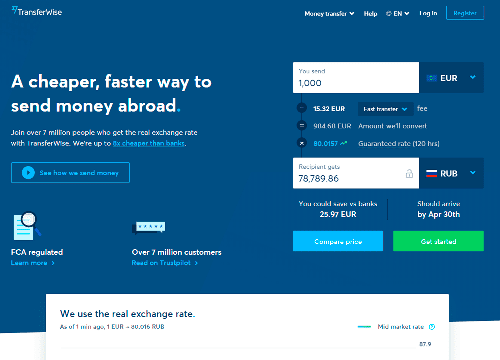

Wise multi-currency account lets its users to keep and spend money in many currencies. In today’s borderless business world, a rapidly growing number of people are in need of this service. This account is very useful for international retailers and frequent travelers. This post is about Wise multi-currency account. Read on to learn more.

Contact Wise

TransferWise Ltd

Transfer options

Withdrawal options

Payment options

What is Wise multi-currency account?

In order to keep your money in many currencies, you need a TransferWise multi-currency account. With this account, you can keep your money in more than fifty currencies. Convert between the currencies is super easy. And you can expect the real-time standard exchange rates anytime. The sign-up does not involve any fee, and it does not require subscription fees.

This account gives you fair exchange rate. You can send it to many foreign countries. TransferWise is committed to offer great deals. With your bank details, anyone can pay you from anywhere. Conversion between the currencies takes just a few seconds.

How to open a Wise multi-currency account

It is an amazing alternative to a bank account. To open this account, you are going to need some information. The pieces of information you need include:

- Your personal details

- Contact information and

- Proof of ID.

When opening the account, you will also need some documentation. They include:

- Identity document such as a copy of your driving license or passport

- Proof of citizenship

- Evidence that you are living in the place you mentioned as your residential address

Opening is a pretty straightforward process. First, you have to gather your documents. Make sure that the documents are recent. The next step is to fill in the application form. The information in the application form will be compared with the documents, and your identity will be verified by the bank. Then you will need to make the initial deposit, sign the signature card and finish setting up.

Conditions

This account has some conditions and restrictions. In terms of the amount, Wise sets no limit for most people. However, if you are receiving USD into your balance, the yearly limit is $1,000,000 for personal accounts and $5,000,000 for business accounts. Per day, the transaction limit is $250,000 for personal accounts and $3,000,000 for business accounts.

Apart from that, people living in some countries can not open their balances. These countries include Iraq, Iran, Burundi, Afghanistan, Chad, Central African Republic, Crimea, Congo Republic, Hong Kong, Eritrea, Cuba, North Korea, Malaysia, State of Libya, Somalia, Syrian Arab Republic, Sudan, Yemen and Venezuela. This list also includes two US states: Nevada and Hawaii.

Advantages of using Wise multi-currency account

This is an electronic account, which is in nature a bit different from a bank account. The most notable advantage of this account is that it does not require you to pay international transaction fees. The rates are always in your favor. In just one account, you can keep your money, convert it, and send it as needed. With this account, you can expect to get the real exchange rates.

It does not involve any hidden cost. The account can be used for both personal and commercial purposes. If you need to travel frequently, or your business requires international transactions, you will find this account very useful.

Popular destinations of transfers

- Afghanistan

- Åland Islands

- Albania

- Algeria

- American Samoa

- Andorra

- Angola

- Anguilla

- Antigua and Barbuda

- Argentina

- Armenia

- Aruba

- Australia

- Austria

- Azerbaijan

- Bahamas

- Bahrain

- Bangladesh

- Barbados

- Belarus

- Belgium

- Belize

- Benin

- Bermuda

- Bhutan

- Bolivia

- Bosnia And Herzegovina

- Botswana

- Brazil

- British Virgin Islands

- Brunei Darussalam

- Bulgaria

- Burkina Faso

- Burundi

- Cambodia

- Cameroon

- Canada

- Cape Verde

- Caribbean Netherlands

- Cayman Islands

- Central African Republic

- Chad

- Chile

- China

- Colombia

- Comoros

- Congo RDC

- Congo

- Cook Islands

- Costa Rica

- Croatia

- Cuba

- Curacao

- Cyprus

- Czech Republic

- Denmark

- Djibouti

- Dominica

- Dominican Republic

- Ecuador

- Egypt

- El Salvador

- Equatorial Guinea

- Eritrea

- Estonia

- Ethiopia

- Faroe Islands

- Fiji

- Finland

- France

- French Guiana

- French Polynesia

- Gabon

- Gambia

- Georgia

- Germany

- Ghana

- Gibraltar

- Greece

- Greenland

- Grenada

- Guadeloupe

- Guam

- Guatemala

- Guinea

- Guinea-Bissau

- Guyana

- Haiti

- Honduras

- Hong Kong

- Hungary

- Iceland

- India

- Indonesia

- Iran

- Iraq

- Ireland

- Israel

- Italy

- Ivory Coast

- Jamaica

- Japan

- Jordan

- Kazakhstan

- Kenya

- Kiribati

- Kosovo

- Kuwait

- Kyrgyzstan

- Laos

- Latvia

- Lebanon

- Lesotho

- Liberia

- Libya

- Liechtenstein

- Lithuania

- Luxembourg

- Macao

- Macedonia

- Madagascar

- Malawi

- Malaysia

- Maldives

- Mali

- Malta

- Marshall Islands

- Martinique

- Mauritania

- Mauritius

- Mayotte

- Mexico

- Micronesia

- Moldova

- Monaco

- Mongolia

- Montenegro

- Morocco

- Mozambique

- Myanmar

- Namibia

- Nauru

- Nepal

- Netherlands

- Netherlands Antilles

- New Caledonia

- New Zealand

- Nicaragua

- Niger

- Nigeria

- Northern Mariana Islands

- Norway

- Oman

- Pakistan

- Palau

- Palestine

- Panama

- Papua New Guinea

- Paraguay

- Peru

- Philippines

- Poland

- Portugal

- Puerto Rico

- Qatar

- Réunion

- Romania

- Russia

- Rwanda

- Saint Barthélemy

- Saint Kitts And Nevis

- Saint Lucia

- Saint Martin

- St Vincent & the Grenadines

- Samoa

- San Marino

- Sao Tome And Principe

- Saudi Arabia

- Senegal

- Serbia

- Seychelles

- Sierra Leone

- Singapore

- Sint Maarten

- Slovakia

- Slovenia

- Solomon Islands

- Somalia

- South Africa

- South Korea

- South Sudan

- Spain

- Sri Lanka

- Sudan

- Suriname

- Swaziland

- Sweden

- Switzerland

- Syrian Arab Republic

- Taiwan

- Tajikistan

- Tanzania

- Thailand

- Timor-Leste

- Togo

- Tonga

- Trinidad And Tobago

- Tunisia

- Turkey

- Turkmenistan

- Turks and Caicos Islands

- Tuvalu

- Uganda

- Ukraine

- United Arab Emirates

- United Kingdom

- United States

- US Minor Outlying Islands

- US Virgin Islands

- Uruguay

- Uzbekistan

- Vanuatu

- Vatican

- Venezuela

- Vietnam

- Wallis And Futuna

- Yemen

- Zambia

- Zimbabwe