Xpress Money is arguably second to none when it comes to its instantaneous power to deliver cash internationally. Present in more than 170 countries; and with over 180,000 reputable online agents situated in different locations, it is among the most vibrant global money remittance companies.

Contact Xpress Money

Xpressmoney

Transfer options

Withdrawal options

Payment options

Founded in 1999 in the UK; and headquartered in London, the company has a solid delivery network that has consistently produced stellar results for the last 15 years.

Why is Xpress Money a Leading Cash Money Vendor?

As a renowned e transfer vendor, Xpress Money guarantees all its customers the safest, fastest and a highly secure means of remitting money to any location worldwide. It is convenient and simple to use Xpress because the company provides cash payment options for sending money from any of their agents.

However, at the pick-up end, you can decide on any alternative that works best for your recipient. You can send to a service delivering to homes, directly to a credit card, a mobile wallet or to a bank account. To find out more about the convenience of using this service, let’s give the highlights of the transfer procedures.

6 Steps about How to Make a Complete Transaction on Xpress

The cash transaction process using this transfer facility is one of the simplest you can ever hope to find anywhere on the internet. All it takes for one to complete a transaction by sending money and for it to be received at the other end are these 6 simple steps:

- Paying a Visit to an Xpress Agency. To send money, you must pay a visit to the Xpress money partner location nearest to you. Provide your recipients details.

- Physical Handing Over of Money. Hand over the money you want to be sent and you are as good as done because the cash is instantly remitted.

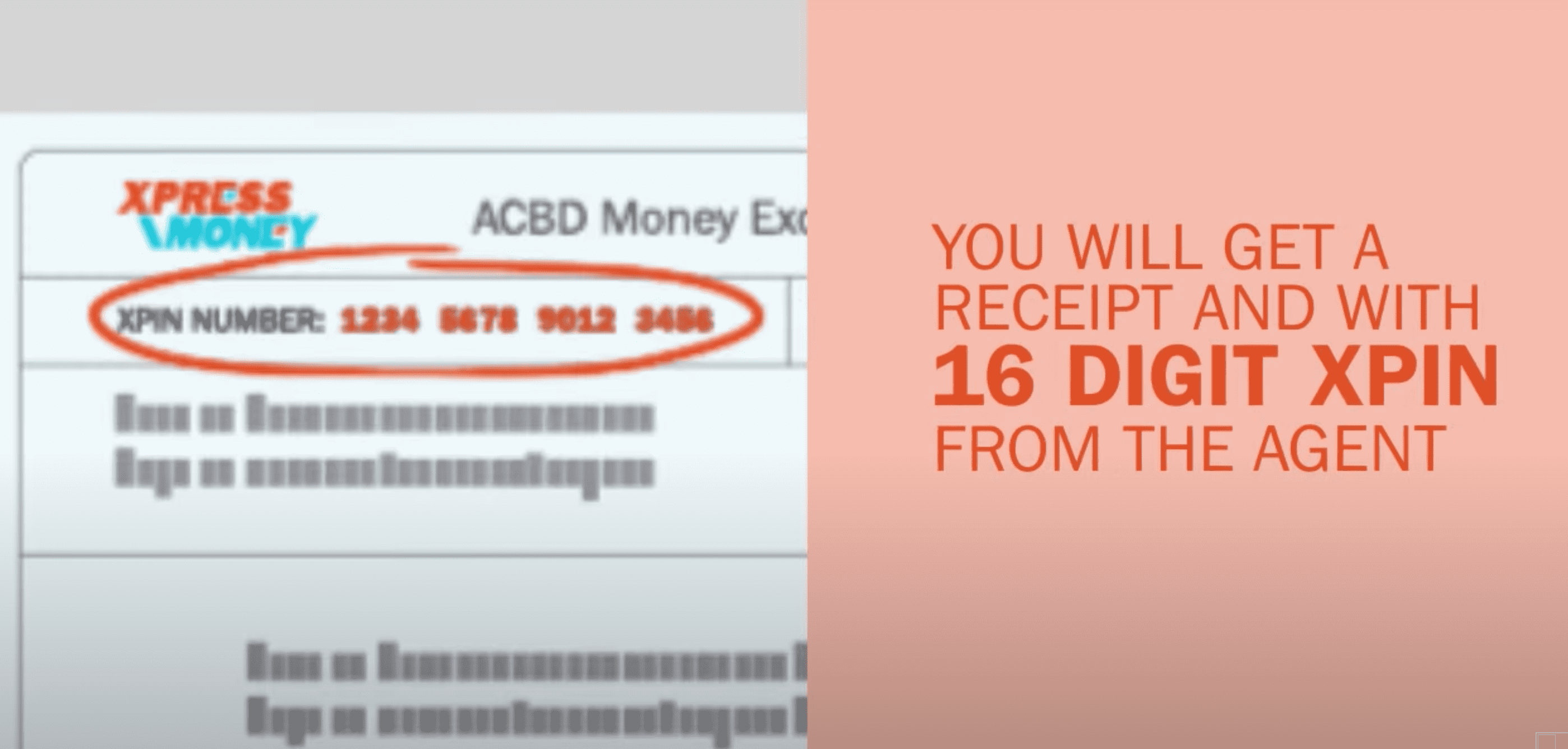

- Sharing the 16-Digit XPIN with the Beneficiary. Ask for and collect a receipt and the 16-digit XPIN and you are ready to go. The other steps are for the receiver to take and they are as follows:

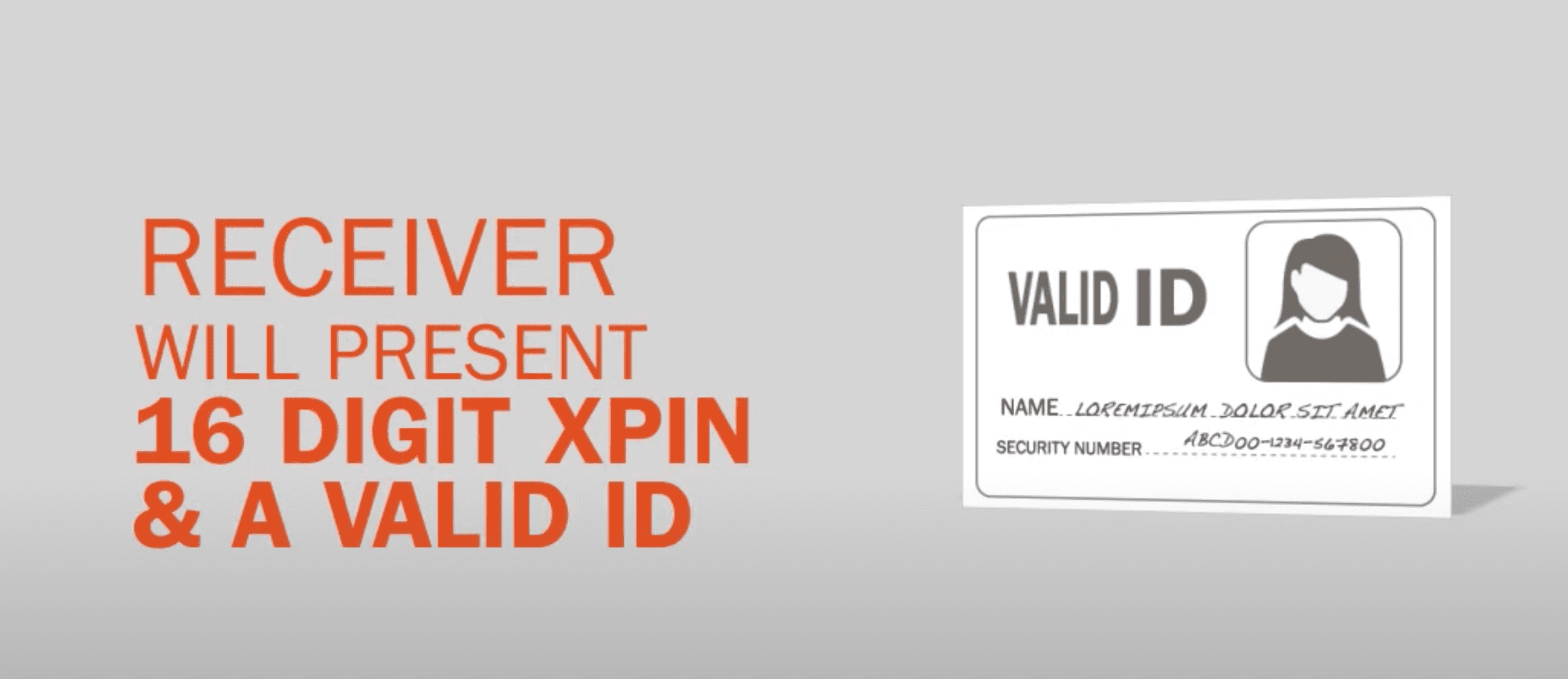

- The Receiver Visiting an Xpress Agency. The receiver visits the nearest agent for Xpress Money.

- Submitting the 16 Digit XPIN. Once at the agency location, the receiver must produce authentic identification, preferably an ID card, and the 16-digit XPIN.

- The Beneficiary Picks Up the Money. After the ID and XPIN are verified, the receiver is free to take the money. The sender then gets a SMS text message confirming the transaction.

Fees & Exchange Rates

Whereas Xpress Money charges very low fees for sending money, the company’s exchange rate is always among the highest in the market. It uses the best comparison engine to ensure customers get great rates of exchange.

Advantages of Using Xpress Money Services

Some of the advantages that make Xpress a top favorite includes:

- High exchange rates and low transaction costs.

- The cash transfer experience is quick and hassle-free.

- It provides an efficient comparison engine which gives instant results of the exchange rates on offer for different currencies.

- Users in the UK can use a mobile application to transact money straight from their smartphones.

- It is simple to use, fast and secure. That means affordability, security and speed.

Xpress Money ranks high among the most convenient and dependable global cash transfer options out there. Trust us and try it NOW!

Popular destinations of transfers

- Afghanistan

- Åland Islands

- Albania

- Algeria

- American Samoa

- Andorra

- Angola

- Anguilla

- Antigua and Barbuda

- Argentina

- Armenia

- Aruba

- Australia

- Austria

- Azerbaijan

- Bahamas

- Bahrain

- Bangladesh

- Barbados

- Belarus

- Belgium

- Belize

- Benin

- Bermuda

- Bhutan

- Bolivia

- Bosnia And Herzegovina

- Botswana

- Brazil

- British Virgin Islands

- Brunei Darussalam

- Bulgaria

- Burkina Faso

- Burundi

- Cambodia

- Cameroon

- Canada

- Cape Verde

- Caribbean Netherlands

- Cayman Islands

- Central African Republic

- Chad

- Chile

- China

- Colombia

- Comoros

- Congo RDC

- Congo

- Cook Islands

- Costa Rica

- Croatia

- Cuba

- Curacao

- Cyprus

- Czech Republic

- Denmark

- Djibouti

- Dominica

- Dominican Republic

- Ecuador

- Egypt

- El Salvador

- Equatorial Guinea

- Eritrea

- Estonia

- Ethiopia

- Faroe Islands

- Fiji

- Finland

- France

- French Guiana

- French Polynesia

- Gabon

- Gambia

- Georgia

- Germany

- Ghana

- Gibraltar

- Greece

- Greenland

- Grenada

- Guadeloupe

- Guam

- Guatemala

- Guinea

- Guinea-Bissau

- Guyana

- Haiti

- Honduras

- Hong Kong

- Hungary

- Iceland

- India

- Indonesia

- Iran

- Iraq

- Ireland

- Israel

- Italy

- Ivory Coast

- Jamaica

- Japan

- Jordan

- Kazakhstan

- Kenya

- Kiribati

- Kosovo

- Kuwait

- Kyrgyzstan

- Laos

- Latvia

- Lebanon

- Lesotho

- Liberia

- Libya

- Liechtenstein

- Lithuania

- Luxembourg

- Macao

- Macedonia

- Madagascar

- Malawi

- Malaysia

- Maldives

- Mali

- Malta

- Marshall Islands

- Martinique

- Mauritania

- Mauritius

- Mayotte

- Mexico

- Micronesia

- Moldova

- Monaco

- Mongolia

- Montenegro

- Morocco

- Mozambique

- Myanmar

- Namibia

- Nauru

- Nepal

- Netherlands

- Netherlands Antilles

- New Caledonia

- New Zealand

- Nicaragua

- Niger

- Nigeria

- Northern Mariana Islands

- Norway

- Oman

- Pakistan

- Palau

- Palestine

- Panama

- Papua New Guinea

- Paraguay

- Peru

- Philippines

- Poland

- Portugal

- Puerto Rico

- Qatar

- Réunion

- Romania

- Russia

- Rwanda

- Saint Barthélemy

- Saint Kitts And Nevis

- Saint Lucia

- Saint Martin

- St Vincent & the Grenadines

- Samoa

- San Marino

- Sao Tome And Principe

- Saudi Arabia

- Senegal

- Serbia

- Seychelles

- Sierra Leone

- Singapore

- Sint Maarten

- Slovakia

- Slovenia

- Solomon Islands

- Somalia

- South Africa

- South Korea

- South Sudan

- Spain

- Sri Lanka

- Sudan

- Suriname

- Swaziland

- Sweden

- Switzerland

- Syrian Arab Republic

- Taiwan

- Tajikistan

- Tanzania

- Thailand

- Timor-Leste

- Togo

- Tonga

- Trinidad And Tobago

- Tunisia

- Turkey

- Turkmenistan

- Turks and Caicos Islands

- Tuvalu

- Uganda

- Ukraine

- United Arab Emirates

- United Kingdom

- United States

- US Minor Outlying Islands

- US Virgin Islands

- Uruguay

- Uzbekistan

- Vanuatu

- Vatican

- Venezuela

- Vietnam

- Wallis And Futuna

- Yemen

- Zambia

- Zimbabwe