Neon was established in the year 2017 by a Swiss neobank, found in Zurich. Since then, the company has continued to expand and grow both locally and internationally by attracting customers from different locations. It has also made partnerships with other companies like TransferWise, SELMA, Connect, and Yova, which have enabled it to expand.

Contact Neon

Neon

Transfer options

Withdrawal options

Payment options

The Neon bank is committed to improving customer service by eradicating extra fees that are incurred during transactions. Moreover, the company aims to make life easier for its customers by reducing the time spent seeking assistance from the bank administration. It is devoted to availing all these services to its customers in an easily accessible and affordable way.

How Neon Works

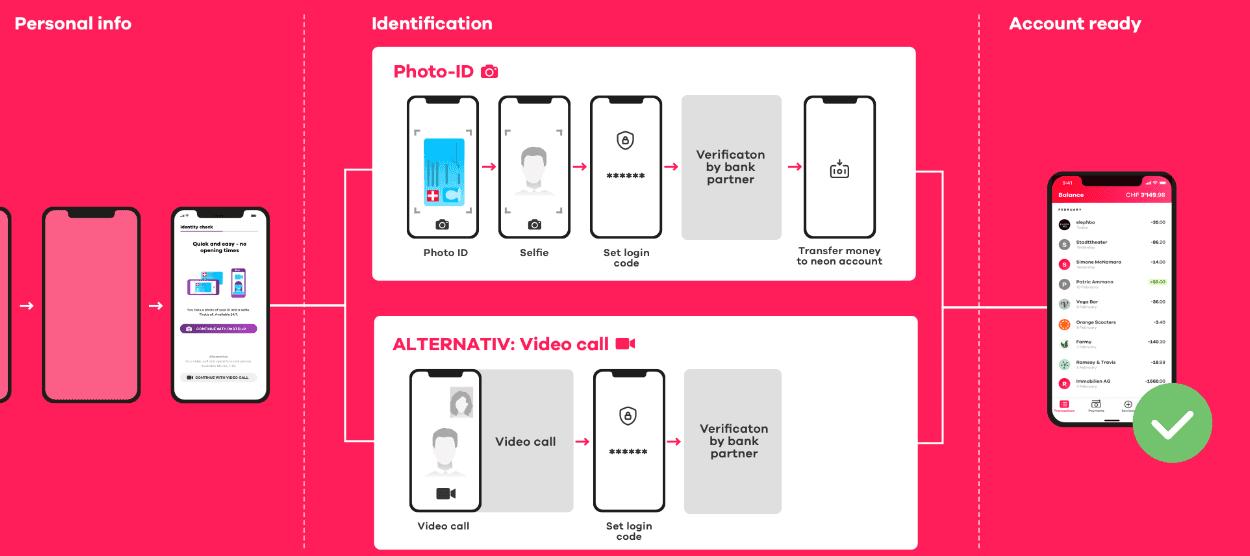

- The first step involves downloading the Neon Application from the google play store and install it on your mobile phone.

- Then, verify your identity and personal information. In this step, you are required to enter the correct details about your name, location, nationality, Swiss residency, and you will receive a short video call to verify the information provided. It’s usually a straightforward process that takes less than ten minutes to ensure that it gets to the right recipient once you send money.

- After complete details verification, you should wait for your account and card to be created. The contact number usually takes about one to two days, and the neon card for about one week to arrive at your location.

- The last step involves charging your account so that you can enjoy the benefit and perks of using Neon.

Fees and Exchange rate

Neon is a very affordable company that allows the user to make transactions without incurring excessive or hidden charges. The company doesn't charge base fees on your account. Therefore, your money will remain intact once you deposit it into your account. Additionally, Neon doesn’t charge domestic payments, and neither does it continuously make recurring charges on your account. In case the customer travels abroad, the company doesn’t make charges on your card while in a foreign nation. It's an affordable company that will enable you to transact easily without incurring unnecessary costs like other banks.

The account also allows the user to make at least two withdraws per month, and usually charge about 1.5% on the money to be removed. These withdrawal charges are minimal and don't vary in a way that doesn't favor the client. When contacting the customer, the bank allows you to make direct calls, which may require additional charges. However, you can use the email to get them, which is free.

Advantages of Using Neon

- The company offers an excellent banking fee policy, which allows you to make transactions at an affordable cost.

- It has an easy sign-up process that guides the user to fill their details on the website correctly.

- It allows customers to get paid their Swiss salary on the Neon bank, which is difficult in other foreign banks.

- It has an excellent foreign fee banking policy that allows the customer to access their money from different locations without incurring any costs.

- The banks have numerous partnerships that provide users with different banking benefits.

Popular destinations of transfers

- Afghanistan

- Åland Islands

- Albania

- Algeria

- American Samoa

- Andorra

- Angola

- Anguilla

- Antigua and Barbuda

- Argentina

- Armenia

- Aruba

- Australia

- Austria

- Azerbaijan

- Bahamas

- Bahrain

- Bangladesh

- Barbados

- Belarus

- Belgium

- Belize

- Benin

- Bermuda

- Bhutan

- Bolivia

- Bosnia And Herzegovina

- Botswana

- Brazil

- British Virgin Islands

- Brunei Darussalam

- Bulgaria

- Burkina Faso

- Burundi

- Cambodia

- Cameroon

- Canada

- Cape Verde

- Caribbean Netherlands

- Cayman Islands

- Central African Republic

- Chad

- Chile

- China

- Colombia

- Comoros

- Congo RDC

- Congo

- Cook Islands

- Costa Rica

- Croatia

- Cuba

- Curacao

- Cyprus

- Czech Republic

- Denmark

- Djibouti

- Dominica

- Dominican Republic

- Ecuador

- Egypt

- El Salvador

- Equatorial Guinea

- Eritrea

- Estonia

- Ethiopia

- Faroe Islands

- Fiji

- Finland

- France

- French Guiana

- French Polynesia

- Gabon

- Gambia

- Georgia

- Germany

- Ghana

- Gibraltar

- Greece

- Greenland

- Grenada

- Guadeloupe

- Guam

- Guatemala

- Guinea

- Guinea-Bissau

- Guyana

- Haiti

- Honduras

- Hong Kong

- Hungary

- Iceland

- India

- Indonesia

- Iran

- Iraq

- Ireland

- Israel

- Italy

- Ivory Coast

- Jamaica

- Japan

- Jordan

- Kazakhstan

- Kenya

- Kiribati

- Kosovo

- Kuwait

- Kyrgyzstan

- Laos

- Latvia

- Lebanon

- Lesotho

- Liberia

- Libya

- Liechtenstein

- Lithuania

- Luxembourg

- Macao

- Macedonia

- Madagascar

- Malawi

- Malaysia

- Maldives

- Mali

- Malta

- Marshall Islands

- Martinique

- Mauritania

- Mauritius

- Mayotte

- Mexico

- Micronesia

- Moldova

- Monaco

- Mongolia

- Montenegro

- Morocco

- Mozambique

- Myanmar

- Namibia

- Nauru

- Nepal

- Netherlands

- Netherlands Antilles

- New Caledonia

- New Zealand

- Nicaragua

- Niger

- Nigeria

- Northern Mariana Islands

- Norway

- Oman

- Pakistan

- Palau

- Palestine

- Panama

- Papua New Guinea

- Paraguay

- Peru

- Philippines

- Poland

- Portugal

- Puerto Rico

- Qatar

- Réunion

- Romania

- Russia

- Rwanda

- Saint Barthélemy

- Saint Kitts And Nevis

- Saint Lucia

- Saint Martin

- St Vincent & the Grenadines

- Samoa

- San Marino

- Sao Tome And Principe

- Saudi Arabia

- Senegal

- Serbia

- Seychelles

- Sierra Leone

- Singapore

- Sint Maarten

- Slovakia

- Slovenia

- Solomon Islands

- Somalia

- South Africa

- South Korea

- South Sudan

- Spain

- Sri Lanka

- Sudan

- Suriname

- Swaziland

- Sweden

- Switzerland

- Syrian Arab Republic

- Taiwan

- Tajikistan

- Tanzania

- Thailand

- Timor-Leste

- Togo

- Tonga

- Trinidad And Tobago

- Tunisia

- Turkey

- Turkmenistan

- Turks and Caicos Islands

- Tuvalu

- Uganda

- Ukraine

- United Arab Emirates

- United Kingdom

- United States

- US Minor Outlying Islands

- US Virgin Islands

- Uruguay

- Uzbekistan

- Vanuatu

- Vatican

- Venezuela

- Vietnam

- Wallis And Futuna

- Yemen

- Zambia

- Zimbabwe