That’s it.

- Validate your account. In the next step, you have to validate your account by giving a personal id proof. Besides that, you will also need to validate your income source. Without validating your account, you won’t be able to transfer funds.

- Initiate the transfer. Once you have validated your account, it’s time to go ahead with your transfer. Select the destination, mention the amount, fill in the details of the recipient, and select the payment method. Cross check everything and make the correction if required.

- Finally, press the send button. Everything is correct? Okay, press the send button. You will receive a confirmation email just after making your transfer. You can also view transaction history on the site itself. Within 2-3 days, the recipient should receive the money.

Fees & exchange rate

Before making online money transfer with an e transfer service, you must know its exchange rate and fees. So, here let us tell you the fees and exchange rate of TransferMate. It charges nearly $11 for non-business customers on all transactions. Speaking of the exchange rates, it always matches the market rates. The best thing about this transfer service is that it offers you money transfer in as many as 130 currencies. So, you can estimate the total converted amount before making the transfer. From fees to the exchange rates, you can have a real-time view of everything before initiating the transfer.

Advantages

TransferMate is an awesome money transfer service that provides a bunch of mind-blowing features to offer you a smooth and hassle-free money transfer experience. Below are the main advantages.

- It is user-friendly and has an easy-to-use interface. Even if you’re new to online money transfer, you won’t face any problem.

- Setting up the account on TransferMate is quick and easy. In just minutes, you’re ready to go.

- It offers competitive exchange rates that are close to market rates.

- TransferMate is quick and fast. It ensures same-day transaction in most of the cases.

- It offers you a huge range of currencies. There are more than 130 currencies available.

- The best advantage is that it has no maximum transfer limit. You can transfer as much as you want. The minimum transfer limit is $1.

Popular destinations of transfers

- Afghanistan

- Åland Islands

- Albania

- Algeria

- American Samoa

- Andorra

- Angola

- Anguilla

- Antigua and Barbuda

- Argentina

- Armenia

- Aruba

- Australia

- Austria

- Azerbaijan

- Bahamas

- Bahrain

- Bangladesh

- Barbados

- Belarus

- Belgium

- Belize

- Benin

- Bermuda

- Bhutan

- Bolivia

- Bosnia And Herzegovina

- Botswana

- Brazil

- British Virgin Islands

- Brunei Darussalam

- Bulgaria

- Burkina Faso

- Burundi

- Cambodia

- Cameroon

- Canada

- Cape Verde

- Caribbean Netherlands

- Cayman Islands

- Central African Republic

- Chad

- Chile

- China

- Colombia

- Comoros

- Congo RDC

- Congo

- Cook Islands

- Costa Rica

- Croatia

- Cuba

- Curacao

- Cyprus

- Czech Republic

- Denmark

- Djibouti

- Dominica

- Dominican Republic

- Ecuador

- Egypt

- El Salvador

- Equatorial Guinea

- Eritrea

- Estonia

- Ethiopia

- Faroe Islands

- Fiji

- Finland

- France

- French Guiana

- French Polynesia

- Gabon

- Gambia

- Georgia

- Germany

- Ghana

- Gibraltar

- Greece

- Greenland

- Grenada

- Guadeloupe

- Guam

- Guatemala

- Guinea

- Guinea-Bissau

- Guyana

- Haiti

- Honduras

- Hong Kong

- Hungary

- Iceland

- India

- Indonesia

- Iran

- Iraq

- Ireland

- Israel

- Italy

- Ivory Coast

- Jamaica

- Japan

- Jordan

- Kazakhstan

- Kenya

- Kiribati

- Kosovo

- Kuwait

- Kyrgyzstan

- Laos

- Latvia

- Lebanon

- Lesotho

- Liberia

- Libya

- Liechtenstein

- Lithuania

- Luxembourg

- Macao

- Macedonia

- Madagascar

- Malawi

- Malaysia

- Maldives

- Mali

- Malta

- Marshall Islands

- Martinique

- Mauritania

- Mauritius

- Mayotte

- Mexico

- Micronesia

- Moldova

- Monaco

- Mongolia

- Montenegro

- Morocco

- Mozambique

- Myanmar

- Namibia

- Nauru

- Nepal

- Netherlands

- Netherlands Antilles

- New Caledonia

- New Zealand

- Nicaragua

- Niger

- Nigeria

- Northern Mariana Islands

- Norway

- Oman

- Pakistan

- Palau

- Palestine

- Panama

- Papua New Guinea

- Paraguay

- Peru

- Philippines

- Poland

- Portugal

- Puerto Rico

- Qatar

- Réunion

- Romania

- Russia

- Rwanda

- Saint Barthélemy

- Saint Kitts And Nevis

- Saint Lucia

- Saint Martin

- St Vincent & the Grenadines

- Samoa

- San Marino

- Sao Tome And Principe

- Saudi Arabia

- Senegal

- Serbia

- Seychelles

- Sierra Leone

- Singapore

- Sint Maarten

- Slovakia

- Slovenia

- Solomon Islands

- Somalia

- South Africa

- South Korea

- South Sudan

- Spain

- Sri Lanka

- Sudan

- Suriname

- Swaziland

- Sweden

- Switzerland

- Syrian Arab Republic

- Taiwan

- Tajikistan

- Tanzania

- Thailand

- Timor-Leste

- Togo

- Tonga

- Trinidad And Tobago

- Tunisia

- Turkey

- Turkmenistan

- Turks and Caicos Islands

- Tuvalu

- Uganda

- Ukraine

- United Arab Emirates

- United Kingdom

- United States

- US Minor Outlying Islands

- US Virgin Islands

- Uruguay

- Uzbekistan

- Vanuatu

- Vatican

- Venezuela

- Vietnam

- Wallis And Futuna

- Yemen

- Zambia

- Zimbabwe