Wise business account helps commercial business owners or sole traders to manage money associated with the company by keeping track of the cash balance, employee payroll, and most importantly about the companies that owed or you owe money to. To do so, just set up your profile via the TransferWise online portal and verify the account by uploading your ID documents to securely make transactions worldwide.

Contact Wise for business

TransferWise Ltd

Transfer options

Withdrawal options

Payment options

The Wise for business account also plays as a multi-currency account in allowing you to make international transactions with multiple currencies for an affordable and lower transaction fee.

Things to do before conducting a transfer

Before conducting a secured international business transfer via TransferWise, you will need to:

- Register your business by providing the business name and location with your registration number and role in the company. TransferWise will verify these details before activating the account.

- Then list down the countries and currencies you wished to make the transaction. Luckily, TransferWise makes this process more convenient by giving you an account number and a routing for each country you conduct business with.

- Upload your bank account details - use your unique bank account details rather than the usual account to centralize all the transactions you make with your clients through TransferWise. However, keep in mind that you will need to pay a slight amount when converting this money to your native currency.

Step by step process of transferring money with Wise

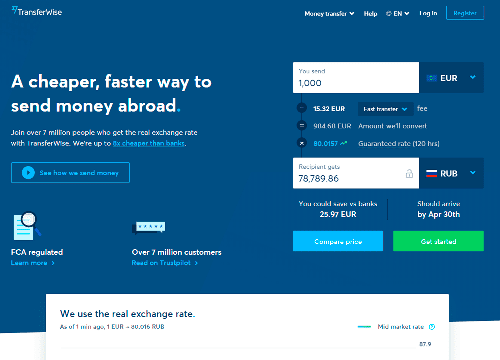

- Browse Wise’s main page.

- Select the senders and recipient currencies and type the amount you wished to send. TransferWise will automatically convert the amount into the recipient currencies before executing the transfer.

- Sign up for an account. You may sign up with an email and password or just connect with Google+ or Facebook.

- Hit off the “Get Started” button to confirm your transaction. Make sure to relook at the currencies, amounts, and fees before approving the transaction.

- Choose the Business Option, to transfer the funds from your TransferWise for Business account.

- Enter your business details and personal details then click on the “Continue” to move to the next step.

- Choose to whom you’re transferring money. Here you have the option to transfer money to another account of yourself or for an account owned by a different person, business, or charity abroad.

- Choose the payment method (Credit Card, Debit Card or Bank Account) and proceed with the transaction.

Fees & Exchange Rates

TransferWise for Business account charges only the lowest transaction fee from their customers. And this fee is imposed on converting the currencies plus in transferring the funds with an additional small margin for developing the TransferWise service. Additionally, there are no hidden fees associated with the transaction and they offer the highest exchange rate with the mind of delivering outstanding service to their customers.

Advantages

Wise for Business is specialized in delivering quality services to customers with competitive mid-market exchange rates and low transfer fees. With Wise, now you can save unnecessary transaction expenses and enjoy a hassle-free transaction at a fast turnaround with a wide range of services.

Popular destinations of transfers

- Afghanistan

- Åland Islands

- Albania

- Algeria

- American Samoa

- Andorra

- Angola

- Anguilla

- Antigua and Barbuda

- Argentina

- Armenia

- Aruba

- Australia

- Austria

- Azerbaijan

- Bahamas

- Bahrain

- Bangladesh

- Barbados

- Belarus

- Belgium

- Belize

- Benin

- Bermuda

- Bhutan

- Bolivia

- Bosnia And Herzegovina

- Botswana

- Brazil

- British Virgin Islands

- Brunei Darussalam

- Bulgaria

- Burkina Faso

- Burundi

- Cambodia

- Cameroon

- Canada

- Cape Verde

- Caribbean Netherlands

- Cayman Islands

- Central African Republic

- Chad

- Chile

- China

- Colombia

- Comoros

- Congo RDC

- Congo

- Cook Islands

- Costa Rica

- Croatia

- Cuba

- Curacao

- Cyprus

- Czech Republic

- Denmark

- Djibouti

- Dominica

- Dominican Republic

- Ecuador

- Egypt

- El Salvador

- Equatorial Guinea

- Eritrea

- Estonia

- Ethiopia

- Faroe Islands

- Fiji

- Finland

- France

- French Guiana

- French Polynesia

- Gabon

- Gambia

- Georgia

- Germany

- Ghana

- Gibraltar

- Greece

- Greenland

- Grenada

- Guadeloupe

- Guam

- Guatemala

- Guinea

- Guinea-Bissau

- Guyana

- Haiti

- Honduras

- Hong Kong

- Hungary

- Iceland

- India

- Indonesia

- Iran

- Iraq

- Ireland

- Israel

- Italy

- Ivory Coast

- Jamaica

- Japan

- Jordan

- Kazakhstan

- Kenya

- Kiribati

- Kosovo

- Kuwait

- Kyrgyzstan

- Laos

- Latvia

- Lebanon

- Lesotho

- Liberia

- Libya

- Liechtenstein

- Lithuania

- Luxembourg

- Macao

- Macedonia

- Madagascar

- Malawi

- Malaysia

- Maldives

- Mali

- Malta

- Marshall Islands

- Martinique

- Mauritania

- Mauritius

- Mayotte

- Mexico

- Micronesia

- Moldova

- Monaco

- Mongolia

- Montenegro

- Morocco

- Mozambique

- Myanmar

- Namibia

- Nauru

- Nepal

- Netherlands

- Netherlands Antilles

- New Caledonia

- New Zealand

- Nicaragua

- Niger

- Nigeria

- Northern Mariana Islands

- Norway

- Oman

- Pakistan

- Palau

- Palestine

- Panama

- Papua New Guinea

- Paraguay

- Peru

- Philippines

- Poland

- Portugal

- Puerto Rico

- Qatar

- Réunion

- Romania

- Russia

- Rwanda

- Saint Barthélemy

- Saint Kitts And Nevis

- Saint Lucia

- Saint Martin

- St Vincent & the Grenadines

- Samoa

- San Marino

- Sao Tome And Principe

- Saudi Arabia

- Senegal

- Serbia

- Seychelles

- Sierra Leone

- Singapore

- Sint Maarten

- Slovakia

- Slovenia

- Solomon Islands

- Somalia

- South Africa

- South Korea

- South Sudan

- Spain

- Sri Lanka

- Sudan

- Suriname

- Swaziland

- Sweden

- Switzerland

- Syrian Arab Republic

- Taiwan

- Tajikistan

- Tanzania

- Thailand

- Timor-Leste

- Togo

- Tonga

- Trinidad And Tobago

- Tunisia

- Turkey

- Turkmenistan

- Turks and Caicos Islands

- Tuvalu

- Uganda

- Ukraine

- United Arab Emirates

- United Kingdom

- United States

- US Minor Outlying Islands

- US Virgin Islands

- Uruguay

- Uzbekistan

- Vanuatu

- Vatican

- Venezuela

- Vietnam

- Wallis And Futuna

- Yemen

- Zambia

- Zimbabwe