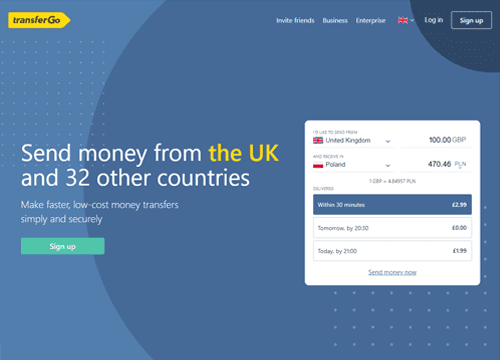

TransferGo is a payment service provider with its operations in the UK and Lithuania, offering services across the world. The company set shop in the UK in the year 2012 and under the supervision of HM Revenue & Customs (HMRC) on the regulations of Money Laundering number 12667079. Further control is by the UK Financial Conduct Authority (FCA) being an authorized institution of payment under number 600886. The UK physical address is on 241 Southwark Bridge Rd, SE1 6FP, London.

Contact TransferGo for business

TransferGo

Transfer options

Withdrawal options

Payment options

The company has a second home in Lithuania, trading as TransferGo Lithuania UAB, which is an electronic institution of money transfer. The Lithuania operations are under the regulation and authority of the Bank of Lithuania. The physical location is on Palangos str. 4, Vilnius, Lithuania, with registration number 304871705, FI Code 32400. From its inception, the company has grown to serve over 2 million people. Transaction transfer of over £3 billion. An excellent customer rating of 4.8 points out of a possible 5 points on Trustpilot.

How to Make a Transaction on TransferGo

- Register or Login - Create an account by registering for new clients or logging in for regular clients via the company’s website.

- Transfer Booking - Indicate the amount you intend to send after providing the details of the recipient and money destination.

- Initiate Local Payment - Process a local payment by use of a debit card, allowing transactions of not more than 1,000 GBP or through a bank account transfer.

- Transfer Completion by TransferGo - The company completes the rest of the transfer process upon receiving your payment within hours to the other end.

- Transfer Tracking – You can track the progress of the transfer by logging in to your account on the website.

Fees and Exchange Rates of TransferGo

You are at liberty to send the exact promised amount due to low fees payable at excellent exchange rates, saving up to around 90% on bank charges. The charges are payable on the volume of transactions and dependent on the money transfer intended country. A commission of 0.00% to 3.3% is chargeable on foreign exchange.

Advantages of TransferGo Business Account

- The use of an API system ensures high-volume transactions at low-cost to customers, employee’s salaries processing, and suppliers’ payment through the elimination of manual processes.

- The company is flexible in providing services to both individual and business customers.

- The use of the company ensures bypassing stringent bureaucracies across nations by enabling the sending of money in over 50 local currencies through cards and bank accounts.

- There is in place a well-driven and organized worker system formed through local and global partnerships to ensure smooth movement of money from one location to another across the globe.

- The company has in place an automated set up of payment geared towards saving you time when the company is tackling the last mile for speedy and safe delivery.

- The provision of multilingual customer service delivery is a plus as clients engage in their familiar and understandable language.

- Thorough money protection is achievable through the use of a stringent account verification process supported by the use of bank-grade security. Batch payment system enhances easy payment of complex transactions where you can pay suppliers and salaries of up to 50 at one go to multiple countries.

Popular destinations of transfers

- Afghanistan

- Åland Islands

- Albania

- Algeria

- American Samoa

- Andorra

- Angola

- Anguilla

- Antigua and Barbuda

- Argentina

- Armenia

- Aruba

- Australia

- Austria

- Azerbaijan

- Bahamas

- Bahrain

- Bangladesh

- Barbados

- Belarus

- Belgium

- Belize

- Benin

- Bermuda

- Bhutan

- Bolivia

- Bosnia And Herzegovina

- Botswana

- Brazil

- British Virgin Islands

- Brunei Darussalam

- Bulgaria

- Burkina Faso

- Burundi

- Cambodia

- Cameroon

- Canada

- Cape Verde

- Caribbean Netherlands

- Cayman Islands

- Central African Republic

- Chad

- Chile

- China

- Colombia

- Comoros

- Congo RDC

- Congo

- Cook Islands

- Costa Rica

- Croatia

- Cuba

- Curacao

- Cyprus

- Czech Republic

- Denmark

- Djibouti

- Dominica

- Dominican Republic

- Ecuador

- Egypt

- El Salvador

- Equatorial Guinea

- Eritrea

- Estonia

- Ethiopia

- Faroe Islands

- Fiji

- Finland

- France

- French Guiana

- French Polynesia

- Gabon

- Gambia

- Georgia

- Germany

- Ghana

- Gibraltar

- Greece

- Greenland

- Grenada

- Guadeloupe

- Guam

- Guatemala

- Guinea

- Guinea-Bissau

- Guyana

- Haiti

- Honduras

- Hong Kong

- Hungary

- Iceland

- India

- Indonesia

- Iran

- Iraq

- Ireland

- Israel

- Italy

- Ivory Coast

- Jamaica

- Japan

- Jordan

- Kazakhstan

- Kenya

- Kiribati

- Kosovo

- Kuwait

- Kyrgyzstan

- Laos

- Latvia

- Lebanon

- Lesotho

- Liberia

- Libya

- Liechtenstein

- Lithuania

- Luxembourg

- Macao

- Macedonia

- Madagascar

- Malawi

- Malaysia

- Maldives

- Mali

- Malta

- Marshall Islands

- Martinique

- Mauritania

- Mauritius

- Mayotte

- Mexico

- Micronesia

- Moldova

- Monaco

- Mongolia

- Montenegro

- Morocco

- Mozambique

- Myanmar

- Namibia

- Nauru

- Nepal

- Netherlands

- Netherlands Antilles

- New Caledonia

- New Zealand

- Nicaragua

- Niger

- Nigeria

- Northern Mariana Islands

- Norway

- Oman

- Pakistan

- Palau

- Palestine

- Panama

- Papua New Guinea

- Paraguay

- Peru

- Philippines

- Poland

- Portugal

- Puerto Rico

- Qatar

- Réunion

- Romania

- Russia

- Rwanda

- Saint Barthélemy

- Saint Kitts And Nevis

- Saint Lucia

- Saint Martin

- St Vincent & the Grenadines

- Samoa

- San Marino

- Sao Tome And Principe

- Saudi Arabia

- Senegal

- Serbia

- Seychelles

- Sierra Leone

- Singapore

- Sint Maarten

- Slovakia

- Slovenia

- Solomon Islands

- Somalia

- South Africa

- South Korea

- South Sudan

- Spain

- Sri Lanka

- Sudan

- Suriname

- Swaziland

- Sweden

- Switzerland

- Syrian Arab Republic

- Taiwan

- Tajikistan

- Tanzania

- Thailand

- Timor-Leste

- Togo

- Tonga

- Trinidad And Tobago

- Tunisia

- Turkey

- Turkmenistan

- Turks and Caicos Islands

- Tuvalu

- Uganda

- Ukraine

- United Arab Emirates

- United Kingdom

- United States

- US Minor Outlying Islands

- US Virgin Islands

- Uruguay

- Uzbekistan

- Vanuatu

- Vatican

- Venezuela

- Vietnam

- Wallis And Futuna

- Yemen

- Zambia

- Zimbabwe