OFX was established in 1998 and is among the largest foreign exchange companies in the world. The company aims to provide individuals as well as companies with fast and secure international money transfers. OFX can help you choose the right combination of products to achieve your goals, even in volatile currency markets.

Contact OFX

OFX

Transfer options

Withdrawal options

Payment options

With 500+ employees globally, OFX has offices in London, Dublin, Sydney, Auckland, Hong Kong, Singapore, Toronto and San Francisco. The company is listed on the Australian securities exchange.

They have helped over 1 million people move money globally and continue to serve customers with different foreign exchange services needs.

The company has a global banking network that allows it to provide good pricing and a competitive exchange rate that saves you money unlike traditional options such as banks.

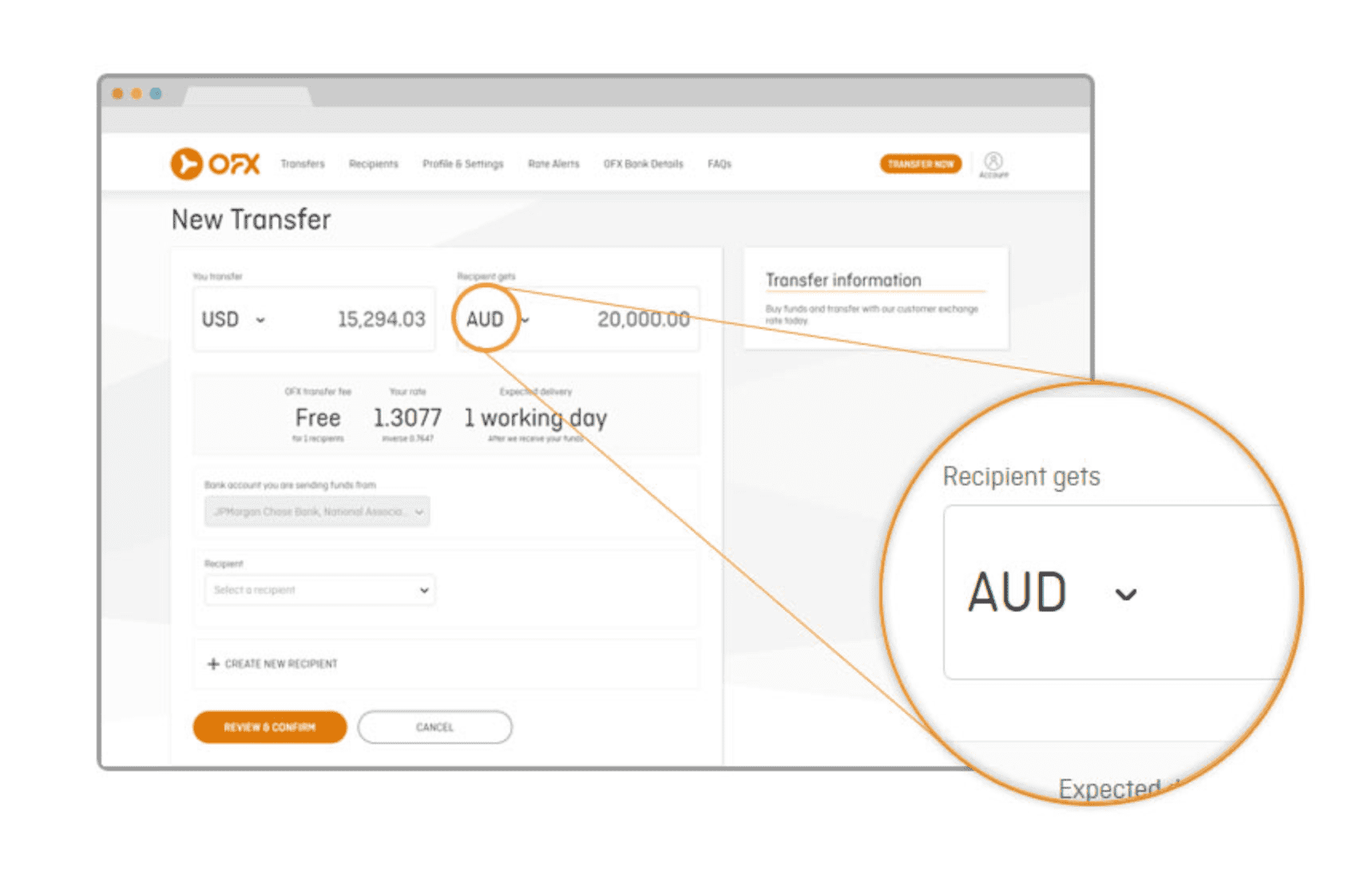

How to make a transaction

To make a successful transaction in OFX, the following steps will help:

- Click "transfer now". Choose which currency you have and the one you want to transfer to and the amount you wish to transfer.

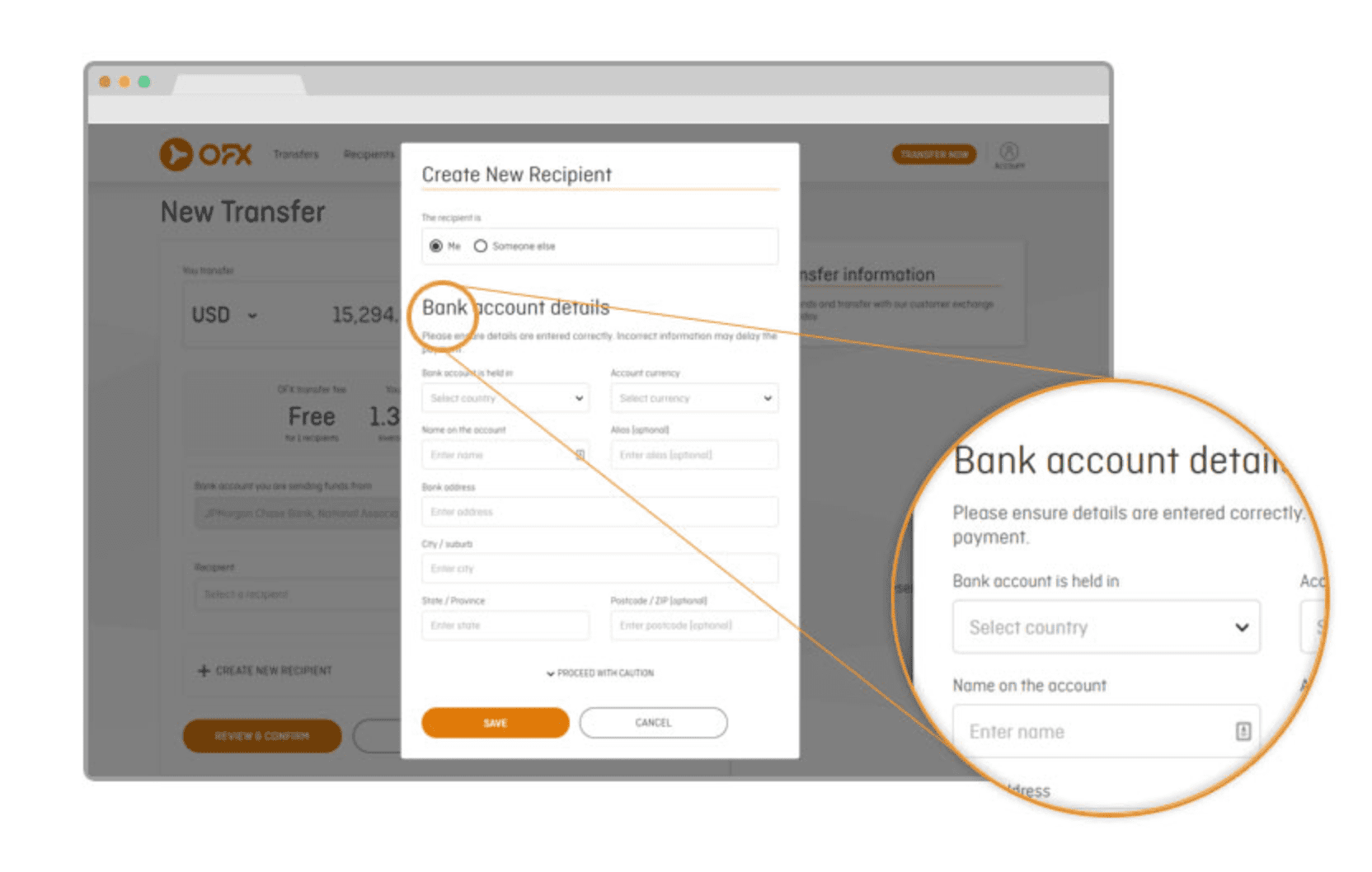

- Add recipients details (account name, account number e.t.c)

- Review and confirm (Enter a "reference" which will be visible on the recipient’s bank account statement. Also enter the reason for transfer). Select ‘Review & Confirm’ for a final check

However, if one prefers, you can set up a transaction with an OFX dealer through the OFX mobile app available on Android and IOS.

Our app allows you to check the exchange rates in the market live and initiate an international money transfer. One can also track their money during the transfer process at any time and anywhere.

Fees & Exchange Rates

OFX Fees

No transfer fees are charged in all their transactions. The whole amount conversion is at an agreed exchange rate.

Another fee encompasses payments settlement through a domestic bank account without the need for receiving bank fees.

In some cases, when transferring money to the beneficiary account, OFX assures you of no deductions from intermediary banks during the process.

Exceptions to the above are ZAR and JPY that might attract additional fees due to the local regulations.

OFX Exchange Rates

OFX has an array of the best exchange rates in the market. The more one spends, the better the exchange rate OFX guarantees you.

The rate agreement an individual makes with OFX helps one know before the beneficiary you want will receive despite the evolution of the exchange rate.

Advantages

The benefits one gets by using OFX as its choice in non-banking FX service provider include:

- Has an outstanding customer service with the needed expertise;

- Many years of experience as well as being the largest in the business which guarantees satisfactory services;

- Availability is 24/7 both online and by phone; hence one can also track their money during the transfer process anytime and anywhere.

- Has an extensive network in banking thus fast and the affordable collection as well as funds delivery;

- Easy and simple transaction processes with zero transfer fees.

Popular destinations of transfers

- Afghanistan

- Åland Islands

- Albania

- Algeria

- American Samoa

- Andorra

- Angola

- Anguilla

- Antigua and Barbuda

- Argentina

- Armenia

- Aruba

- Australia

- Austria

- Azerbaijan

- Bahamas

- Bahrain

- Bangladesh

- Barbados

- Belarus

- Belgium

- Belize

- Benin

- Bermuda

- Bhutan

- Bolivia

- Bosnia And Herzegovina

- Botswana

- Brazil

- British Virgin Islands

- Brunei Darussalam

- Bulgaria

- Burkina Faso

- Burundi

- Cambodia

- Cameroon

- Canada

- Cape Verde

- Caribbean Netherlands

- Cayman Islands

- Central African Republic

- Chad

- Chile

- China

- Colombia

- Comoros

- Congo RDC

- Congo

- Cook Islands

- Costa Rica

- Croatia

- Cuba

- Curacao

- Cyprus

- Czech Republic

- Denmark

- Djibouti

- Dominica

- Dominican Republic

- Ecuador

- Egypt

- El Salvador

- Equatorial Guinea

- Eritrea

- Estonia

- Ethiopia

- Faroe Islands

- Fiji

- Finland

- France

- French Guiana

- French Polynesia

- Gabon

- Gambia

- Georgia

- Germany

- Ghana

- Gibraltar

- Greece

- Greenland

- Grenada

- Guadeloupe

- Guam

- Guatemala

- Guinea

- Guinea-Bissau

- Guyana

- Haiti

- Honduras

- Hong Kong

- Hungary

- Iceland

- India

- Indonesia

- Iran

- Iraq

- Ireland

- Israel

- Italy

- Ivory Coast

- Jamaica

- Japan

- Jordan

- Kazakhstan

- Kenya

- Kiribati

- Kosovo

- Kuwait

- Kyrgyzstan

- Laos

- Latvia

- Lebanon

- Lesotho

- Liberia

- Libya

- Liechtenstein

- Lithuania

- Luxembourg

- Macao

- Macedonia

- Madagascar

- Malawi

- Malaysia

- Maldives

- Mali

- Malta

- Marshall Islands

- Martinique

- Mauritania

- Mauritius

- Mayotte

- Mexico

- Micronesia

- Moldova

- Monaco

- Mongolia

- Montenegro

- Morocco

- Mozambique

- Myanmar

- Namibia

- Nauru

- Nepal

- Netherlands

- Netherlands Antilles

- New Caledonia

- New Zealand

- Nicaragua

- Niger

- Nigeria

- Northern Mariana Islands

- Norway

- Oman

- Pakistan

- Palau

- Palestine

- Panama

- Papua New Guinea

- Paraguay

- Peru

- Philippines

- Poland

- Portugal

- Puerto Rico

- Qatar

- Réunion

- Romania

- Russia

- Rwanda

- Saint Barthélemy

- Saint Kitts And Nevis

- Saint Lucia

- Saint Martin

- St Vincent & the Grenadines

- Samoa

- San Marino

- Sao Tome And Principe

- Saudi Arabia

- Senegal

- Serbia

- Seychelles

- Sierra Leone

- Singapore

- Sint Maarten

- Slovakia

- Slovenia

- Solomon Islands

- Somalia

- South Africa

- South Korea

- South Sudan

- Spain

- Sri Lanka

- Sudan

- Suriname

- Swaziland

- Sweden

- Switzerland

- Syrian Arab Republic

- Taiwan

- Tajikistan

- Tanzania

- Thailand

- Timor-Leste

- Togo

- Tonga

- Trinidad And Tobago

- Tunisia

- Turkey

- Turkmenistan

- Turks and Caicos Islands

- Tuvalu

- Uganda

- Ukraine

- United Arab Emirates

- United Kingdom

- United States

- US Minor Outlying Islands

- US Virgin Islands

- Uruguay

- Uzbekistan

- Vanuatu

- Vatican

- Venezuela

- Vietnam

- Wallis And Futuna

- Yemen

- Zambia

- Zimbabwe