XendPay is one of the lowest-cost international money transfer services. It is available in over 200 countries and supports more than 50 currencies. It was founded by Indian immigrant Rajesh Agrawal, and the goal was to provide other immigrants with a cheap option to send money to family and friends, and he did.

Contact XendPay

XendPay

Transfer options

Withdrawal options

Payment options

XendPay is popular for being one of the few services featuring a "Pay what you want" model, which basically allows the user to decide the fees to complete your transaction. Over the years, the company has gained popularity amongst small and medium businesses that use the platform to pay salaries and overseas suppliers.

How to make a Transaction using XendPay?

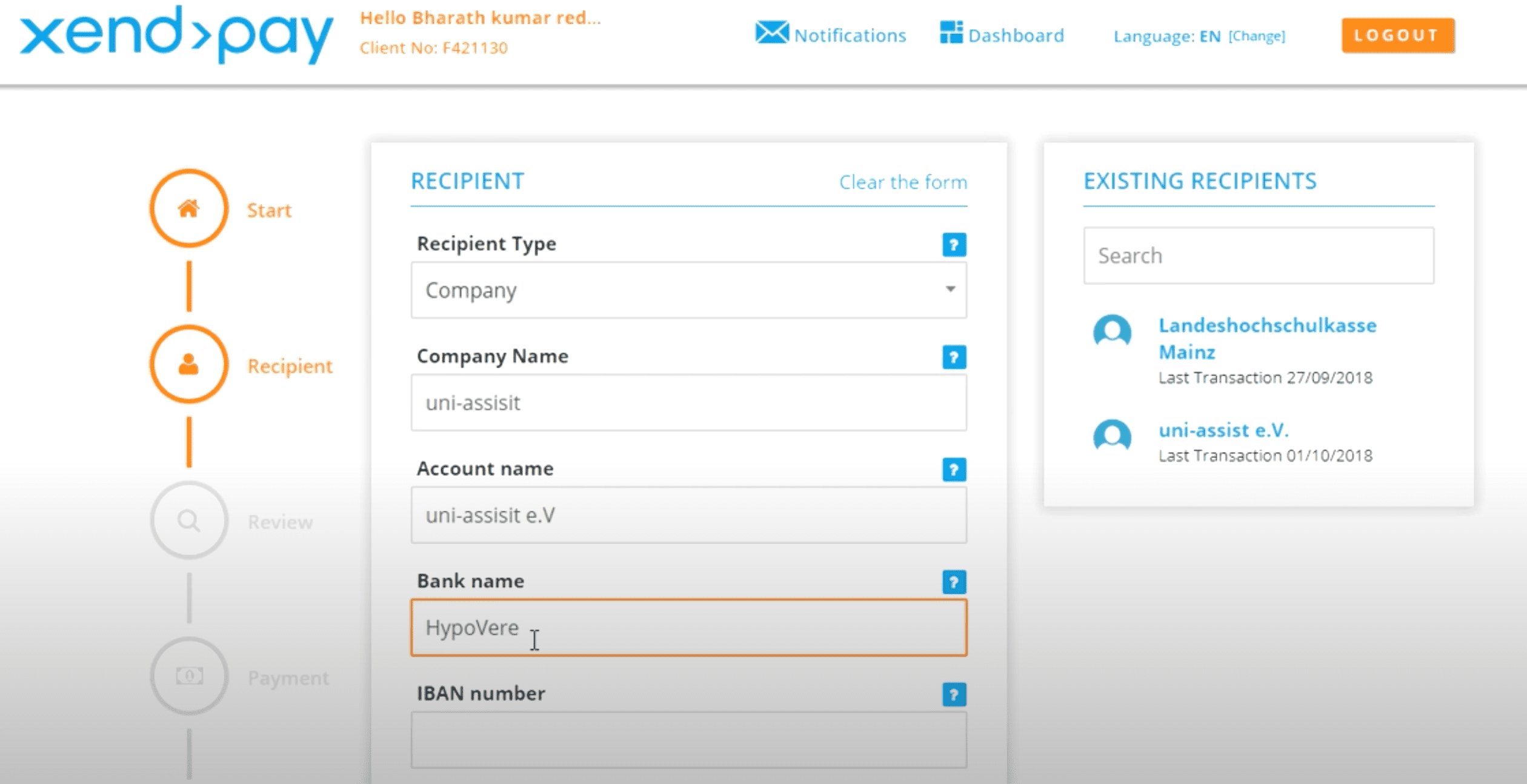

If there is one thing that users love about XendPay is how easy it is to use the platform to send money. Whether you are a seasoned user or this is your first time using XendPay, here is a detailed step by step guide on how to successfully make a transaction on the platform.

- Creating an account. XendPay allows you to create two types of accounts, Business and Personal. You can either fill in the personal information they ask or sign up directly by using your Google or Facebook account.

- Verify your account. For this, you need to provide proof of identity (Passport, ID Card, Driving License, or National Resident Permit) and address (Bank statements, Utility Bills, ID Card, Driving License, and Tenancy Agreement). The verification process takes up to three days to be completed.

- Transferring your Money. Once your account has been verified, you can proceed to transfer your money. All you need to do is enter the Country of origin, the Country of destination, and the amount of money you'll be sending. Next, enter the recipient's information, and confirm the transfer.

- Payment Method. Lastly, all you need to do is choose between a bank transfer, debit card, or credit card to complete the transaction.

Fees & Exchange Rates

Like other international money transfer services, XendPay makes money by charging transfer fees and exchange rates. As mentioned before, the thing that makes the company stand out from the rest is its "Pay What You Want" feature. This means that for a $2000 transfer, you get to choose how much the fees you'll pay. You can go as slow as $1 thereafter the fees and rates will go up depending on the currency and the destination of the funds, but not to worry, the XendPay's goal has been to remain the cheapest option, so those fees will normally range between 0.4 and 2%.

For every transfer you make, XendPay charges a fix exchange rate that normally never exceeds 1%. Making it the perfect choice for either big or small transfers. Finally, besides transfer fees and exchange rates, XendPay does not make additional charges.

Advantages of using XendPay

Using XendPay to send money overseas is your best option when you are looking for the most competitive rates, affordable rates, and secure transactions.

Popular destinations of transfers

- Afghanistan

- Åland Islands

- Albania

- Algeria

- American Samoa

- Andorra

- Angola

- Anguilla

- Antigua and Barbuda

- Argentina

- Armenia

- Aruba

- Australia

- Austria

- Azerbaijan

- Bahamas

- Bahrain

- Bangladesh

- Barbados

- Belarus

- Belgium

- Belize

- Benin

- Bermuda

- Bhutan

- Bolivia

- Bosnia And Herzegovina

- Botswana

- Brazil

- British Virgin Islands

- Brunei Darussalam

- Bulgaria

- Burkina Faso

- Burundi

- Cambodia

- Cameroon

- Canada

- Cape Verde

- Caribbean Netherlands

- Cayman Islands

- Central African Republic

- Chad

- Chile

- China

- Colombia

- Comoros

- Congo RDC

- Congo

- Cook Islands

- Costa Rica

- Croatia

- Cuba

- Curacao

- Cyprus

- Czech Republic

- Denmark

- Djibouti

- Dominica

- Dominican Republic

- Ecuador

- Egypt

- El Salvador

- Equatorial Guinea

- Eritrea

- Estonia

- Ethiopia

- Faroe Islands

- Fiji

- Finland

- France

- French Guiana

- French Polynesia

- Gabon

- Gambia

- Georgia

- Germany

- Ghana

- Gibraltar

- Greece

- Greenland

- Grenada

- Guadeloupe

- Guam

- Guatemala

- Guinea

- Guinea-Bissau

- Guyana

- Haiti

- Honduras

- Hong Kong

- Hungary

- Iceland

- India

- Indonesia

- Iran

- Iraq

- Ireland

- Israel

- Italy

- Ivory Coast

- Jamaica

- Japan

- Jordan

- Kazakhstan

- Kenya

- Kiribati

- Kosovo

- Kuwait

- Kyrgyzstan

- Laos

- Latvia

- Lebanon

- Lesotho

- Liberia

- Libya

- Liechtenstein

- Lithuania

- Luxembourg

- Macao

- Macedonia

- Madagascar

- Malawi

- Malaysia

- Maldives

- Mali

- Malta

- Marshall Islands

- Martinique

- Mauritania

- Mauritius

- Mayotte

- Mexico

- Micronesia

- Moldova

- Monaco

- Mongolia

- Montenegro

- Morocco

- Mozambique

- Myanmar

- Namibia

- Nauru

- Nepal

- Netherlands

- Netherlands Antilles

- New Caledonia

- New Zealand

- Nicaragua

- Niger

- Nigeria

- Northern Mariana Islands

- Norway

- Oman

- Pakistan

- Palau

- Palestine

- Panama

- Papua New Guinea

- Paraguay

- Peru

- Philippines

- Poland

- Portugal

- Puerto Rico

- Qatar

- Réunion

- Romania

- Russia

- Rwanda

- Saint Barthélemy

- Saint Kitts And Nevis

- Saint Lucia

- Saint Martin

- St Vincent & the Grenadines

- Samoa

- San Marino

- Sao Tome And Principe

- Saudi Arabia

- Senegal

- Serbia

- Seychelles

- Sierra Leone

- Singapore

- Sint Maarten

- Slovakia

- Slovenia

- Solomon Islands

- Somalia

- South Africa

- South Korea

- South Sudan

- Spain

- Sri Lanka

- Sudan

- Suriname

- Swaziland

- Sweden

- Switzerland

- Syrian Arab Republic

- Taiwan

- Tajikistan

- Tanzania

- Thailand

- Timor-Leste

- Togo

- Tonga

- Trinidad And Tobago

- Tunisia

- Turkey

- Turkmenistan

- Turks and Caicos Islands

- Tuvalu

- Uganda

- Ukraine

- United Arab Emirates

- United Kingdom

- United States

- US Minor Outlying Islands

- US Virgin Islands

- Uruguay

- Uzbekistan

- Vanuatu

- Vatican

- Venezuela

- Vietnam

- Wallis And Futuna

- Yemen

- Zambia

- Zimbabwe