Kabayan Remit is a money transfer operator registered in 2012 in the United Kingdom and headquartered in Bicester. It specializes in remittances from 6 European countries namely the UK, Germany, the Netherlands, Ireland, Norway and Gibraltar. Remittances are made online or via mobile digital wallets. It is recognized for fast, hustle free, and affordable transfers to ‘Kabayans’ or Filipinos living in their home country.

Contact Kabayan Remit

Kabayan Remit

Transfer options

Withdrawal options

Payment options

Transact With Kabayan Remit

Customer reviews rate this provider as one of the best ways to transfer money:

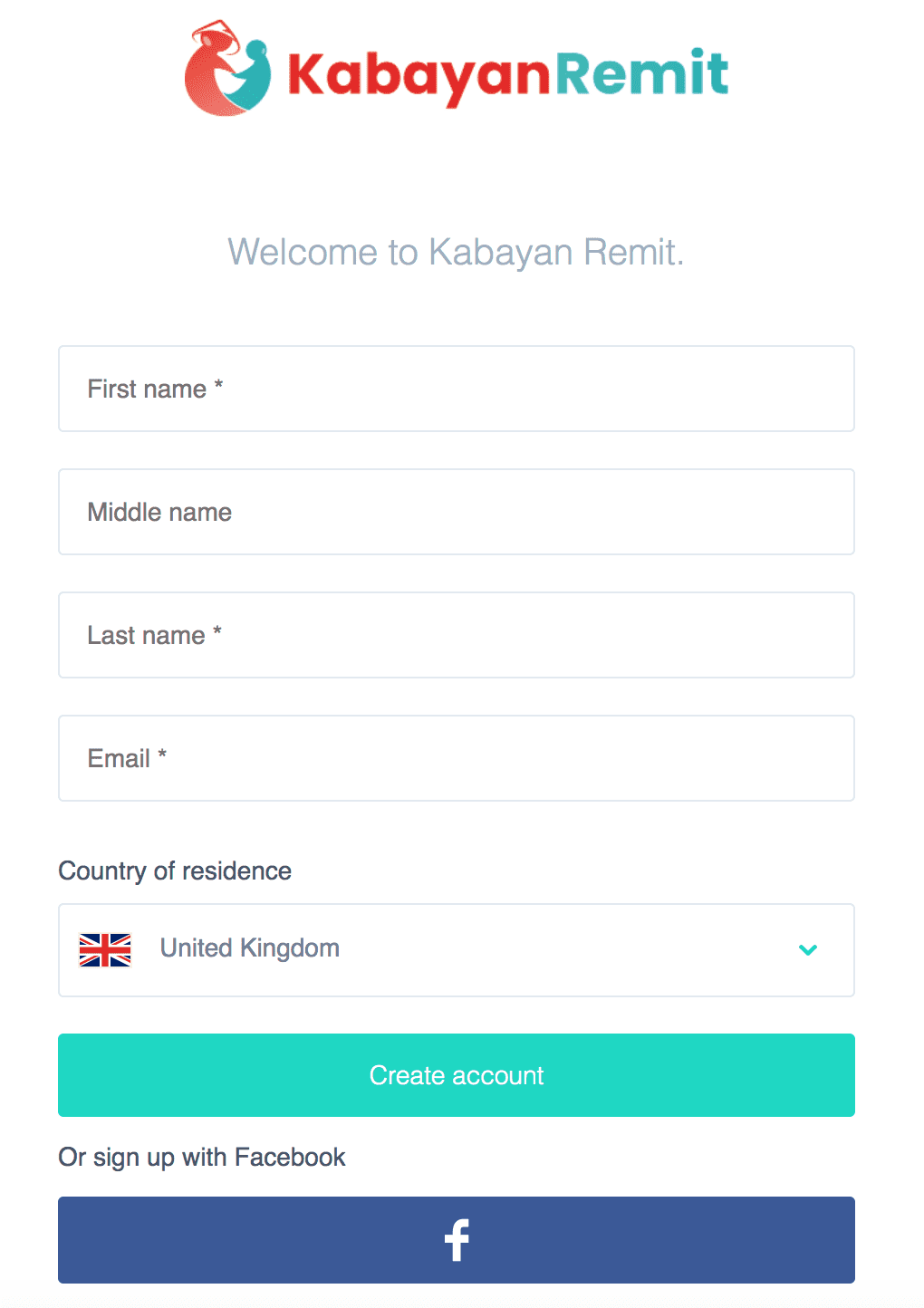

- Create your account. You can create a free account on their website or download and install their mobile app.

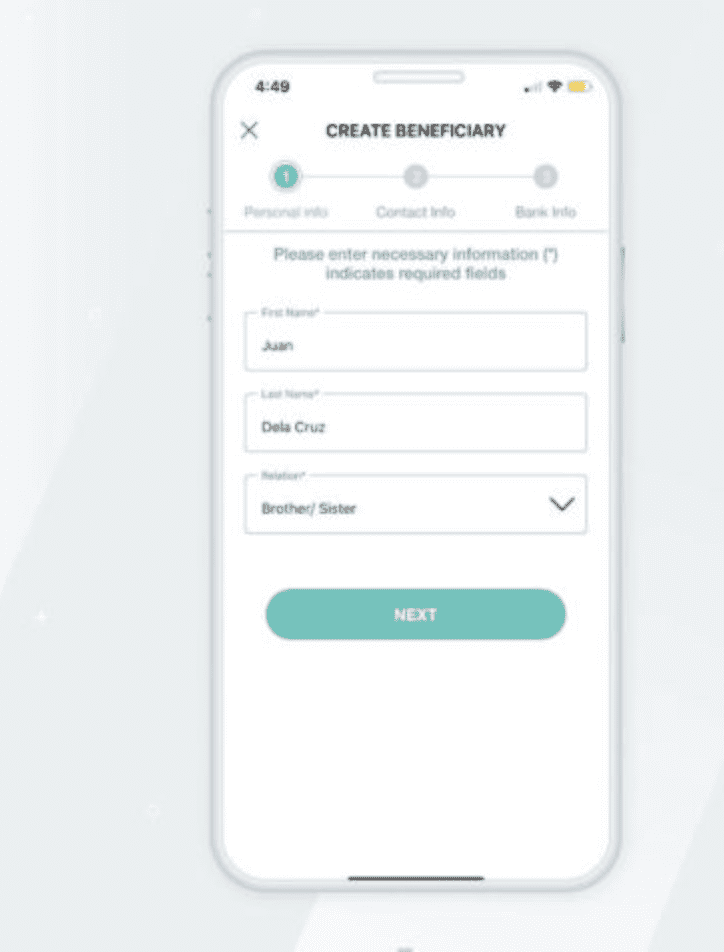

- Add Recipient information. Add the receiver’s information. Add their official names, mobile phone number, bank account number, recognized ID and in some instances, physical address.

- Select pay-out method. How is your recipient going to receive their funds? Select whether the funds will be remitted via direct deposit to bank account, cash pick up from an agent, home delivery, or mobile digital wallet.

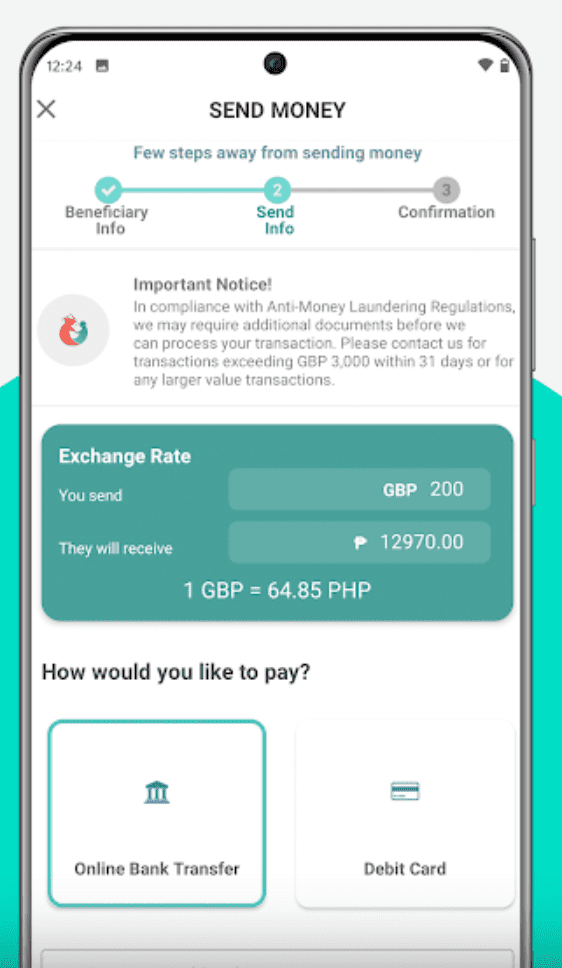

- Select pay-in method. How are you funding the transfer? Add your bank account or debit card as the pay-in method

- Indicate transfer amount in Preferred currency. Based on the sending limits for your chosen pay-in method and within the given payment period, enter the amount in GBP, Euros or Norwegian Crones to transfer. You can remit up to GBP 999 per transaction on your debit card.

- Confirm all details and pay. Always double-check if information entered is correct. Errors may delay your transaction. Once you have paid, expect funds to be delivered in minutes, or in a couple business days depending on the pay-out method you chose.

KabayanRemit’s Fees and Exchange Rates

Fees:

Fees are calculated based on selected pay-in and pay-out methods alongside the transfer amount. For debit card pay-ins, fees start from GBP3.99 for bank deposit pay-outs and GBP4.99 for cash collection pay-outs. For direct online bank transfer pay-ins fees start from GBP2.99 for bank deposit pay-outs and GBP3.99 for cash collection pay-outs.

Exchange Rates:

KabayanRemit is one of the cheapest ways to send money because it offers a very strong exchange rate as compared to other vendors. The operator collects a 0.81% commission above banks’ set exchange rate. Most vendors collect 1-2%.

Benefits when you wire money with Kabayan Remit:

- Transact for free on your first transfer as a newly registered user.

- Earn rewards for valid referrals. These rewards will go towards discounts on future transfers with the provider

- Pay select bills from abroad using your mobile phone or laptop. You can pay SSS, PAG-IBIG, SMDC and Filinvest real estate, as well as car insurance bills among others

- Your reciever experiences the convenience of cash delivered right to their doorstep, which is if especially useful if they are mobility-challenged

- Speedy transfers with digital wallet mobile transfers made in minutes, bank deposits in under an hour, and cash pick-ups in a day for Manila metro area.

Popular destinations of transfers

- Afghanistan

- Åland Islands

- Albania

- Algeria

- American Samoa

- Andorra

- Angola

- Anguilla

- Antigua and Barbuda

- Argentina

- Armenia

- Aruba

- Australia

- Austria

- Azerbaijan

- Bahamas

- Bahrain

- Bangladesh

- Barbados

- Belarus

- Belgium

- Belize

- Benin

- Bermuda

- Bhutan

- Bolivia

- Bosnia And Herzegovina

- Botswana

- Brazil

- British Virgin Islands

- Brunei Darussalam

- Bulgaria

- Burkina Faso

- Burundi

- Cambodia

- Cameroon

- Canada

- Cape Verde

- Caribbean Netherlands

- Cayman Islands

- Central African Republic

- Chad

- Chile

- China

- Colombia

- Comoros

- Congo RDC

- Congo

- Cook Islands

- Costa Rica

- Croatia

- Cuba

- Curacao

- Cyprus

- Czech Republic

- Denmark

- Djibouti

- Dominica

- Dominican Republic

- Ecuador

- Egypt

- El Salvador

- Equatorial Guinea

- Eritrea

- Estonia

- Ethiopia

- Faroe Islands

- Fiji

- Finland

- France

- French Guiana

- French Polynesia

- Gabon

- Gambia

- Georgia

- Germany

- Ghana

- Gibraltar

- Greece

- Greenland

- Grenada

- Guadeloupe

- Guam

- Guatemala

- Guinea

- Guinea-Bissau

- Guyana

- Haiti

- Honduras

- Hong Kong

- Hungary

- Iceland

- India

- Indonesia

- Iran

- Iraq

- Ireland

- Israel

- Italy

- Ivory Coast

- Jamaica

- Japan

- Jordan

- Kazakhstan

- Kenya

- Kiribati

- Kosovo

- Kuwait

- Kyrgyzstan

- Laos

- Latvia

- Lebanon

- Lesotho

- Liberia

- Libya

- Liechtenstein

- Lithuania

- Luxembourg

- Macao

- Macedonia

- Madagascar

- Malawi

- Malaysia

- Maldives

- Mali

- Malta

- Marshall Islands

- Martinique

- Mauritania

- Mauritius

- Mayotte

- Mexico

- Micronesia

- Moldova

- Monaco

- Mongolia

- Montenegro

- Morocco

- Mozambique

- Myanmar

- Namibia

- Nauru

- Nepal

- Netherlands

- Netherlands Antilles

- New Caledonia

- New Zealand

- Nicaragua

- Niger

- Nigeria

- Northern Mariana Islands

- Norway

- Oman

- Pakistan

- Palau

- Palestine

- Panama

- Papua New Guinea

- Paraguay

- Peru

- Philippines

- Poland

- Portugal

- Puerto Rico

- Qatar

- Réunion

- Romania

- Russia

- Rwanda

- Saint Barthélemy

- Saint Kitts And Nevis

- Saint Lucia

- Saint Martin

- St Vincent & the Grenadines

- Samoa

- San Marino

- Sao Tome And Principe

- Saudi Arabia

- Senegal

- Serbia

- Seychelles

- Sierra Leone

- Singapore

- Sint Maarten

- Slovakia

- Slovenia

- Solomon Islands

- Somalia

- South Africa

- South Korea

- South Sudan

- Spain

- Sri Lanka

- Sudan

- Suriname

- Swaziland

- Sweden

- Switzerland

- Syrian Arab Republic

- Taiwan

- Tajikistan

- Tanzania

- Thailand

- Timor-Leste

- Togo

- Tonga

- Trinidad And Tobago

- Tunisia

- Turkey

- Turkmenistan

- Turks and Caicos Islands

- Tuvalu

- Uganda

- Ukraine

- United Arab Emirates

- United Kingdom

- United States

- US Minor Outlying Islands

- US Virgin Islands

- Uruguay

- Uzbekistan

- Vanuatu

- Vatican

- Venezuela

- Vietnam

- Wallis And Futuna

- Yemen

- Zambia

- Zimbabwe